Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

Growing Together: Economic Integration for an Inclusive and - escap

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

to them. In addition, international issues are<br />

often denominated in <strong>for</strong>eign currencies,<br />

raising the prospect of currency mismatches,<br />

of which m<strong>an</strong>y countries are very wary after<br />

the experience of the Asi<strong>an</strong> fin<strong>an</strong>cial crisis.<br />

This could be addressed by issuing bonds<br />

in domestic currency, though this would<br />

effectively pass the <strong>for</strong>eign exch<strong>an</strong>ge risk<br />

to <strong>for</strong>eign investors, which would require<br />

effective hedging facilities. Bond fin<strong>an</strong>cing is<br />

likely to become more import<strong>an</strong>t in the future<br />

as bond markets become more efficient,<br />

though this is unlikely to happen quick<br />

enough to fund urgent infrastructure projects.<br />

Equity markets<br />

Similar constraints apply to equity markets.<br />

Equity funding could be attracted either<br />

through investment in infrastructure<br />

comp<strong>an</strong>ies or through the securitization of<br />

infrastructure assets. At present, however, only<br />

a few infrastructure comp<strong>an</strong>ies in the Asia-<br />

Pacific region are listed on stock markets. With<br />

the exception of activity in Australia <strong>an</strong>d Jap<strong>an</strong>,<br />

FIGURE TITLE<br />

there has been relatively little securitization<br />

of infrastructure assets; globally listed Asia-<br />

Pacific infrastructure securities make up only<br />

3 to 4 per cent of global market capitalization.<br />

At present, without the necessary market <strong>an</strong>d<br />

regulatory infrastructure <strong>an</strong>d improvements<br />

in corporate govern<strong>an</strong>ce, equity funding is<br />

unlikely to fin<strong>an</strong>ce infrastructure needs in the<br />

poorer developing countries.<br />

Public-private partnerships<br />

One way of addressing government<br />

budgetary constraints <strong>an</strong>d opening up more<br />

opportunities <strong>for</strong> private sector participation<br />

is through public-private partnerships<br />

(PPPs). A major motivation <strong>for</strong> using PPPs<br />

is to improve the value <strong>for</strong> money of service<br />

delivery. Another is af<strong>for</strong>dability. Because<br />

of their ability to relieve pressures on<br />

government budgets <strong>an</strong>d improve service<br />

delivery, PPPs are a promising avenue of<br />

infrastructure fin<strong>an</strong>cing. To make it <strong>an</strong> effective<br />

tool, a robust legal <strong>an</strong>d regulatory framework<br />

must be set up. In addition, it is crucial to follow<br />

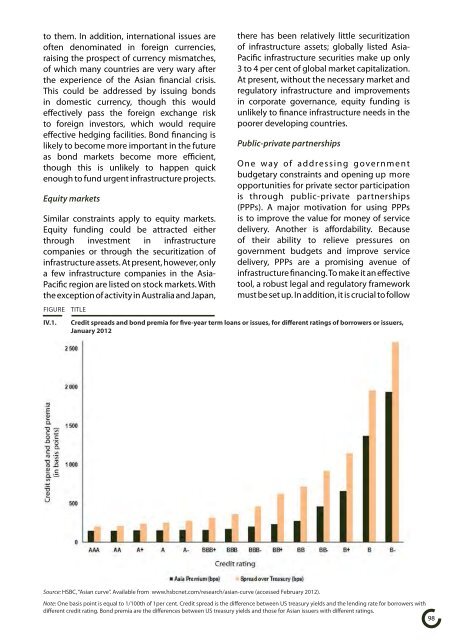

IV.1. Credit spreads <strong>an</strong>d bond premia <strong>for</strong> five-year term lo<strong>an</strong>s or issues, <strong>for</strong> different ratings of borrowers or issuers,<br />

J<strong>an</strong>uary 2012<br />

Source: HSBC, “Asi<strong>an</strong> curve”. Available from www.hsbcnet.com/research/asi<strong>an</strong>-curve (accessed February 2012).<br />

Note: One basis point is equal to 1/100th of 1per cent. Credit spread is the difference between US treasury yields <strong>an</strong>d the lending rate <strong>for</strong> borrowers with<br />

different credit rating. Bond premia are the differences between US treasury yields <strong>an</strong>d those <strong>for</strong> Asi<strong>an</strong> issuers with different ratings.<br />

98