Regional Markets

56ec00c44c641_local-markets-book_complete_LR

56ec00c44c641_local-markets-book_complete_LR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 Opportunities for development<br />

Although none of the projects interventions specifically aimed at development of ICT<br />

or mobile phone infrastructure, the emergence of mobile telephones was occasionally<br />

mentioned as contributing to a reduction of transaction costs (and an increase of atthe-gate<br />

prices). In Kenya, for instance, most smallholders can use their mobile phones<br />

to exchange information on prices and production volumes, or to make deals with local<br />

traders – the number of trips that traders make to remotely located suppliers is reduced.<br />

Besides, thanks to mobile telephony, several farmers can now coordinate and bulk their<br />

produce, and can transfer money through M-Pesa.<br />

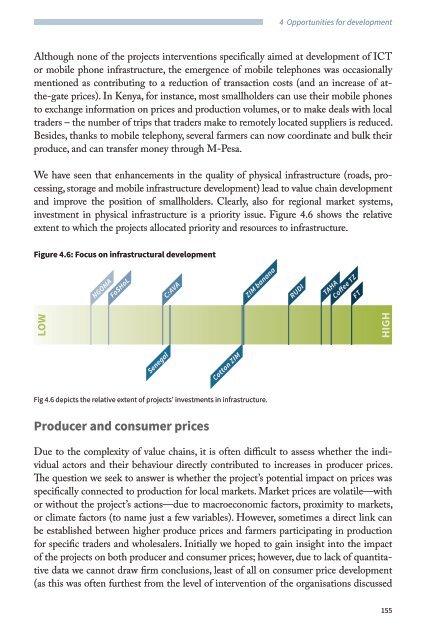

We have seen that enhancements in the quality of physical infrastructure (roads, processing,<br />

storage and mobile infrastructure development) lead to value chain development<br />

and improve the position of smallholders. Clearly, also for regional market systems,<br />

investment in physical infrastructure is a priority issue. Figure 4.6 shows the relative<br />

extent to which the projects allocated priority and resources to infrastructure.<br />

Figure 4.6: Focus on infrastructural development<br />

NGOMA<br />

FoSHoL<br />

C:AVA<br />

ZIM banana<br />

RUDI<br />

TAHA<br />

Coffee TZ<br />

FT<br />

LOW<br />

HIGH<br />

Senegal<br />

Cotton ZIM<br />

Fig 4.6 depicts the relative extent of projects’ investments in infrastructure.<br />

Producer and consumer prices<br />

Due to the complexity of value chains, it is often difficult to assess whether the individual<br />

actors and their behaviour directly contributed to increases in producer prices.<br />

The question we seek to answer is whether the project’s potential impact on prices was<br />

specifically connected to production for local markets. Market prices are volatile—with<br />

or without the project’s actions—due to macroeconomic factors, proximity to markets,<br />

or climate factors (to name just a few variables). However, sometimes a direct link can<br />

be established between higher produce prices and farmers participating in production<br />

for specific traders and wholesalers. Initially we hoped to gain insight into the impact<br />

of the projects on both producer and consumer prices; however, due to lack of quantitative<br />

data we cannot draw firm conclusions, least of all on consumer price development<br />

(as this was often furthest from the level of intervention of the organisations discussed<br />

155