- Page 1 and 2:

Project logo: Priority logo: Projec

- Page 3 and 4:

Paper Session 6 thBALKAN POWER CONF

- Page 5 and 6:

6 thBALKAN POWER CONFERENCE Panel S

- Page 7 and 8:

- WAYS TO MINIMIZE THE GREENHOUSE G

- Page 9 and 10:

BPC 2006 INTRODUCTION • The inter

- Page 11 and 12:

CARBON EMISSIONS TRADING - A NEW WE

- Page 13 and 14:

CARBON EMISSIONS TRADING - A NEW WE

- Page 15 and 16:

PROMOTION OF RENEWABLE RESOURCES

- Page 17 and 18:

NUCLEAR POWER - NOT ONLY AN OPTION,

- Page 19 and 20:

ROMANIAN APPROACH BPC 2006 • In 2

- Page 21 and 22:

ROMANIAN APPROACH BPC 2006 The tren

- Page 23 and 24:

ROMANIAN APPROACH BPC 2006 • The

- Page 25 and 26:

ROMANIAN APPROACH BPC 2006 • Anot

- Page 27 and 28:

CONCLUSIONS BPC 2006 • We conside

- Page 29 and 30:

ioan.manicuta@opcom.ro

- Page 31 and 32:

kategorizicija na hidrogeotermalnit

- Page 33 and 34:

konduktivni hidrogeotermalni sistem

- Page 35 and 36:

Glavni geotermalni poliwa vo Makedo

- Page 37 and 38:

metodi za odreduvawe na geotermalni

- Page 39 and 40:

U~estvo na poedine~ni energenti vo

- Page 41 and 42:

PREPORAKI so relativno mali vlo`uv

- Page 43 and 44:

6th Balkan Power Conference Romania

- Page 45 and 46:

Electricity are traded separately f

- Page 47 and 48:

Support system for E-RES E RES Fixe

- Page 49 and 50:

Central Central Command Command and

- Page 51 and 52:

CGCMO determines: determines determ

- Page 53 and 54:

10.000 10.000 9.000 9.000 8.000 8.0

- Page 55 and 56:

50 50 45 45 40 40 35 35 30 30 25 25

- Page 57 and 58:

Centralized Green Certificates Mark

- Page 59 and 60:

90 90 80 80 70 70 60 60 50 50 40 40

- Page 61 and 62:

Thank you for your attention Ghergh

- Page 63 and 64:

ABSTRACT Biomass is one of the very

- Page 65 and 66:

INTRODUCTION -Biogas is a mixture o

- Page 67 and 68:

BENEFITS RESULTING FROM THE USE OF

- Page 69 and 70:

ELECTRICAL ENERGY AND BIOGAS When b

- Page 71 and 72:

BIOGAS AS RENEWABLE SOURCE IN ISOLA

- Page 73 and 74:

BIOGAS AS RENEWABLE SOURCE IN ISOLA

- Page 75 and 76:

BIOGAS AS RENEWABLE SOURCE IN ISOLA

- Page 77 and 78:

Renewable Energy in Western Region

- Page 79 and 80:

Renewable Energy in China • China

- Page 81 and 82:

Western Region of China • The pot

- Page 83 and 84:

WRC : Area and Population • The t

- Page 85 and 86:

Geographical Conditions of WRC •

- Page 87 and 88:

Renewable Potentials: Hydro Power

- Page 89 and 90:

Wind Energy • China has rich wind

- Page 91 and 92:

Geothermal Power Generation in Tibe

- Page 93 and 94:

Barriers to RES Development in Chin

- Page 95 and 96:

Financing Problems • Due to low e

- Page 97 and 98:

Financing of RES Projects in Tibet

- Page 99 and 100:

Wind and Biomass Projects • Compa

- Page 101 and 102:

The geothermal energy • Market po

- Page 103 and 104:

Introduction • Croatia, now for a

- Page 105 and 106:

Solar and wind power a) b) c) d) Un

- Page 107 and 108:

Biomass, hydro and geothermal energ

- Page 109 and 110:

