Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FIGURE TITLE<br />

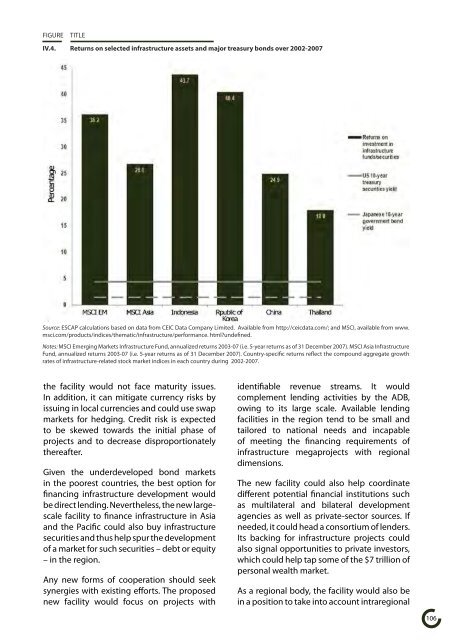

IV.4. Returns on selected infrastructure assets <strong>an</strong>d major treasury bonds over 2002-2007<br />

Source: ESCAP calculations based on data from CEIC Data Comp<strong>an</strong>y Limited. Available from http://ceicdata.com/; <strong>an</strong>d MSCI, available from www.<br />

msci.com/products/indices/thematic/infrastructure/per<strong>for</strong>m<strong>an</strong>ce. html?undefined.<br />

Notes: MSCI Emerging Markets Infrastructure Fund, <strong>an</strong>nualized returns 2003-07 (i.e. 5-year returns as of 31 December 2007). MSCI Asia Infrastructure<br />

Fund, <strong>an</strong>nualized returns 2003-07 (i.e. 5-year returns as of 31 December 2007). Country-specific returns reflect the compound aggregate growth<br />

rates of infrastructure-related stock market indices in each country during 2002-2007.<br />

the facility would not face maturity issues.<br />

In addition, it c<strong>an</strong> mitigate currency risks by<br />

issuing in local currencies <strong>an</strong>d could use swap<br />

markets <strong>for</strong> hedging. Credit risk is expected<br />

to be skewed towards the initial phase of<br />

projects <strong>an</strong>d to decrease disproportionately<br />

thereafter.<br />

Given the underdeveloped bond markets<br />

in the poorest countries, the best option <strong>for</strong><br />

fin<strong>an</strong>cing infrastructure development would<br />

be direct lending. Nevertheless, the new largescale<br />

facility to fin<strong>an</strong>ce infrastructure in Asia<br />

<strong>an</strong>d the Pacific could also buy infrastructure<br />

securities <strong>an</strong>d thus help spur the development<br />

of a market <strong>for</strong> such securities – debt or equity<br />

– in the region.<br />

Any new <strong>for</strong>ms of cooperation should seek<br />

synergies with existing ef<strong>for</strong>ts. The proposed<br />

new facility would focus on projects with<br />

identifiable revenue streams. It would<br />

complement lending activities by the ADB,<br />

owing to its large scale. Available lending<br />

facilities in the region tend to be small <strong>an</strong>d<br />

tailored to national needs <strong>an</strong>d incapable<br />

of meeting the fin<strong>an</strong>cing requirements of<br />

infrastructure megaprojects with regional<br />

dimensions.<br />

The new facility could also help coordinate<br />

different potential fin<strong>an</strong>cial institutions such<br />

as multilateral <strong>an</strong>d bilateral development<br />

agencies as well as private-sector sources. If<br />

needed, it could head a consortium of lenders.<br />

Its backing <strong>for</strong> infrastructure projects could<br />

also signal opportunities to private investors,<br />

which could help tap some of the $7 trillion of<br />

personal wealth market.<br />

As a regional body, the facility would also be<br />

in a position to take into account intraregional<br />

106