Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

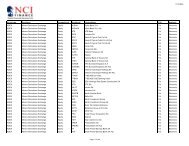

J-Trader Tools<br />

Options strategy type Explanation<br />

Calendar Put Spread<br />

Straddle vs Call<br />

Straddle vs Put<br />

Reversal (Conversion)<br />

Synthetic Conversion/<br />

Reversal<br />

Straddle Calendar Spread<br />

Diagonal Straddle<br />

Calendar Spread<br />

Diagonal Calendar Call<br />

Spread<br />

Diagonal Calendar Put<br />

Spread<br />

Sell near month put, buy far month put (same strikes across the two months).<br />

Buy a straddle versus selling a call: buy the straddle (ie, buy a put and call at the<br />

same strike), as well as selling a call at any strike.<br />

Buy a straddle versus selling a put: buy the straddle (ie, buy a put and call at the<br />

same strike), as well as selling a put at any strike.<br />

Reversal: Buy call, set put at same strike, sell underlying.<br />

Conversion: Same sequence as Reversal, but submitted to the market as a sell/offer<br />

order.<br />

Same as Reversal (Conversion), except that you aren’t trading the underlying leg.<br />

Sell Straddle in near month, buy straddle in far month at same strike. (Sell near<br />

month put, sell near month call, buy far put, buy far call.)<br />

Sell straddle in near month, buy straddle in far month at different strike: sell near<br />

month put, sell near month call, buy far month put, buy far month call.<br />

Sell near month call, buy any far month call at a different strike.<br />

Sell near month put, buy any far month put at a different strike.<br />

<strong>Futures</strong> Strategies<br />

The types of future strategy you can choose on the Strategy Calculator (page 64) are as follows:<br />

<strong>Futures</strong> strategy type<br />

Calendar Spread<br />

Butterfly<br />

Condor<br />

ICS Spread<br />

Explanation<br />

Buy near month, sell far month.<br />

Buy near contract month, sell two contracts in far month, buy one contract in yet<br />

farther month. (The delivery months and the gaps between them do not have to be<br />

equal.)<br />

Buy near month, sell later moth, sell yet later month and buy later month still. (The<br />

delivery months do not have to be consecutive and the gaps between them do not<br />

have to be equal.)<br />

(eCBOT exchange only)<br />

Buy future contract, sell future contract. Two different commodities can be<br />

selected and the ratio set for the first and second legs.<br />

Using the List Ticker<br />

The List Ticker (available from Tools/List Ticker) displays all options, futures, RFQs, block trades, and<br />

strategy trades for any number of contracts on any number of exchanges. It provides immediate access<br />

to information on pricing and transactions. Note that you can only display trades from here, not enter<br />

or amend them.<br />

Follow these steps:<br />

1 From J-Trader’s main menu, select Tools List Ticker.<br />

© Patsystems Ltd 31/05/2011 15:19:00 67