Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

J-Trader Tools<br />

... and unticking the items you don’t want. Notice how unticking a parent unticks all its children,<br />

although you can subsequently tick the children individually.<br />

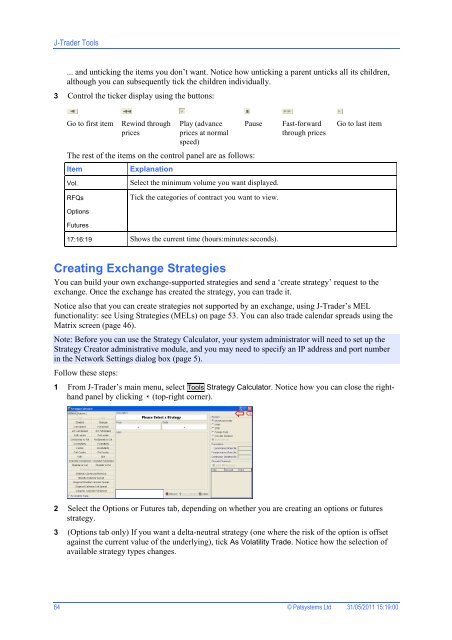

3 Control the ticker display using the buttons:<br />

Go to first item<br />

Rewind through<br />

prices<br />

Play (advance<br />

prices at normal<br />

speed)<br />

Pause<br />

The rest of the items on the control panel are as follows:<br />

Item<br />

Vol.<br />

Explanation<br />

Select the minimum volume you want displayed.<br />

Fast-forward<br />

through prices<br />

Go to last item<br />

RFQs<br />

Tick the categories of contract you want to view.<br />

Options<br />

<strong>Futures</strong><br />

17:16:19 Shows the current time (hours:minutes:seconds).<br />

Creating Exchange Strategies<br />

You can build your own exchange-supported strategies and send a ‘create strategy’ request to the<br />

exchange. Once the exchange has created the strategy, you can trade it.<br />

Notice also that you can create strategies not supported by an exchange, using J-Trader’s MEL<br />

functionality: see Using Strategies (MELs) on page 53. You can also trade calendar spreads using the<br />

Matrix screen (page 46).<br />

Note: Before you can use the Strategy Calculator, your system administrator will need to set up the<br />

Strategy Creator administrative module, and you may need to specify an IP address and port number<br />

in the Network Settings dialog box (page 5).<br />

Follow these steps:<br />

1 From J-Trader’s main menu, select Tools Strategy Calculator. Notice how you can close the righthand<br />

panel by clicking (top-right corner).<br />

2 Select the Options or <strong>Futures</strong> tab, depending on whether you are creating an options or futures<br />

strategy.<br />

3 (Options tab only) If you want a delta-neutral strategy (one where the risk of the option is offset<br />

against the current value of the underlying), tick As Volatility Trade. Notice how the selection of<br />

available strategy types changes.<br />

64 © Patsystems Ltd 31/05/2011 15:19:00