International Post Guide - Australia Post

International Post Guide - Australia Post

International Post Guide - Australia Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>International</strong> <strong>Post</strong> <strong>Guide</strong> 151<br />

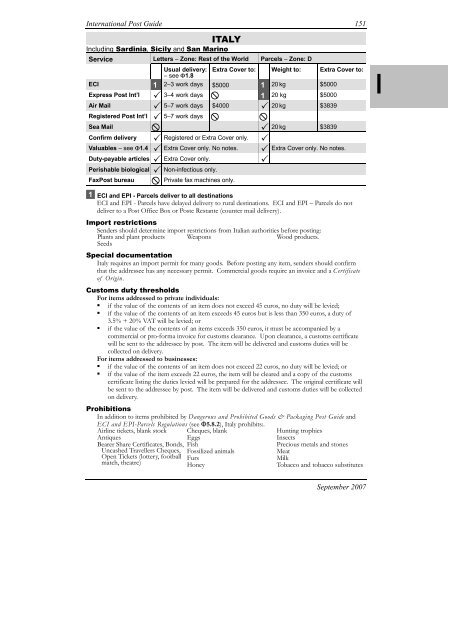

ITALY<br />

Including Sardinia, Sicily and San Marino<br />

Service Letters – Zone: Rest of the World Parcels – Zone: D<br />

Usual delivery:<br />

– see �1.8<br />

Extra Cover to: Weight to: Extra Cover to:<br />

ECI 1 2–3 work days $5000 1 20 kg $5000<br />

Express <strong>Post</strong> Int’l � 3–4 work days Air Mail �<br />

� 1 20 kg $5000<br />

5–7 work days $4000 � 20 kg $3839<br />

Registered <strong>Post</strong> Int’l � 5–7 work days Sea Mail �<br />

� �<br />

� 20 kg $3839<br />

Confirm delivery � Registered or Extra Cover only. Valuables – see �1.4 �<br />

�<br />

Extra Cover only. No notes. Duty-payable articles �<br />

� Extra Cover only. No notes.<br />

Extra Cover only. Perishable biological � Non-infectious only.<br />

Fax<strong>Post</strong> bureau � Private fax machines only.<br />

�<br />

1 ECI and EPI - Parcels deliver to all destinations<br />

ECI and EPI - Parcels have delayed delivery to rural destinations. ECI and EPI – Parcels do not<br />

deliver to a <strong>Post</strong> Office Box or <strong>Post</strong>e Restante (counter mail delivery).<br />

Import restrictions<br />

Senders should determine import restrictions from Italian authorities before posting:<br />

Plants and plant products<br />

Seeds<br />

Special documentation<br />

Weapons Wood products.<br />

Italy requires an import permit for many goods. Before posting any item, senders should confirm<br />

that the addressee has any necessary permit. Commercial goods require an invoice and a Certificate<br />

of Origin.<br />

Customs duty thresholds<br />

For items addressed to private individuals:<br />

� if the value of the contents of an item does not exceed 45 euros, no duty will be levied;<br />

� if the value of the contents of an item exceeds 45 euros but is less than 350 euros, a duty of<br />

3.5% + 20% VAT will be levied; or<br />

� if the value of the contents of an items exceeds 350 euros, it must be accompanied by a<br />

commercial or pro-forma invoice for customs clearance. Upon clearance, a customs certificate<br />

will be sent to the addressee by post. The item will be delivered and customs duties will be<br />

collected on delivery.<br />

For items addressed to businesses:<br />

� if the value of the contents of an item does not exceed 22 euros, no duty will be levied; or<br />

� if the value of the item exceeds 22 euros, the item will be cleared and a copy of the customs<br />

certificate listing the duties levied will be prepared for the addressee. The original certificate will<br />

be sent to the addressee by post. The item will be delivered and customs duties will be collected<br />

on delivery.<br />

Prohibitions<br />

In addition to items prohibited by Dangerous and Prohibited Goods & Packaging <strong>Post</strong> <strong>Guide</strong> and<br />

ECI and EPI-Parcels Regulations (see �5.8.2), Italy prohibits:.<br />

Airline tickets, blank stock Cheques, blank<br />

Hunting trophies<br />

Antiques<br />

Eggs<br />

Insects<br />

Bearer Share Certificates, Bonds, Fish<br />

Uncashed Travellers Cheques, Fossilized animals<br />

Open Tickets (lottery, football Furs<br />

match, theatre)<br />

Honey<br />

Precious metals and stones<br />

Meat<br />

Milk<br />

Tobacco and tobacco substitutes<br />

September 2007<br />

I