Housing Counseling Process Evaluation and Design of ... - HUD User

Housing Counseling Process Evaluation and Design of ... - HUD User

Housing Counseling Process Evaluation and Design of ... - HUD User

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

that subprime delinquencies are much more likely to require lenders to absorb a financial loss if the<br />

borrower is to have a resolution that retains ownership—either through a reduction in principle <strong>and</strong>/or<br />

through a reduction in interest rate (<strong>and</strong> so the value <strong>of</strong> the mortgage). Further complicating<br />

agencies’ efforts to seek resolutions to these defaults is that many loans have been packaged into<br />

trusts with varying rules regarding the options that can be presented to delinquent borrowers, making<br />

it difficult for counselors <strong>and</strong> loan servicers to know what options are available.<br />

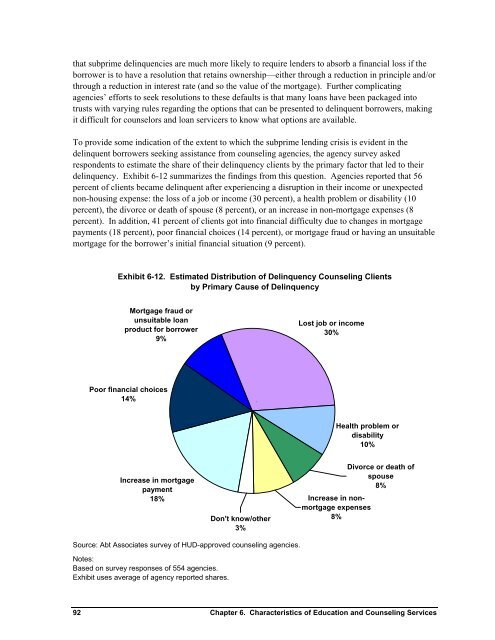

To provide some indication <strong>of</strong> the extent to which the subprime lending crisis is evident in the<br />

delinquent borrowers seeking assistance from counseling agencies, the agency survey asked<br />

respondents to estimate the share <strong>of</strong> their delinquency clients by the primary factor that led to their<br />

delinquency. Exhibit 6-12 summarizes the findings from this question. Agencies reported that 56<br />

percent <strong>of</strong> clients became delinquent after experiencing a disruption in their income or unexpected<br />

non-housing expense: the loss <strong>of</strong> a job or income (30 percent), a health problem or disability (10<br />

percent), the divorce or death <strong>of</strong> spouse (8 percent), or an increase in non-mortgage expenses (8<br />

percent). In addition, 41 percent <strong>of</strong> clients got into financial difficulty due to changes in mortgage<br />

payments (18 percent), poor financial choices (14 percent), or mortgage fraud or having an unsuitable<br />

mortgage for the borrower’s initial financial situation (9 percent).<br />

Exhibit 6-12. Estimated Distribution <strong>of</strong> Delinquency <strong>Counseling</strong> Clients<br />

by Primary Cause <strong>of</strong> Delinquency<br />

Mortgage fraud or<br />

unsuitable loan<br />

product for borrower<br />

9%<br />

Lost job or income<br />

30%<br />

Poor financial choices<br />

14%<br />

`<br />

Health problem or<br />

disability<br />

10%<br />

Increase in mortgage<br />

payment<br />

18%<br />

Divorce or death <strong>of</strong><br />

spouse<br />

8%<br />

Increase in nonmortgage<br />

expenses<br />

Don't know/other 8%<br />

3%<br />

Source: Abt Associates survey <strong>of</strong> <strong>HUD</strong>-approved counseling agencies. <br />

Notes: <br />

Based on survey responses <strong>of</strong> 554 agencies. <br />

Exhibit uses average <strong>of</strong> agency reported shares. <br />

92<br />

Chapter 6. Characteristics <strong>of</strong> Education <strong>and</strong> <strong>Counseling</strong> Services