RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

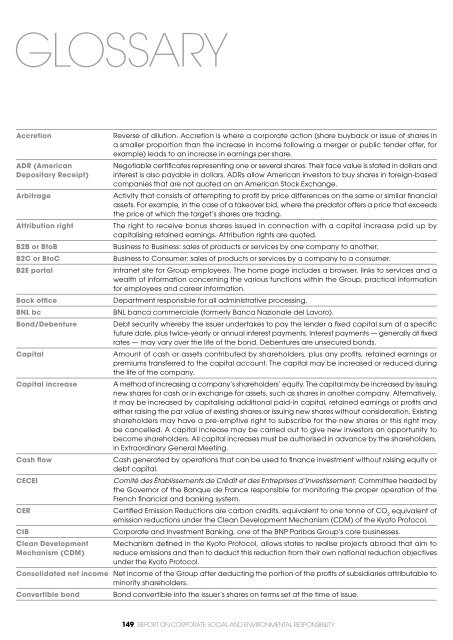

gloSSaRy<br />

Accreti<strong>on</strong> reverse of diluti<strong>on</strong>. accreti<strong>on</strong> is where a corporate acti<strong>on</strong> (share buyback or issue of shares in<br />

a smaller proporti<strong>on</strong> than the increase in income following a merger or public tender offer, for<br />

example) leads to an increase in earnings per share.<br />

adr (american<br />

depositary receipt)<br />

negotiable certificates representing <strong>on</strong>e or several shares. their face value is stated in dollars and<br />

interest is also payable in dollars. adrs allow american investors to buy shares in foreign-based<br />

companies that are not quoted <strong>on</strong> an american stock exchange.<br />

Arbitrage activity that c<strong>on</strong>sists of attempting to profit by price differences <strong>on</strong> the same or similar financial<br />

assets. for example, in the case of a takeover bid, where the predator offers a price that exceeds<br />

the price at which the target’s shares are trading.<br />

Attributi<strong>on</strong> right the right to receive b<strong>on</strong>us shares issued in c<strong>on</strong>necti<strong>on</strong> with a capital increase paid up by<br />

capitalising retained earnings. attributi<strong>on</strong> rights are quoted.<br />

b2b or btob business to business: sales of products or services by <strong>on</strong>e company to another.<br />

b2c or btoc business to c<strong>on</strong>sumer: sales of products or services by a company to a c<strong>on</strong>sumer.<br />

b2e portal intranet site for group employees. the home page includes a browser, links to services and a<br />

wealth of informati<strong>on</strong> c<strong>on</strong>cerning the various functi<strong>on</strong>s within the group, practical informati<strong>on</strong><br />

for employees and career informati<strong>on</strong>.<br />

back office department resp<strong>on</strong>sible for all administrative processing.<br />

bnl bc bnl banca commerciale (formerly banca nazi<strong>on</strong>ale del lavoro).<br />

b<strong>on</strong>d/debenture debt security whereby the issuer undertakes to pay the lender a fixed capital sum at a specific<br />

future date, plus twice-yearly or annual interest payments. interest payments — generally at fixed<br />

rates — may vary over the life of the b<strong>on</strong>d. debentures are unsecured b<strong>on</strong>ds.<br />

capital amount of cash or assets c<strong>on</strong>tributed by shareholders, plus any profits, retained earnings or<br />

premiums transferred to the capital account. the capital may be increased or reduced during<br />

the life of the company.<br />

capital increase a method of increasing a company’s shareholders’ equity. the capital may be increased by issuing<br />

new shares for cash or in exchange for assets, such as shares in another company. alternatively,<br />

it may be increased by capitalising additi<strong>on</strong>al paid-in capital, retained earnings or profits and<br />

either raising the par value of existing shares or issuing new shares without c<strong>on</strong>siderati<strong>on</strong>. existing<br />

shareholders may have a pre-emptive right to subscribe for the new shares or this right may<br />

be cancelled. a capital increase may be carried out to give new investors an opportunity to<br />

become shareholders. all capital increases must be authorised in advance by the shareholders,<br />

in extraordinary general meeting.<br />

cash flow cash generated by operati<strong>on</strong>s that can be used to finance investment without raising equity or<br />

debt capital.<br />

cecei Comité des Établissements de Crédit et des Entreprises d’Investissement: committee headed by<br />

the governor of the banque de france resp<strong>on</strong>sible for m<strong>on</strong>itoring the proper operati<strong>on</strong> of the<br />

french financial and banking system.<br />

ceR certified emissi<strong>on</strong> reducti<strong>on</strong>s are carb<strong>on</strong> credits, equivalent to <strong>on</strong>e t<strong>on</strong>ne of co equivalent of<br />

2<br />

emissi<strong>on</strong> reducti<strong>on</strong>s under the clean development mechanism (cdm) of the Kyoto Protocol.<br />

cib corporate and investment banking, <strong>on</strong>e of the bnP <strong>Paribas</strong> group’s core businesses.<br />

clean development<br />

mechanism (Cdm)<br />

mechanism defined in the Kyoto Protocol, allows states to realise projects abroad that aim to<br />

reduce emissi<strong>on</strong>s and then to deduct this reducti<strong>on</strong> from their own nati<strong>on</strong>al reducti<strong>on</strong> objectives<br />

under the Kyoto Protocol.<br />

c<strong>on</strong>solidated net income net income of the group after deducting the porti<strong>on</strong> of the profits of subsidiaries attributable to<br />

minority shareholders.<br />

c<strong>on</strong>vertible b<strong>on</strong>d b<strong>on</strong>d c<strong>on</strong>vertible into the issuer’s shares <strong>on</strong> terms set at the time of issue.<br />

149 <str<strong>on</strong>g>RepoRt</str<strong>on</strong>g> <strong>on</strong> CoRpoRate SoCial and enviR<strong>on</strong>mental ReSp<strong>on</strong>Sibility