2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

15. Other non-current assets<br />

At December 31, <strong>2006</strong>, other non-current assets amount to 1,573 thousand euros (4,502 thousand euros at December 31, 2005)<br />

and consist of amounts receivable from tax authorities due after one year.<br />

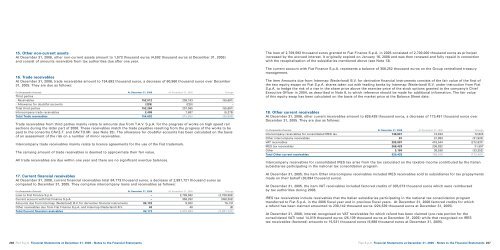

16. Trade receivables<br />

At December 31, <strong>2006</strong>, trade receivables amount to 154,692 thousand euros, a decrease of 60,960 thousand euros over December<br />

31, 2005. They are due as follows:<br />

(in thousands of euros) At December 31, <strong>2006</strong> At December 31, 2005 Change<br />

Third parties<br />

- Receivables 152,512 208,193 (55,681)<br />

- Allowance for doubtful accounts (228) (228) –<br />

Total third parties 152,284 207,965 (55,681)<br />

Intercompany trade receivables 2,408 7,687 (5,279)<br />

Total Trade receivables 154,692 215,652 (60,960)<br />

Trade receivables from third parties mainly relate to amounts due from T.A.V. S.p.A. for the progress of works on high speed rail<br />

sections during the latter part of <strong>2006</strong>. These receivables match the trade payables resulting from the progress of the works to be<br />

paid to the consortia CAV.E.T. and CAV.TO.MI. (see Note 25). The allowance for doubtful accounts has been calculated on the basis<br />

of an assessment of the risk on a number of minor receivables.<br />

Intercompany trade receivables mainly relate to licence agreements for the use of the <strong>Fiat</strong> trademark.<br />

The carrying amount of trade receivables is deemed to approximate their fair value.<br />

All trade receivables are due within one year and there are no significant overdue balances.<br />

17. Current financial receivables<br />

At December 31, <strong>2006</strong>, current financial receivables total 84,173 thousand euros, a decrease of 2,991,721 thousand euros as<br />

compared to December 31, 2005. They comprise intercompany loans and receivables as follows:<br />

(in thousands of euros) At December 31, <strong>2006</strong> At December 31, 2005 Change<br />

Loan to <strong>Fiat</strong> Finance S.p.A. – 2,709,592 (2,709,592)<br />

Current account with <strong>Fiat</strong> Finance S.p.A. – 358,252 (358,252)<br />

Amounts due from Intermap (Nederland) B.V. for derivative financial instruments 84,133 8,002 76,131<br />

Other receivables due from <strong>Fiat</strong> Finance S.p.A. and Intermap (Nederland) B.V. 40 48 (8)<br />

Total Current financial receivables 84,173 3,075,894 (2,991,721)<br />

266 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements<br />

The loan of 2,709,592 thousand euros granted to <strong>Fiat</strong> Finance S.p.A. in 2005 consisted of 2,700,000 thousand euros as principal<br />

increased by the accrued interest. It originally expired on January 16, <strong>2006</strong> and was then renewed and fully repaid in connection<br />

with the recapitalisation of the subsidiaries mentioned above (see Note 13).<br />

The current account with <strong>Fiat</strong> Finance S.p.A. represents a balance of 358,252 thousand euros on the Group centralised treasury<br />

management.<br />

The item Amounts due from Intermap (Nederland) B.V. for derivative financial instruments consists of the fair value of the first of<br />

the two equity swaps on <strong>Fiat</strong> S.p.A. shares taken out with leading banks by Intermap (Nederland) B.V. under instruction from <strong>Fiat</strong><br />

S.p.A. to hedge the risk of a rise in the share price above the exercise price of the stock options granted to the company’s Chief<br />

Executive Officer in 2004, as described in Note 8, to which reference should be made for additional information. The fair value<br />

of this equity swap has been calculated on the basis of the market price at the Balance Sheet date.<br />

18. Other current receivables<br />

At December 31, <strong>2006</strong>, other current receivables amount to 626,428 thousand euros, a decrease of 173,491 thousand euros over<br />

December 31, 2005. They are due as follows:<br />

(in thousands of euros) At December 31, <strong>2006</strong> At December 31, 2005 Change<br />

Intercompany receivables for consolidated IRES tax 146,847 74,024 72,823<br />

Other intercompany receivables 61 31,983 (31,922)<br />

VAT receivables 205,907 418,544 (212,637)<br />

IRES tax receivables 268,429 236,832 31,597<br />

Other 5,184 38,536 (33,352)<br />

Total Other current receivables 626,428 799,919 (173,491)<br />

Intercompany receivables for consolidated IRES tax arise from the tax calculated on the taxable income contributed by the Italian<br />

subsidiaries participating in the national tax consolidation program.<br />

At December 31, 2005, the item Other intercompany receivables included IRES receivables sold to subsidiaries for tax prepayments<br />

made on their behalf (30,894 thousand euros).<br />

At December 31, 2005, the item VAT receivables included factored credits of 335,073 thousand euros which were reimbursed<br />

by tax authorities during <strong>2006</strong>.<br />

IRES tax receivables include receivables that the Italian subsidiaries participating in the national tax consolidation program<br />

transferred to <strong>Fiat</strong> S.p.A. in the <strong>2006</strong> fiscal year and in previous fiscal years. At December 31, <strong>2006</strong> factored credits for which<br />

a refund has been claimed amounted to 230,142 thousand euros (224,539 thousand euros at December 31, 2005).<br />

At December 31, <strong>2006</strong>, interest recognised on VAT receivables for which refund has been claimed (pro-rata portion for the<br />

consolidated VAT) total 14,019 thousand euros (25,139 thousand euros at December 31, 2005) while that recognised on IRES<br />

tax receivables (factored) amounts to 15,531 thousand euros (9,886 thousand euros at December 31, 2005).<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 267