Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

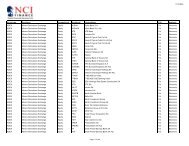

Trading With J-Trader<br />

Column<br />

Description<br />

Enter or select<br />

Name of the MEL strategy: e.g. DAX FTSE SPREAD.<br />

Legs<br />

Pricing<br />

Settlement<br />

Ticks<br />

Clips<br />

(Information only)<br />

Number of legs currently included in the strategy.<br />

How you want the displayed price to be calculated:<br />

Weighted: The MEL price is calculated allowing for the ratios between the legs, the<br />

ratios themselves being specified in the —Legs— frame, Ratio column. For example,<br />

(4 x FDAX price) against (3 x FTSE price).<br />

Linear: Each leg is priced at a ratio of one, irrespective of the ratio at which it is<br />

executed: (1 x FDAX price) against (1 x FTSE price).<br />

Note: This does not affect transactions. The legs of the strategy are always executed in<br />

the ratios specified.<br />

Tick this checkbox to include the settlement price at the previous close: e.g. (4 x<br />

FDAX price - settlement price) against (3 x (FTSE price - settlement price).<br />

Tick-size increment in which you want the MEL’s price to be displayed.<br />

The base (base 32, base 64, and base 128) or decimal used depends on the contracts<br />

you select in the —Legs— frame. If different legs use different bases, J-Trader defaults<br />

to the largest tick.<br />

Clip size.<br />

For example, you could simulate an iceberg by trading 100 lots of the MEL in clips of<br />

10.<br />

4 Add the legs. Each leg represents a separate buy or sell operation, to be executed the number of<br />

times shown in the Ratio column, and in the order they are shown in the list.<br />

For each leg you add:<br />

i. Click Add.<br />

ii. Fill in the row, as follows:<br />

Column<br />

B/S<br />

Ratio<br />

Exchange<br />

Commodity<br />

Contract<br />

Coefficient<br />

Type<br />

Enter or select<br />

Buy or Sell.<br />

Quantity or weighting of this leg.<br />

Exchange, commodity and contract for the leg.<br />

5 Click OK to save and close the Settings dialog.<br />

Trading a MEL<br />

To trade a MEL:<br />

Factor by which the leg price is multiplied, to manage tick size differentials<br />

(and/or account for FX exposure).<br />

For example, suppose you had a DAX leg (priced at €25 per tick with an exchange<br />

value of £17) and the FTSE (priced at £10 per tick): you’d give the FTSE a coefficient<br />

of 1.7.<br />

Whether the leg is to be traded as a Market or Limit order.<br />

54 © Patsystems Ltd 31/05/2011 15:19:00