Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Trading With J-Trader<br />

Column<br />

High Price<br />

Explanation<br />

For example, if you were buying a butterfly, you’d be buying one lot of leg 1, selling two<br />

lots of leg 2, and buying one lot of leg 3: that’s four legs, but only one butterfly: so the<br />

total traded volume is 1.<br />

Highest, and lowest, price at which the strategy has traded during the current trading day.<br />

Low Price<br />

Closing Price<br />

Last Traded Price<br />

Closing price. This is generated from the settlement prices for the individual legs.<br />

Price at which the strategy last traded.<br />

Using Strategies (MELs)<br />

You can create and trade “multi-exchange leggers” (MELs): strategies that are not supported by<br />

exchanges.<br />

You can use MELs to trade both inter-market (e.g. trading the DAX against the FTSE) and intramarket<br />

(e.g. LIFFE Short Sterling against Gilts). Other uses include buying/selling an index against<br />

futures for the constituent securities, or using the automatic-execution capabilities of MELs to<br />

simulate icebergs.<br />

MELs are executed automatically once the price criteria are met. There is a small legging risk to<br />

trading unsupported strategies like this, namely the risk that one leg executes while the other fails; to<br />

reduce your exposure on larger trades, you can specify a clip size, e.g. send 100 lots in clips of 10.<br />

J-Trader will calculate a ‘MEL Price’ for your strategy, using the parameters defining the relationship<br />

between the legs. This is a synthetic price, existing only locally on J-Trader and not at the exchange.<br />

Once a leg is executed, it exists as an entirely normal order at an exchange, unrelated to any other<br />

orders anywhere (except on your screen).<br />

Note: If you have the Strategy Calculator (page 64), you can create exchange-supported strategies.<br />

Creating a MEL<br />

To create a MEL:<br />

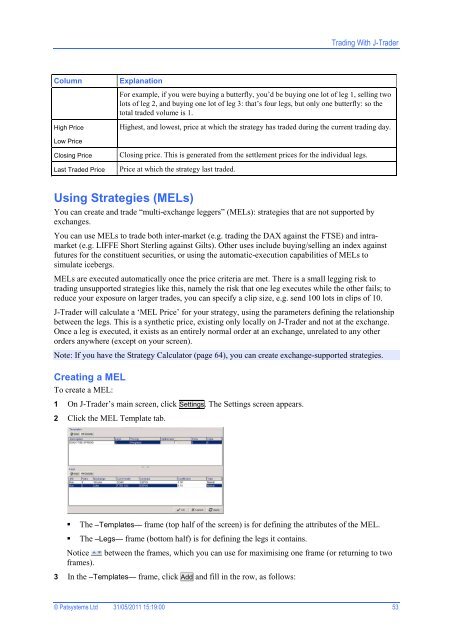

1 On J-Trader’s main screen, click Settings. The Settings screen appears.<br />

2 Click the MEL Template tab.<br />

The –Templates— frame (top half of the screen) is for defining the attributes of the MEL.<br />

The –Legs— frame (bottom half) is for defining the legs it contains.<br />

Notice between the frames, which you can use for maximising one frame (or returning to two<br />

frames).<br />

3 In the –Templates— frame, click Add and fill in the row, as follows:<br />

© Patsystems Ltd 31/05/2011 15:19:00 53