2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

234<br />

Financial Review of <strong>Fiat</strong> S.p.A.<br />

The financial statements illustrated and commented on in the following pages have been prepared on the basis of the company’s<br />

statutory financial statements at December 31, <strong>2006</strong> to which reference should be made. In compliance with European Regulation<br />

no. 1606 of July 19, 2002, starting from 2005 the <strong>Fiat</strong> Group has adopted International Financial <strong>Report</strong>ing Standards (“IFRS”)<br />

issued by the International Accounting Standards Board (“IASB”) in the preparation of its consolidated financial statements. On the<br />

basis of national laws implementing that Regulation, starting from <strong>2006</strong> the Parent Company <strong>Fiat</strong> S.p.A. is presenting its financial<br />

statements in accordance with IFRS, which are reported together with comparative figures for the previous year.<br />

Operating Performance<br />

The Parent Company earned net income of 2,343 million euros in <strong>2006</strong>, 1,226 million euros higher than in 2005 when the result<br />

included net non-recurring income of 1,714 million euros.<br />

The company’s Income Statement is summarised in the following table:<br />

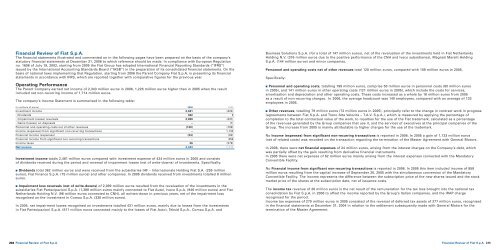

(in millions of euros) <strong>2006</strong> 2005<br />

Investment income 2,461 (424)<br />

- Dividends 362 8<br />

- (Impairment losses) reversals 2,099 (431)<br />

- Gains (losses) on disposals – (1)<br />

Personnel and operating costs net of other revenues (120) (109)<br />

Income (expenses) from significant non-recurring transactions – 1,133<br />

Financial income (expenses) (24) (62)<br />

Financial income from significant non-recurring transactions – 858<br />

Income taxes 26 (279)<br />

Net income 2,343 1,117<br />

Investment income totals 2,461 million euros compared with investment expense of 424 million euros in 2005 and consists<br />

of dividends received during the period and reversal of impairment losses (net of write-downs) of investments. Specifically:<br />

■ Dividends total 362 million euros and were received from the subsidiaries IHF – Internazionale Holding <strong>Fiat</strong> S.A. (259 million<br />

euros), <strong>Fiat</strong> Finance S.p.A. (75 million euros) and other companies. In 2005 dividends received from investments totalled 8 million<br />

euros.<br />

■ Impairment loss reversals (net of write-downs) of 2,099 million euros resulted from the revaluation of the investments in the<br />

subsidiaries <strong>Fiat</strong> Partecipazioni S.p.A. (1,388 million euros mainly connected to <strong>Fiat</strong> Auto), Iveco S.p.A. (946 million euros) and <strong>Fiat</strong><br />

Netherlands Holding N.V. (96 million euros connected to CNH), all written-down in previous years, net of the impairment loss<br />

recognised on the investment in Comau S.p.A. (330 million euros).<br />

In 2005, net impairment losses recognised on investments totalled 431 million euros, mainly due to losses from the investments<br />

in <strong>Fiat</strong> Partecipazioni S.p.A. (811 million euros connected mainly to the losses of <strong>Fiat</strong> Auto), Teksid S.p.A., Comau S.p.A. and<br />

Financial Review of <strong>Fiat</strong> S.p.A.<br />

Business Solutions S.p.A. (for a total of 147 million euros), net of the revaluation of the investments held in <strong>Fiat</strong> Netherlands<br />

Holding N.V. (376 million euros due to the positive performance of the CNH and Iveco subsidiaries), Magneti Marelli Holding<br />

S.p.A. (144 million euros) and minor companies.<br />

Personnel and operating costs net of other revenues total 120 million euros, compared with 109 million euros in 2005.<br />

Specifically:<br />

■ Personnel and operating costs, totalling 199 million euros, comprise 58 million euros in personnel costs (60 million euros<br />

in 2005), and 141 million euros in other operating costs (121 million euros in 2005), which include the costs for services,<br />

amortisation and depreciation and other operating costs. These costs increased as a whole by 18 million euros from 2005<br />

as a result of non-recurring charges. In <strong>2006</strong>, the average headcount was 140 employees, compared with an average of 133<br />

employees in 2005.<br />

■ Other revenues, totalling 79 million euros (72 million euros in 2005), principally refer to the change in contract work in progress<br />

(agreements between <strong>Fiat</strong> S.p.A. and Treno Alta Velocità – T.A.V. S.p.A.), which is measured by applying the percentage of<br />

completion to the total contractual value of the work, to royalties for the use of the <strong>Fiat</strong> trademark, calculated as a percentage<br />

of the revenues generated by the Group companies that use it, and the services of executives at the principal companies of the<br />

Group. The increase from 2005 is mainly attributable to higher charges for the use of the trademark.<br />

No Income (expenses) from significant non-recurring transactions is reported in <strong>2006</strong>. In 2005 a gain of 1,133 million euros<br />

(net of related costs) was recorded on the transaction regarding the termination of the Master Agreement with General Motors.<br />

In <strong>2006</strong>, there were net financial expenses of 24 million euros, arising from the interest charges on the Company’s debt, which<br />

was partially offset by the gain resulting from derivative financial instruments.<br />

In 2005 there were net expenses of 62 million euros mainly arising from the interest expenses connected with the Mandatory<br />

Convertible Facility.<br />

No Financial income from significant non-recurring transactions is reported in <strong>2006</strong>. In 2005 this item included income of 858<br />

million euros resulting from the capital increase of September 20, 2005 with the simultaneous conversion of the Mandatory<br />

Convertible Facility. The income represents the difference between the subscription price of the new shares issued and the stock<br />

market price of the shares at the subscription date, net of issuance costs.<br />

The income tax revenue of 26 million euros is the net result of the remuneration for the tax loss brought into the national tax<br />

consolidation by <strong>Fiat</strong> S.p.A. in <strong>2006</strong> to offset the income reported by the Group’s Italian companies, and the IRAP charge<br />

recognised for the period.<br />

Income tax expenses of 279 million euros in 2005 consisted of the reversal of deferred tax assets of 277 million euros, recognised<br />

in the financial statements at December 31, 2004 in relation to the settlement subsequently made with General Motors for the<br />

termination of the Master Agreement.<br />

Financial Review of <strong>Fiat</strong> S.p.A. 235