Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

Download User Guide - Berkeley Futures Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

J-Trader Tools<br />

Options Strategies<br />

The types of option strategy you can choose from on the Strategy Calculator (page 64) are described in<br />

the following table. Notice how the selection of available strategies changes according to whether As<br />

Volatility Trade is ticked.<br />

The options strategy types are as follows:<br />

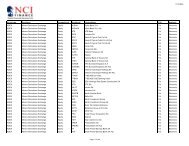

Options strategy type Explanation<br />

Call<br />

Put<br />

Straddle<br />

Strangle<br />

Call Spread<br />

Put Spread<br />

2x1 Call Spread<br />

2x1 Put Spread<br />

Call Spread vs Put<br />

Put Spread vs Call<br />

Call Butterfly<br />

Standard call.<br />

Standard put.<br />

Buy put, buy call at same strike.<br />

Buy put, buy call at higher strike.<br />

Buy call, sell and call (same month) at higher strike.<br />

Buy put, sell any put (same month) at lower strike.<br />

Sell call, buy two calls at higher strike.<br />

Sell put, buy two puts at lower strike.<br />

Buy a call spread versus selling a put: buy a call, sell a call at a higher strike, sell a<br />

put at any strike.<br />

Buy a put spread versus selling a call: buy a put, sell a put at a lower strike, sell a<br />

call at any strike.<br />

Buy call, sell two calls at higher strikes, buy call at a higher strike. (The strikes do<br />

not have to be consecutive and the gaps between them do not have to be equal.)<br />

Put Butterfly<br />

Combo<br />

Iron Butterfly<br />

Call Condor<br />

Put Condor<br />

Calendar Call Spread<br />

Buy put, sell two puts at higher strikes, buy put at a higher strike. (The strikes do<br />

not have to be consecutive and the gaps between them do not have to be equal.)<br />

Sell call, buy put at lower strike.<br />

Buy the straddle, sell the strangle. This must be entered in the following sequence:<br />

sell put, buy put and call at higher strike, sell call at a higher strike. (The strikes do<br />

not have to be consecutive and the gaps between them do not have to be equal.)<br />

Buy near month, sell later month, sell yet later month and buy later month still.<br />

(The delivery months do not have to be consecutive and the gaps between them do<br />

not have to be equal.)<br />

Sell near month call, buy far month call (same strikes across the two months).<br />

66 © Patsystems Ltd 31/05/2011 15:19:00