RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

RepoRt on - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

changes<br />

in share<br />

ownership<br />

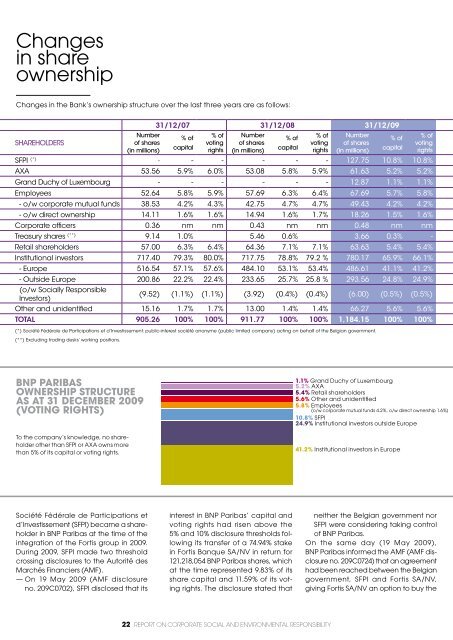

changes in the bank’s ownership structure over the last three years are as follows:<br />

SHAREHOLDERS<br />

number<br />

of shares<br />

(in milli<strong>on</strong>s)<br />

société fédérale de Participati<strong>on</strong>s et<br />

d’investissement (sfPi) became a shareholder<br />

in bnP <strong>Paribas</strong> at the time of the<br />

integrati<strong>on</strong> of the fortis group in 2009.<br />

during 2009, sfPi made two threshold<br />

crossing disclosures to the autorité des<br />

marchés financiers (amf).<br />

— <strong>on</strong> 19 may 2009 (amf disclosure<br />

no. 209c0702), sfPi disclosed that its<br />

31/12/07 31/12/08 31/12/09<br />

% of<br />

capital<br />

% of<br />

voting<br />

rights<br />

number<br />

of shares<br />

(in milli<strong>on</strong>s)<br />

% of<br />

capital<br />

interest in bnP <strong>Paribas</strong>’ capital and<br />

voting rights had risen above the<br />

5% and 10% disclosure thresholds following<br />

its transfer of a 74.94% stake<br />

in fortis banque sa/nv in return for<br />

121,218,054 bnP <strong>Paribas</strong> shares, which<br />

at the time represented 9.83% of its<br />

share capital and 11.59% of its voting<br />

rights. the disclosure stated that<br />

% of<br />

voting<br />

rights<br />

22 <str<strong>on</strong>g>RepoRt</str<strong>on</strong>g> <strong>on</strong> CoRpoRate SoCial and enviR<strong>on</strong>mental ReSp<strong>on</strong>Sibility<br />

number<br />

of shares<br />

(in milli<strong>on</strong>s)<br />

SFPI (*) - - - - - - 127.75 10.8% 10.8%<br />

AxA 53.56 5.9% 6.0% 53.08 5.8% 5.9% 61.63 5.2% 5.2%<br />

Grand duchy of Luxembourg - - - - - - 12.87 1.1% 1.1%<br />

Employees 52.64 5.8% 5.9% 57.69 6.3% 6.4% 67.69 5.7% 5.8%<br />

- o/w corporate mutual funds 38.53 4.2% 4.3% 42.75 4.7% 4.7% 49.43 4.2% 4.2%<br />

- o/w direct ownership 14.11 1.6% 1.6% 14.94 1.6% 1.7% 18.26 1.5% 1.6%<br />

Corporate officers 0.36 nm nm 0.43 nm nm 0.48 nm nm<br />

Treasury shares (**) 9.14 1.0% 5.46 0.6% 3.66 0.3% -<br />

Retail shareholders 57.00 6.3% 6.4% 64.36 7.1% 7.1% 63.63 5.4% 5.4%<br />

Instituti<strong>on</strong>al investors 717.40 79.3% 80.0% 717.75 78.8% 79.2 % 780.17 65.9% 66.1%<br />

- Europe 516.54 57.1% 57.6% 484.10 53.1% 53.4% 486.61 41.1% 41.2%<br />

- Outside Europe 200.86 22.2% 22.4% 233.65 25.7% 25.8 % 293.56 24.8% 24.9%<br />

(o/w Socially Resp<strong>on</strong>sible<br />

Investors)<br />

(9.52) (1.1%) (1.1%) (3.92) (0.4%) (0.4%) (6.00) (0.5%) (0.5%)<br />

Other and unidentified 15.16 1.7% 1.7% 13.00 1.4% 1.4% 66.27 5.6% 5.6%<br />

TOTAL 905.26 100% 100% 911.77 100% 100% 1,184.15 100% 100%<br />

(*) Société Fédérale de Participati<strong>on</strong>s et d’Investissement: public-interest société an<strong>on</strong>yme (public limited company) acting <strong>on</strong> behalf of the Belgian government.<br />

(**) Excluding trading desks’ working positi<strong>on</strong>s.<br />

bnp pARibAs<br />

oWneRship stRuctuRe<br />

As At 31 decembeR 2009<br />

(voting rigHts)<br />

to the company’s knowledge, no shareholder<br />

other than sfPi or axa owns more<br />

than 5% of its capital or voting rights.<br />

% of<br />

capital<br />

41.2% instituti<strong>on</strong>al investors in europe<br />

% of<br />

voting<br />

rights<br />

1.1% grand duchy of luxembourg<br />

5.2% axa<br />

5.4% retail shareholders<br />

5.6% other and unidentified<br />

5.8% employees<br />

(o/w corporate mutual funds 4.2%, o/w direct ownership 1.6%)<br />

10.8% sfPi<br />

24.9% instituti<strong>on</strong>al investors outside europe<br />

neither the belgian government nor<br />

sfPi were c<strong>on</strong>sidering taking c<strong>on</strong>trol<br />

of bnP <strong>Paribas</strong>.<br />

<strong>on</strong> the same day (19 may 2009),<br />

bnP <strong>Paribas</strong> informed the amf (amf disclosure<br />

no. 209c0724) that an agreement<br />

had been reached between the belgian<br />

government, sfPi and fortis sa/nv,<br />

giving fortis sa/nv an opti<strong>on</strong> to buy the