Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER FOUR<br />

97<br />

Enh<strong>an</strong>cing regional fin<strong>an</strong>cial cooperation<br />

TABLE TITLE<br />

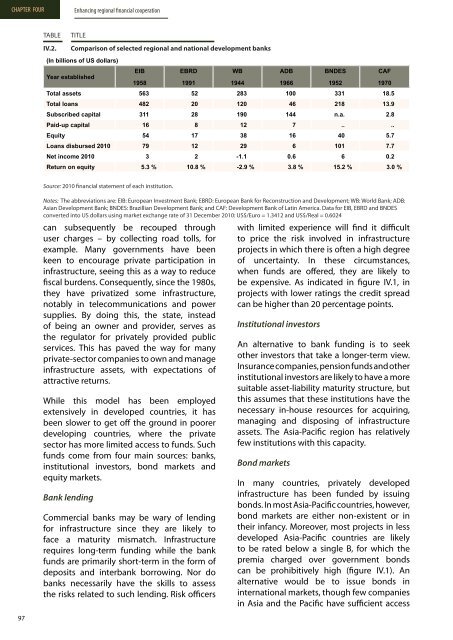

IV.2. Comparison of selected regional <strong>an</strong>d national development b<strong>an</strong>ks<br />

(In billions of US dollars)<br />

Year established<br />

EIB<br />

1958<br />

EBRD<br />

1991<br />

WB<br />

1944<br />

ADB<br />

1966<br />

BNDES<br />

1952<br />

CAF<br />

1970<br />

Total assets 563 52 283 100 331 18.5<br />

Total lo<strong>an</strong>s 482 20 120 46 218 13.9<br />

Subscribed capital 311 28 190 144 n.a. 2.8<br />

Paid-up capital 16 8 12 7 .. ..<br />

Equity 54 17 38 16 40 5.7<br />

Lo<strong>an</strong>s disbursed 2010 79 12 29 6 101 7.7<br />

Net income 2010 3 2 -1.1 0.6 6 0.2<br />

Return on equity 5.3 % 10.8 % -2.9 % 3.8 % 15.2 % 3.0 %<br />

Source: 2010 fin<strong>an</strong>cial statement of each institution.<br />

Notes: The abbreviations are: EIB: Europe<strong>an</strong> Investment B<strong>an</strong>k; EBRD: Europe<strong>an</strong> B<strong>an</strong>k <strong>for</strong> Reconstruction <strong>an</strong>d Development; WB: World B<strong>an</strong>k; ADB:<br />

Asi<strong>an</strong> Development B<strong>an</strong>k; BNDES: Brazilli<strong>an</strong> Development B<strong>an</strong>k; <strong>an</strong>d CAF: Development B<strong>an</strong>k of Latin America. Data <strong>for</strong> EIB, EBRD <strong>an</strong>d BNDES<br />

converted into US dollars using market exch<strong>an</strong>ge rate of 31 December 2010: US$/Euro = 1.3412 <strong>an</strong>d US$/Real = 0.6024<br />

c<strong>an</strong> subsequently be recouped through<br />

user charges – by collecting road tolls, <strong>for</strong><br />

example. M<strong>an</strong>y governments have been<br />

keen to encourage private participation in<br />

infrastructure, seeing this as a way to reduce<br />

fiscal burdens. Consequently, since the 1980s,<br />

they have privatized some infrastructure,<br />

notably in telecommunications <strong>an</strong>d power<br />

supplies. By doing this, the state, instead<br />

of being <strong>an</strong> owner <strong>an</strong>d provider, serves as<br />

the regulator <strong>for</strong> privately provided public<br />

services. This has paved the way <strong>for</strong> m<strong>an</strong>y<br />

private-sector comp<strong>an</strong>ies to own <strong>an</strong>d m<strong>an</strong>age<br />

infrastructure assets, with expectations of<br />

attractive returns.<br />

While this model has been employed<br />

extensively in developed countries, it has<br />

been slower to get off the ground in poorer<br />

developing countries, where the private<br />

sector has more limited access to funds. Such<br />

funds come from four main sources: b<strong>an</strong>ks,<br />

institutional investors, bond markets <strong>an</strong>d<br />

equity markets.<br />

B<strong>an</strong>k lending<br />

Commercial b<strong>an</strong>ks may be wary of lending<br />

<strong>for</strong> infrastructure since they are likely to<br />

face a maturity mismatch. Infrastructure<br />

requires long-term funding while the b<strong>an</strong>k<br />

funds are primarily short-term in the <strong>for</strong>m of<br />

deposits <strong>an</strong>d interb<strong>an</strong>k borrowing. Nor do<br />

b<strong>an</strong>ks necessarily have the skills to assess<br />

the risks related to such lending. Risk officers<br />

with limited experience will find it difficult<br />

to price the risk involved in infrastructure<br />

projects in which there is often a high degree<br />

of uncertainty. In these circumst<strong>an</strong>ces,<br />

when funds are offered, they are likely to<br />

be expensive. As indicated in figure IV.1, in<br />

projects with lower ratings the credit spread<br />

c<strong>an</strong> be higher th<strong>an</strong> 20 percentage points.<br />

Institutional investors<br />

An alternative to b<strong>an</strong>k funding is to seek<br />

other investors that take a longer-term view.<br />

Insur<strong>an</strong>ce comp<strong>an</strong>ies, pension funds <strong>an</strong>d other<br />

institutional investors are likely to have a more<br />

suitable asset-liability maturity structure, but<br />

this assumes that these institutions have the<br />

necessary in-house resources <strong>for</strong> acquiring,<br />

m<strong>an</strong>aging <strong>an</strong>d disposing of infrastructure<br />

assets. The Asia-Pacific region has relatively<br />

few institutions with this capacity.<br />

Bond markets<br />

In m<strong>an</strong>y countries, privately developed<br />

infrastructure has been funded by issuing<br />

bonds. In most Asia-Pacific countries, however,<br />

bond markets are either non-existent or in<br />

their inf<strong>an</strong>cy. Moreover, most projects in less<br />

developed Asia-Pacific countries are likely<br />

to be rated below a single B, <strong>for</strong> which the<br />

premia charged over government bonds<br />

c<strong>an</strong> be prohibitively high (figure IV.1). An<br />

alternative would be to issue bonds in<br />

international markets, though few comp<strong>an</strong>ies<br />

in Asia <strong>an</strong>d the Pacific have sufficient access