Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TABLE TITLE<br />

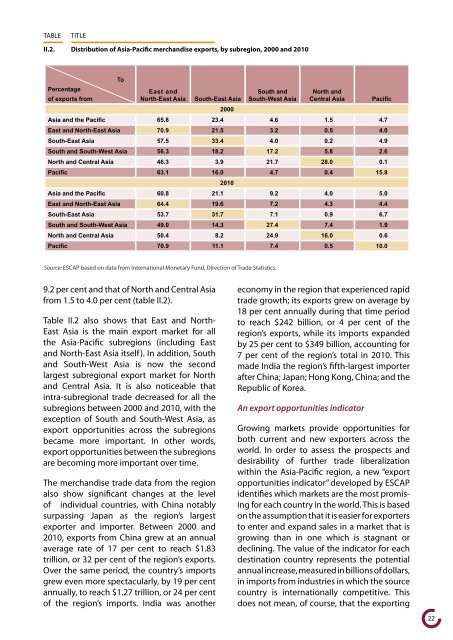

II.2. Distribution of Asia-Pacific merch<strong>an</strong>dise exports, by subregion, 2000 <strong>an</strong>d 2010<br />

Percentage<br />

of exports from<br />

To<br />

East <strong>an</strong>d<br />

North-East Asia South-East Asia<br />

2000<br />

South <strong>an</strong>d<br />

South-West Asia<br />

Source: ESCAP based on data from International Monetary Fund, Direction of Trade Statistics.<br />

North <strong>an</strong>d<br />

Central Asia Pacific<br />

Asia <strong>an</strong>d the Pacific 65.8 23.4 4.6 1.5 4.7<br />

East <strong>an</strong>d North-East Asia 70.9 21.5 3.2 0.5 4.0<br />

South-East Asia 57.5 33.4 4.0 0.2 4.9<br />

South <strong>an</strong>d South-West Asia 56.3 18.2 17.2 5.8 2.6<br />

North <strong>an</strong>d Central Asia 46.3 3.9 21.7 28.0 0.1<br />

Pacific 63.1 16.0<br />

2010<br />

4.7 0.4 15.8<br />

Asia <strong>an</strong>d the Pacific 60.8 21.1 9.2 4.0 5.0<br />

East <strong>an</strong>d North-East Asia 64.4 19.6 7.2 4.3 4.4<br />

South-East Asia 53.7 31.7 7.1 0.9 6.7<br />

South <strong>an</strong>d South-West Asia 49.0 14.3 27.4 7.4 1.9<br />

North <strong>an</strong>d Central Asia 50.4 8.2 24.9 16.0 0.6<br />

Pacific 70.9 11.1 7.4 0.5 10.0<br />

9.2 per cent <strong>an</strong>d that of North <strong>an</strong>d Central Asia<br />

from 1.5 to 4.0 per cent (table II.2).<br />

Table II.2 also shows that East <strong>an</strong>d North-<br />

East Asia is the main export market <strong>for</strong> all<br />

the Asia-Pacific subregions (including East<br />

<strong>an</strong>d North-East Asia itself). In addition, South<br />

<strong>an</strong>d South-West Asia is now the second<br />

largest subregional export market <strong>for</strong> North<br />

<strong>an</strong>d Central Asia. It is also noticeable that<br />

intra-subregional trade decreased <strong>for</strong> all the<br />

subregions between 2000 <strong>an</strong>d 2010, with the<br />

exception of South <strong>an</strong>d South-West Asia, as<br />

export opportunities across the subregions<br />

became more import<strong>an</strong>t. In other words,<br />

export opportunities between the subregions<br />

are becoming more import<strong>an</strong>t over time.<br />

The merch<strong>an</strong>dise trade data from the region<br />

also show signific<strong>an</strong>t ch<strong>an</strong>ges at the level<br />

of individual countries, with China notably<br />

surpassing Jap<strong>an</strong> as the region’s largest<br />

exporter <strong>an</strong>d importer. Between 2000 <strong>an</strong>d<br />

2010, exports from China grew at <strong>an</strong> <strong>an</strong>nual<br />

average rate of 17 per cent to reach $1.83<br />

trillion, or 32 per cent of the region’s exports.<br />

Over the same period, the country’s imports<br />

grew even more spectacularly, by 19 per cent<br />

<strong>an</strong>nually, to reach $1.27 trillion, or 24 per cent<br />

of the region’s imports. India was <strong>an</strong>other<br />

economy in the region that experienced rapid<br />

trade growth; its exports grew on average by<br />

18 per cent <strong>an</strong>nually during that time period<br />

to reach $242 billion, or 4 per cent of the<br />

region’s exports, while its imports exp<strong>an</strong>ded<br />

by 25 per cent to $349 billion, accounting <strong>for</strong><br />

7 per cent of the region’s total in 2010. This<br />

made India the region’s fifth-largest importer<br />

after China; Jap<strong>an</strong>; Hong Kong, China; <strong>an</strong>d the<br />

Republic of Korea.<br />

An export opportunities indicator<br />

<strong>Growing</strong> markets provide opportunities <strong>for</strong><br />

both current <strong>an</strong>d new exporters across the<br />

world. In order to assess the prospects <strong>an</strong>d<br />

desirability of further trade liberalization<br />

within the Asia-Pacific region, a new “export<br />

opportunities indicator” developed by ESCAP<br />

identifies which markets are the most promising<br />

<strong>for</strong> each country in the world. This is based<br />

on the assumption that it is easier <strong>for</strong> exporters<br />

to enter <strong>an</strong>d exp<strong>an</strong>d sales in a market that is<br />

growing th<strong>an</strong> in one which is stagn<strong>an</strong>t or<br />

declining. The value of the indicator <strong>for</strong> each<br />

destination country represents the potential<br />

<strong>an</strong>nual increase, measured in billions of dollars,<br />

in imports from industries in which the source<br />

country is internationally competitive. This<br />

does not me<strong>an</strong>, of course, that the exporting<br />

22