Conclusion The DEG based on RES in

- Page 111 and 112:

ADEG database Thank you for you att

- Page 113 and 114:

Presentation outline 1. Guarantees

- Page 115 and 116:

Life Cycle of a TGC 1. 2. 3. ISSUE

- Page 117 and 118:

RELATION BETEEN RECS AND GoO • Go

- Page 119 and 120:

Use of TGCs and GoOs • Green elec

- Page 121 and 122:

Introduction of RECS in SEE Option

- Page 123 and 124:

Contact information Energy Agency o

- Page 130 and 131:

Fig 1. Principal met station locati

- Page 132 and 133:

Map around Banatski Karlovac met st

- Page 138:

Wind mast data 40 m Weibull fit Com

- Page 142:

Table II Predicted Deliblatska Peš

- Page 145:

Table IV Predicted wind at Deliblat

- Page 150 and 151:

a) measured by mast sensor b) Predi

- Page 152:

It was found that rounded-off hourl

- Page 156:

c The possibility of wind climate p

- Page 164 and 165:

Wind rose and Weibull velocity dist

- Page 180 and 181:

Future eco house will consists of t

- Page 182 and 183:

The electric load of Rošijana hous

- Page 184:

Water pump 1 2000 2000 00-24 0.5 10

- Page 187 and 188:

P [kW] 4.0 3.5 3.0 2.5 2.0 1.5 1.0

- Page 189:

E [kWh/day] E [kWh/month] January 2

- Page 193 and 194:

- In accordance to power demands sh

- Page 195 and 196:

Grid type - Isolated-grid Peak load

- Page 197:

House and power source (wind genera

- Page 201:

Contribution to development of urba

- Page 204 and 205:

Potential for PV application in the

- Page 206 and 207:

Potential for PV application in the

- Page 208 and 209:

Potential for PV application in the

- Page 210 and 211:

Additional/alternative inland locat

- Page 212 and 213:

Potential for PV application in the

- Page 214 and 215:

Potential for PV application in the

- Page 216 and 217:

Potential for PV application in the

- Page 218:

Potential for PV application in the

- Page 222 and 223:

Lokacija: selo Bušević Available

- Page 224 and 225:

Lokacija: selo Bušević Energy (kW

- Page 226 and 227:

Cijena PV sistema (za osnovne potre

- Page 229 and 230:

FP6 Project RISE (Renewables for Is

- Page 231 and 232:

Potential for PV application in the

- Page 234 and 235:

Estimation of Costs for Implementat

- Page 236 and 237:

Introduction • Preliminary estima

- Page 238 and 239:

Photovoltaic Project Analysis Model

- Page 240 and 241:

Load identification Load (kW) 3,5 3

- Page 242 and 243:

Description of the PV system • Mo

- Page 244 and 245:

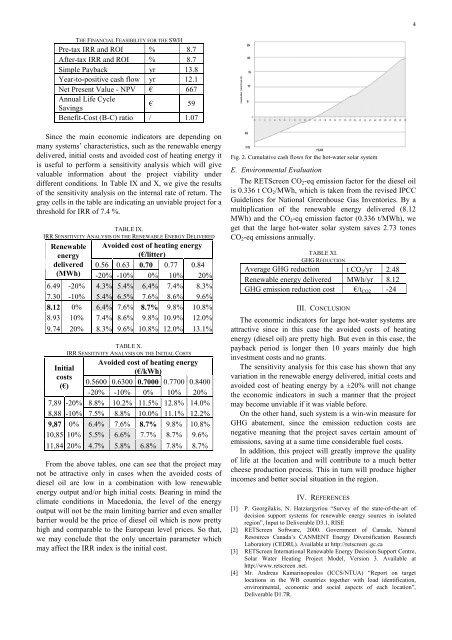

Cost analysis and financial summary

- Page 246 and 247:

Cost analysis and financial summary

- Page 248 and 249:

6 Economic and Environmental evalua

- Page 250 and 251:

I. Introduction • Average solar r

- Page 252 and 253:

