sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

sejal architectural glass limited - Securities and Exchange Board of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

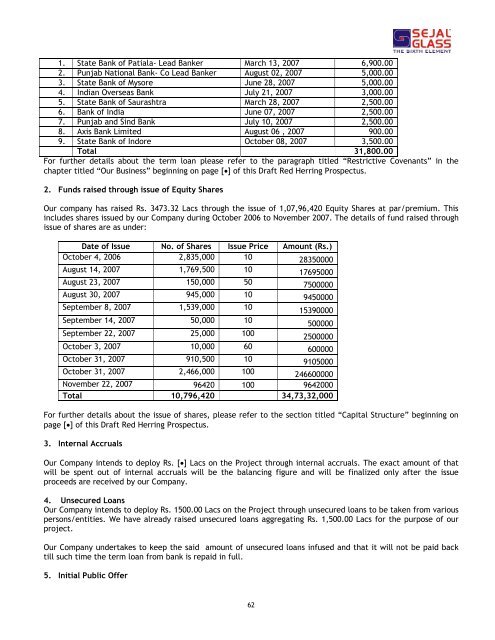

1. State Bank <strong>of</strong> Patiala- Lead Banker March 13, 2007 6,900.00<br />

2. Punjab National Bank- Co Lead Banker August 02, 2007 5,000.00<br />

3. State Bank <strong>of</strong> Mysore June 28, 2007 5,000.00<br />

4. Indian Overseas Bank July 21, 2007 3,000.00<br />

5. State Bank <strong>of</strong> Saurashtra March 28, 2007 2,500.00<br />

6. Bank <strong>of</strong> India June 07, 2007 2,500.00<br />

7. Punjab <strong>and</strong> Sind Bank July 10, 2007 2,500.00<br />

8. Axis Bank Limited August 06 , 2007 900.00<br />

9. State Bank <strong>of</strong> Indore October 08, 2007 3,500.00<br />

Total 31,800.00<br />

For further details about the term loan please refer to the paragraph titled “Restrictive Covenants” in the<br />

chapter titled “Our Business” beginning on page [•] <strong>of</strong> this Draft Red Herring Prospectus.<br />

2. Funds raised through issue <strong>of</strong> Equity Shares<br />

Our company has raised Rs. 3473.32 Lacs through the issue <strong>of</strong> 1,07,96,420 Equity Shares at par/premium. This<br />

includes shares issued by our Company during October 2006 to November 2007. The details <strong>of</strong> fund raised through<br />

issue <strong>of</strong> shares are as under:<br />

Date <strong>of</strong> Issue No. <strong>of</strong> Shares Issue Price Amount (Rs.)<br />

October 4, 2006 2,835,000 10 28350000<br />

August 14, 2007 1,769,500 10 17695000<br />

August 23, 2007 150,000 50 7500000<br />

August 30, 2007 945,000 10 9450000<br />

September 8, 2007 1,539,000 10<br />

15390000<br />

September 14, 2007 50,000 10<br />

500000<br />

September 22, 2007 25,000 100<br />

2500000<br />

October 3, 2007 10,000 60 600000<br />

October 31, 2007 910,500 10 9105000<br />

October 31, 2007 2,466,000 100 246600000<br />

November 22, 2007 96420 100 9642000<br />

Total 10,796,420 34,73,32,000<br />

For further details about the issue <strong>of</strong> shares, please refer to the section titled “Capital Structure” beginning on<br />

page [•] <strong>of</strong> this Draft Red Herring Prospectus.<br />

3. Internal Accruals<br />

Our Company intends to deploy Rs. [•] Lacs on the Project through internal accruals. The exact amount <strong>of</strong> that<br />

will be spent out <strong>of</strong> internal accruals will be the balancing figure <strong>and</strong> will be finalized only after the issue<br />

proceeds are received by our Company.<br />

4. Unsecured Loans<br />

Our Company intends to deploy Rs. 1500.00 Lacs on the Project through unsecured loans to be taken from various<br />

persons/entities. We have already raised unsecured loans aggregating Rs. 1,500.00 Lacs for the purpose <strong>of</strong> our<br />

project.<br />

Our Company undertakes to keep the said amount <strong>of</strong> unsecured loans infused <strong>and</strong> that it will not be paid back<br />

till such time the term loan from bank is repaid in full.<br />

5. Initial Public Offer<br />

62