RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

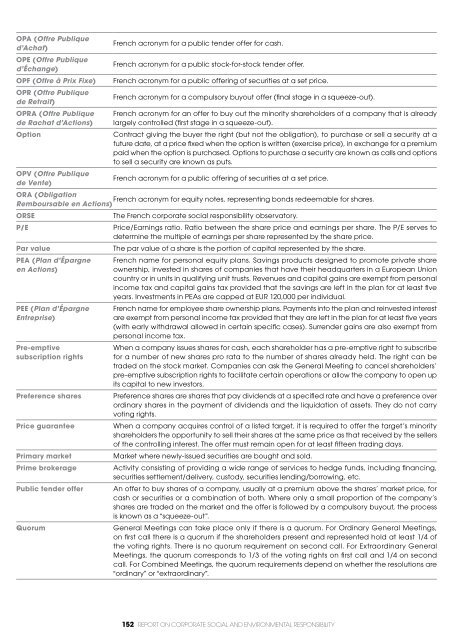

opa (Offre Publique<br />

d’Achat)<br />

ope (Offre Publique<br />

d’Échange)<br />

french acr<strong>on</strong>ym for a public tender offer for cash.<br />

french acr<strong>on</strong>ym for a public stock-for-stock tender offer.<br />

opF (Offre à Prix Fixe) french acr<strong>on</strong>ym for a public offering of securities at a set price.<br />

opr (Offre Publique<br />

de Retrait)<br />

opra (Offre Publique<br />

de Rachat d’Acti<strong>on</strong>s)<br />

french acr<strong>on</strong>ym for a compulsory buyout offer (final stage in a squeeze-out).<br />

french acr<strong>on</strong>ym for an offer to buy out the minority shareholders of a company that is already<br />

largely c<strong>on</strong>trolled (first stage in a squeeze-out).<br />

opti<strong>on</strong> c<strong>on</strong>tract giving the buyer the right (but not the obligati<strong>on</strong>), to purchase or sell a security at a<br />

future date, at a price fixed when the opti<strong>on</strong> is written (exercise price), in exchange for a premium<br />

paid when the opti<strong>on</strong> is purchased. opti<strong>on</strong>s to purchase a security are known as calls and opti<strong>on</strong>s<br />

to sell a security are known as puts.<br />

opv (Offre Publique<br />

french acr<strong>on</strong>ym for a public offering of securities at a set price.<br />

de Vente)<br />

ora (Obligati<strong>on</strong><br />

french acr<strong>on</strong>ym for equity notes, representing b<strong>on</strong>ds redeemable for shares.<br />

Remboursable en Acti<strong>on</strong>s)<br />

oRse the french corporate social resp<strong>on</strong>sibility observatory.<br />

p/e Price/earnings ratio. ratio between the share price and earnings per share. the P/e serves to<br />

determine the multiple of earnings per share represented by the share price.<br />

par value the par value of a share is the porti<strong>on</strong> of capital represented by the share.<br />

pea (Plan d’Épargne<br />

en Acti<strong>on</strong>s)<br />

pee (Plan d’Épargne<br />

Entreprise)<br />

pre-emptive<br />

subscripti<strong>on</strong> rights<br />

french name for pers<strong>on</strong>al equity plans. savings products designed to promote private share<br />

ownership, invested in shares of companies that have their headquarters in a european uni<strong>on</strong><br />

country or in units in qualifying unit trusts. revenues and capital gains are exempt from pers<strong>on</strong>al<br />

income tax and capital gains tax provided that the savings are left in the plan for at least five<br />

years. investments in Peas are capped at eur 120,000 per individual.<br />

french name for employee share ownership plans. Payments into the plan and reinvested interest<br />

are exempt from pers<strong>on</strong>al income tax provided that they are left in the plan for at least five years<br />

(with early withdrawal allowed in certain specific cases). surrender gains are also exempt from<br />

pers<strong>on</strong>al income tax.<br />

when a company issues shares for cash, each shareholder has a pre-emptive right to subscribe<br />

for a number of new shares pro rata to the number of shares already held. the right can be<br />

traded <strong>on</strong> the stock market. companies can ask the general meeting to cancel shareholders’<br />

pre-emptive subscripti<strong>on</strong> rights to facilitate certain operati<strong>on</strong>s or allow the company to open up<br />

its capital to new investors.<br />

preference shares Preference shares are shares that pay dividends at a specified rate and have a preference over<br />

ordinary shares in the payment of dividends and the liquidati<strong>on</strong> of assets. they do not carry<br />

voting rights.<br />

price guarantee when a company acquires c<strong>on</strong>trol of a listed target, it is required to offer the target’s minority<br />

shareholders the opportunity to sell their shares at the same price as that received by the sellers<br />

of the c<strong>on</strong>trolling interest. the offer must remain open for at least fifteen trading days.<br />

primary market market where newly-issued securities are bought and sold.<br />

prime brokerage activity c<strong>on</strong>sisting of providing a wide range of services to hedge funds, including financing,<br />

securities settlement/delivery, custody, securities lending/borrowing, etc.<br />

public tender offer an offer to buy shares of a company, usually at a premium above the shares’ market price, for<br />

cash or securities or a combinati<strong>on</strong> of both. where <strong>on</strong>ly a small proporti<strong>on</strong> of the company’s<br />

shares are traded <strong>on</strong> the market and the offer is followed by a compulsory buyout, the process<br />

is known as a “squeeze-out”.<br />

Quorum general meetings can take place <strong>on</strong>ly if there is a quorum. for ordinary general meetings,<br />

<strong>on</strong> first call there is a quorum if the shareholders present and represented hold at least 1/4 of<br />

the voting rights. there is no quorum requirement <strong>on</strong> sec<strong>on</strong>d call. for extraordinary general<br />

meetings, the quorum corresp<strong>on</strong>ds to 1/3 of the voting rights <strong>on</strong> first call and 1/4 <strong>on</strong> sec<strong>on</strong>d<br />

call. for combined meetings, the quorum requirements depend <strong>on</strong> whether the resoluti<strong>on</strong>s are<br />

“ordinary” or “extraordinary”.<br />

152 <str<strong>on</strong>g>RepoRt</str<strong>on</strong>g> <strong>on</strong> CoRpoRate SoCial and enviR<strong>on</strong>mental ReSp<strong>on</strong>Sibility