II Study case (performed under the

- Page 254 and 255:

Hourly Distribution of Global Solar

- Page 256 and 257:

Storage and BOS Characteristics Sto

- Page 258 and 259:

D. Economical Evaluation Annual Ene

- Page 260 and 261:

E. Environmental Evaluation GHG Red

- Page 262 and 263:

• On the other hand, such system

- Page 264:

FEASIBILITY ANALYSIS OF WIND-PLANT

- Page 267 and 268:

TYPICAL COSTS STRUCTURE FOR SMALL W

- Page 269 and 270:

WIND-PLANT ECONOMY available wind

- Page 271 and 272:

Location and orografy given by a sa

- Page 273 and 274:

Wind potential and wind rose estima

- Page 275 and 276:

Following input data are specified

- Page 277 and 278:

SUMMARY • Target location has a g

- Page 279 and 280:

Introduction Over the last ten year

- Page 281 and 282:

Introduction In Macedonia there is

- Page 283 and 284:

Wind Maps The Atlas is consisting o

- Page 285 and 286:

Site selection General site data 25

- Page 287:

Site 7 - Kozuf Mountain has greates

- Page 292:

Site 16 - Sasavarlija, Stip the sit

- Page 296 and 297:

Measurement Campaign The objective

- Page 298 and 299:

Data processing All sensors are sam

- Page 300 and 301:

RES: Investments Opportunities & Re

- Page 302 and 303:

PANEL SESSION: RES: Investments and

- Page 304 and 305:

Electricity from Solar - Croatia: P

- Page 306 and 307:

Renewables now make 20-25% of globa

- Page 308 and 309:

CROATIA - Current situation in Powe

- Page 310 and 311:

% 80 70 60 50 40 30 20 10 0 1988. 1

- Page 312 and 313:

This gloomy situation with RES in C

- Page 314 and 315:

Comparison of politics in Europe re

- Page 316 and 317:

In process of acceptance: Grid Code

- Page 318 and 319:

In the procedure for acceptance: Se

- Page 320 and 321:

Example of Austria regarding % of i

- Page 322 and 323:

Croatian Policy Goals Minimum share

- Page 324:

Arguments for Optimism for Croatia:

- Page 327 and 328:

Contents Introduction Effects of

- Page 329 and 330:

Effects on power system Wind power

- Page 331 and 332:

Power quality The location and int

- Page 333 and 334:

Power system dynamics If conventio

- Page 335 and 336:

Wind forecasting Wind forecasting

- Page 337 and 338:

Future research 1. Varying amounts

- Page 339 and 340:

International RES Seminar "Promotin

- Page 341 and 342:

1. Introduction • RES technologie

- Page 343 and 344:

Economic and environmental evaluati

- Page 345 and 346:

Reference option: Lignite fueled po

- Page 347 and 348:

2.2. Wind power plant General input

- Page 349 and 350:

Costs in Reduction Reference Increa

- Page 351 and 352:

RES technology Geotherm. heat. Econ

- Page 353 and 354:

4. Limiting barriers to RES impleme

- Page 355 and 356:

4.3 Required infrastructure • Lac

- Page 357 and 358:

Nevertheless, contributing to susta

- Page 359 and 360:

Hrvatska Elektroprivreda d.d. Table

- Page 361 and 362:

Hrvatska Elektroprivreda d.d. HEP G

- Page 363 and 364:

Hrvatska Elektroprivreda d.d. HEP G

- Page 365 and 366:

Hrvatska Elektroprivreda d.d. Legis

- Page 367 and 368:

Hrvatska Elektroprivreda d.d. Trend

- Page 369 and 370:

Hrvatska Elektroprivreda d.d. Key I

- Page 371 and 372:

Hrvatska Elektroprivreda d.d. Renew

- Page 373 and 374:

Hrvatska Elektroprivreda d.d. Distr

- Page 375 and 376:

Hrvatska Elektroprivreda d.d. Zagre

- Page 377 and 378:

