Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

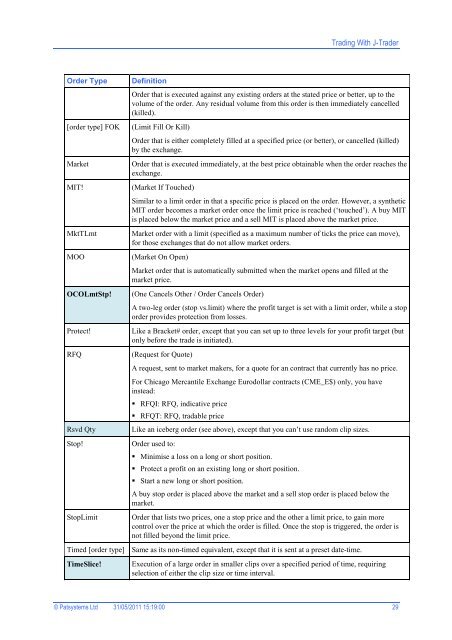

Trading With J-Trader<br />

Order Type<br />

[order type] FOK<br />

Market<br />

MIT!<br />

MktTLmt<br />

MOO<br />

OCOLmtStp!<br />

Protect!<br />

RFQ<br />

Rsvd Qty<br />

Stop!<br />

StopLimit<br />

Definition<br />

Order that is executed against any existing orders at the stated price or better, up to the<br />

volume of the order. Any residual volume from this order is then immediately cancelled<br />

(killed).<br />

(Limit Fill Or Kill)<br />

Order that is either completely filled at a specified price (or better), or cancelled (killed)<br />

by the exchange.<br />

Order that is executed immediately, at the best price obtainable when the order reaches the<br />

exchange.<br />

(Market If Touched)<br />

Similar to a limit order in that a specific price is placed on the order. However, a synthetic<br />

MIT order becomes a market order once the limit price is reached (‘touched’). A buy MIT<br />

is placed below the market price and a sell MIT is placed above the market price.<br />

Market order with a limit (specified as a maximum number of ticks the price can move),<br />

for those exchanges that do not allow market orders.<br />

(Market On Open)<br />

Market order that is automatically submitted when the market opens and filled at the<br />

market price.<br />

(One Cancels Other / Order Cancels Order)<br />

A two-leg order (stop vs.limit) where the profit target is set with a limit order, while a stop<br />

order provides protection from losses.<br />

Like a Bracket# order, except that you can set up to three levels for your profit target (but<br />

only before the trade is initiated).<br />

(Request for Quote)<br />

A request, sent to market makers, for a quote for an contract that currently has no price.<br />

For Chicago Mercantile Exchange Eurodollar contracts (CME_E$) only, you have<br />

instead:<br />

RFQI: RFQ, indicative price<br />

RFQT: RFQ, tradable price<br />

Like an iceberg order (see above), except that you can’t use random clip sizes.<br />

Order used to:<br />

Minimise a loss on a long or short position.<br />

Protect a profit on an existing long or short position.<br />

Start a new long or short position.<br />

A buy stop order is placed above the market and a sell stop order is placed below the<br />

market.<br />

Order that lists two prices, one a stop price and the other a limit price, to gain more<br />

control over the price at which the order is filled. Once the stop is triggered, the order is<br />

not filled beyond the limit price.<br />

Timed [order type] Same as its non-timed equivalent, except that it is sent at a preset date-time.<br />

TimeSlice!<br />

Execution of a large order in smaller clips over a specified period of time, requiring<br />

selection of either the clip size or time interval.<br />

© Patsystems Ltd 31/05/2011 15:19:00 29