Prva stran - WBC-INCO Net

Prva stran - WBC-INCO Net

Prva stran - WBC-INCO Net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

combined with other electronic devices with the purpose of<br />

better system performance.<br />

The chosen PV array would have an array area of 54,2 m 2<br />

and would consist of 43 modules. Because there is enough<br />

space at the sheepfold, the size of the array is not limited by<br />

the available land area. The roofs of the two small houses<br />

could be also used for mounting the PV array, which in that<br />

case could be divided in two separate parts, but bearing in<br />

mind that the size of the array should not exceed<br />

approximately half of the roof area. Where the PV arrays<br />

would be installed is important when calculating the costs of<br />

the supporting array equipment.<br />

As stated before, the battery should have two days of<br />

anatomy, which should provide reasonable availability for<br />

the system. The battery that could be used for this<br />

application would be with nominal voltage of 24V and<br />

efficiency of 85%. The nominal battery voltage has no<br />

influence on the energy predictions of the model used by the<br />

software application. The use of additional diesel machine is<br />

not taken in consideration because it was assumed that the<br />

batteries would be able to provide enough reserve for the<br />

system.<br />

E. Cost analysis and financial summary<br />

Using this software application, the initial costs for the<br />

installation can be estimated. To perform these cost<br />

analyses, data for possible prices referring to energy<br />

equipment, balance of equipment, and miscellaneous are<br />

needed. The compilation of these data for Macedonia was<br />

especially difficult as the penetration of PV equipment on<br />

the market is quite low, so hardly any reference values exist.<br />

The basic energy equipment in this case includes the PV<br />

modules, while the balance of equipment includes the<br />

module support structure, the inverter, the batteries as well<br />

as the other electrical equipment. The costs for system<br />

installation and transport are also considered when the<br />

initial costs are calculated. The initial costs for the prefeasibility<br />

study were calculated using average market<br />

prices [6] for all equipment which could be installed on site.<br />

The costs for preparing and developing the pre-feasibility<br />

study at this stage were not considered.<br />

When performing cost analyses, it is important to stress<br />

out what conventional sources would be replaced with the<br />

proposed PV system. Two possible cases for the selected<br />

target location were analyzed:<br />

• replacement of a diesel aggregate; and<br />

• avoiding grid extension.<br />

1) Replacement of a Diesel Aggregate,<br />

When replacing a base system, which in this case is a<br />

diesel aggregate, with a PV system, the specific fuel<br />

consumption needed to provide given amount of electrical<br />

energy is directly related to the avoided cost of energy. The<br />

calculations were made assuming that the avoided cost of<br />

energy is 0,7 €/L (approx. 2,6 €/gal). These values,<br />

including the renewable energy delivered by the system are<br />

used by the software to calculate the annual energy savings.<br />

Several economic parameters like: energy cost escalation<br />

rate, inflation, discount rate etc are used by the model to<br />

obtain the cumulative cash flow for the proposed project.<br />

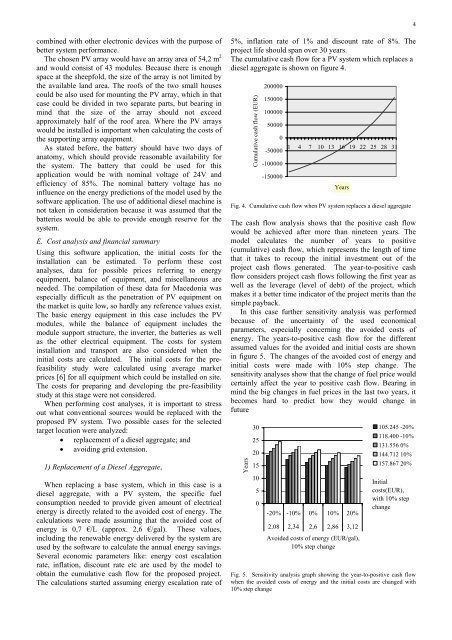

The calculations started assuming energy escalation rate of<br />

5%, inflation rate of 1% and discount rate of 8%. The<br />

project life should span over 30 years.<br />

The cumulative cash flow for a PV system which replaces a<br />

diesel aggregate is shown on figure 4.<br />

Cumulative cash flow (EUR)<br />

200000<br />

150000<br />

100000<br />

50000<br />

0<br />

-50000<br />

-100000<br />

-150000<br />

1 4 7 10 13 16 19 22 25 28 31<br />

Years<br />

Fig. 4. Cumulative cash flow when PV system replaces a diesel aggregate<br />

The cash flow analysis shows that the positive cash flow<br />

would be achieved after more than nineteen years. The<br />

model calculates the number of years to positive<br />

(cumulative) cash flow, which represents the length of time<br />

that it takes to recoup the initial investment out of the<br />

project cash flows generated. The year-to-positive cash<br />

flow considers project cash flows following the first year as<br />

well as the leverage (level of debt) of the project, which<br />

makes it a better time indicator of the project merits than the<br />

simple payback.<br />

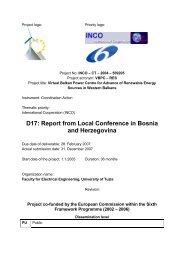

In this case further sensitivity analysis was performed<br />

because of the uncertainty of the used economical<br />

parameters, especially concerning the avoided costs of<br />

energy. The years-to-positive cash flow for the different<br />

assumed values for the avoided and initial costs are shown<br />

in figure 5. The changes of the avoided cost of energy and<br />

initial costs were made with 10% step change. The<br />

sensitivity analyses show that the change of fuel price would<br />

certainly affect the year to positive cash flow. Bearing in<br />

mind the big changes in fuel prices in the last two years, it<br />

becomes hard to predict how they would change in<br />

future<br />

Years<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-20% -10% 0% 10% 20%<br />

2,08 2,34 2,6 2,86 3,12<br />

Avoided costs of energy (EUR/gal),<br />

10% step change<br />

105.245 -20%<br />

118.400 -10%<br />

131.556 0%<br />

144.712 10%<br />

157.867 20%<br />

Initial<br />

costs(EUR),<br />

with 10% step<br />

change<br />

Fig. 5. Sensitivity analysis graph showing the year-to-positive cash flow<br />

when the avoided costs of energy and the initial costs are changed with<br />

10% step change<br />

4