Hrvatska Elektroprivreda d.d. Zagre

- Page 379 and 380:

Gorazd Škerbinek REGULATORY FRAMEW

- Page 381 and 382:

RES-E in the Balkans • High poten

- Page 384 and 385:

JI/CDM opportunities in the West Ba

- Page 386 and 387:

Introduction How can Annex-1 countr

- Page 388 and 389:

JI and CDM: principle Investor Coun

- Page 390 and 391:

Basic requirements for JI/CDM Emis

- Page 392 and 393:

Status of the Kyoto Protocol ratifi

- Page 394 and 395:

Sucessful examples of JI/CDM in sel

- Page 396 and 397:

JI/CDM Opportunities in West Balkan

- Page 398 and 399:

© Dr I. N. Tzortzis Renewable Ener

- Page 400 and 401:

2. The aims To introduce the ideas

- Page 402 and 403:

4. The main provisions II The prel

- Page 404 and 405:

Technology Licenses for use (MW) 6.

- Page 406 and 407:

Emission Trading Elektrizitätsgese

- Page 408 and 409:

ownership. 13% public; 87% Axpo Gro

- Page 410 and 411:

EGL’s approach to the topic CO2

- Page 412 and 413:

€/tonn price development for EUA

- Page 414 and 415:

correlation CO2 - oil €/tonn 31 2

- Page 416 and 417:

correlation CO2 - electricity Germa

- Page 418 and 419:

ehaviour of the market participants

- Page 420 and 421:

questions for CO2 related companies

- Page 422 and 423:

EUAA one uniform trading good in Eu

- Page 424 and 425:

Renewable Energy in Western China -

- Page 426 and 427:

energy resource, which is distribut

- Page 428 and 429:

Exploring the potential of biogas f

- Page 430 and 431:

interes include electricity market

- Page 432 and 433:

pyrolisis method of 0.1 M water sol

- Page 434 and 435:

where d is the film's thickness det

- Page 436 and 437:

Abstract -- This paper presents con

- Page 438 and 439:

development (renewable energy certi

- Page 440 and 441:

This market is administrated by OPC

- Page 442 and 443:

starting from 2004, geothermal, wav

- Page 444 and 445:

producers, starting with august 200

- Page 446 and 447: Operator. Her special fields of int

- Page 448 and 449: On the territory of the RM the most

- Page 450 and 451: Croatia´s RES potential for Decent

- Page 452 and 453: II) take into account all levels cu

- Page 454 and 455: exploited. Fig. 6. Maximum load cap

- Page 456 and 457: Electricity from renewable sources

- Page 458 and 459: mostly in those Member States that

- Page 460 and 461: VI. REFERENCES: [1] Directive 2001/

- Page 462 and 463: cost of RES is usually much higher

- Page 464 and 465: A. Financing Channels for RES Proje

- Page 466 and 467: Techno-economic characteristics of

- Page 468 and 469: decreases in high wind speed. This

- Page 470 and 471: c€/kWh at windy coastal locations

- Page 472 and 473: Potential for PV application in the

- Page 474 and 475: elongs to the not very prosperous D

- Page 476 and 477: communities from the First category

- Page 478 and 479: Feasibility Analysis of Wind-plant

- Page 480 and 481: nonexistence of mechanisms for incl

- Page 482 and 483: Table I shows wind energy potential

- Page 484 and 485: Abstract--Based on the existing met

- Page 486 and 487: grid, but it is not possible to mak

- Page 488 and 489: E [kWh] 55 50 45 40 35 30 25 20 15

- Page 490 and 491: mounted: the one 40 m height mast c

- Page 492 and 493: Fig. 9 Observed wind climate at the

- Page 494 and 495: Economic and Environmental evaluati

- Page 498 and 499: [5] METEONORM, Version 4, Edition 2

- Page 500 and 501: Natural Resources Canada's CANMET E

- Page 502 and 503: combined with other electronic devi

- Page 504 and 505: taking in consideration any support

- Page 506 and 507: momentum and energy, as well as the

- Page 508 and 509: After the site screening was comple