sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A complaint bearing Complaint No. 635 <strong>of</strong> 1998 was filed in the District Consumer Disputes Redressal<br />

Forum, Mumbai on December 12, 1998 by the Complainants against the opposite party, in respect <strong>of</strong><br />

recovery <strong>of</strong> a sum <strong>of</strong> Rs. 54,000/- as payable on maturity <strong>of</strong> the bonds @ 18% p.a. as interest, a sum<br />

<strong>of</strong> Rs. 20,000 towards interest paid on borrowings <strong>and</strong> mental tension suffered by arranging the funds<br />

<strong>and</strong> an amount <strong>of</strong> Rs. 10,000/- towards the cost <strong>and</strong> expenses incurred in the correspondence <strong>and</strong><br />

towards cost <strong>of</strong> the complaint. The District Consumer Disputes Redressal Forum, by its order dated<br />

September 28, 2000 ordered the Opposite Party to pay to the Complainants a sum <strong>of</strong> Rs. 54000/- with<br />

interest @ 12% per annum <strong>and</strong> Rs. 1000/- as costs towards the Complaint. The Complainants have not<br />

got any response or payment <strong>of</strong> the decretal amount <strong>and</strong> have therefore filed an Appeal before the<br />

Consumer Disputes Redressal Commission, Maharashtra.<br />

The said Appeal is pending before the Consumer Disputes Redressal Commission, Maharashtra.<br />

Cases filed against our Directors<br />

There are no cases filed against our directors.<br />

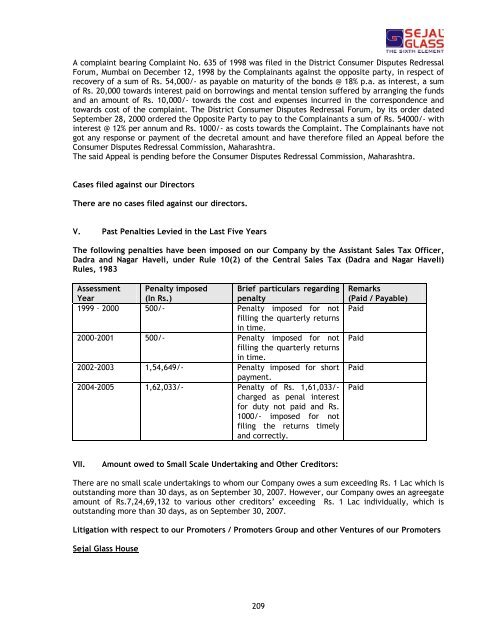

V. Past Penalties Levied in the Last Five Years<br />

The following penalties have been imposed on our Company by the Assistant Sales Tax Officer,<br />

Dadra <strong>and</strong> Nagar Haveli, under Rule 10(2) <strong>of</strong> the Central Sales Tax (Dadra <strong>and</strong> Nagar Haveli)<br />

Rules, 1983<br />

Assessment Penalty imposed Brief particulars regarding<br />

Year<br />

(In Rs.)<br />

penalty<br />

1999 – 2000 500/- Penalty imposed for not<br />

filling the quarterly returns<br />

in time.<br />

2000-2001 500/- Penalty imposed for not<br />

filling the quarterly returns<br />

in time.<br />

2002-2003 1,54,649/- Penalty imposed for short<br />

payment.<br />

2004-2005 1,62,033/- Penalty <strong>of</strong> Rs. 1,61,033/charged<br />

as penal interest<br />

for duty not paid <strong>and</strong> Rs.<br />

1000/- imposed for not<br />

filing the returns timely<br />

<strong>and</strong> correctly.<br />

VII. Amount owed to Small Scale Undertaking <strong>and</strong> Other Creditors:<br />

209<br />

Remarks<br />

(Paid / Payable)<br />

Paid<br />

There are no small scale undertakings to whom our Company owes a sum exceeding Rs. 1 Lac which is<br />

outst<strong>and</strong>ing more than 30 days, as on September 30, 2007. However, our Company owes an agreegate<br />

amount <strong>of</strong> Rs.7,24,69,132 to various other creditors’ exceeding Rs. 1 Lac individually, which is<br />

outst<strong>and</strong>ing more than 30 days, as on September 30, 2007.<br />

Litigation with respect to our Promoters / Promoters Group <strong>and</strong> other Ventures <strong>of</strong> our Promoters<br />

Sejal Glass House<br />

Paid<br />

Paid<br />

Paid