2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fidis Retail Italia (FRI)<br />

All the rights of and commitments to Synesis Finanziaria S.p.A. (the company that held 51% of Fidis Retail Italia S.p.A.) described<br />

in Note 32 to the consolidated financial statements at December 31, 2005 terminated when <strong>Fiat</strong> exercised its call option on<br />

December 28, <strong>2006</strong> on establishing the FAFS joint venture with Crédit Agricole.<br />

Sales of receivables<br />

The Group has discounted receivables and bills without recourse having due dates after December 31, <strong>2006</strong> amounting to 5,697 million<br />

euros (2,463 million euros at December 31, 2005, with due dates after that date), which refer to trade receivables and other receivables<br />

for 4,489 million euros (2,007 million euros at December 31, 2005) and receivables from financing for 1,208 million euros (456 million<br />

euros at December 31, 2005). These amounts include receivables, mainly from the sales network, sold to jointly-controlled financial<br />

services companies (FAFS) for 3,400 million euros and associated financial service companies (Iveco Financial Services, controlled by<br />

Barclays) for 661 million euros (710 million euros at December 31, 2005). The increase recorded during <strong>2006</strong> is due to the<br />

deconsolidation of the financial services companies of <strong>Fiat</strong> Auto conveyed in the above mentioned joint venture with Crédit Agricole.<br />

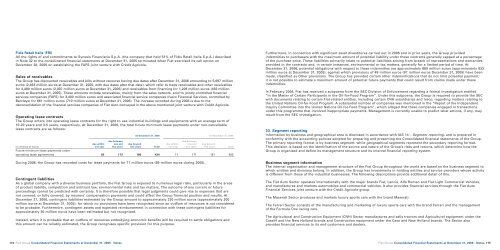

Operating lease contracts<br />

The Group enters into operating lease contracts for the right to use industrial buildings and equipments with an average term of<br />

10-20 years and 3-5 years, respectively, At December 31, <strong>2006</strong>, the total future minimum lease payments under non-cancellable<br />

lease contracts are as follows:<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

due between due between<br />

due within one and due beyond due within one and due beyond<br />

(in millions of euros) one year five years five years Total one year five years five years Total<br />

Future minimum lease payments under<br />

operating lease agreements 82 172 180 434 71 171 161 403<br />

During <strong>2006</strong>, the Group has recorded costs for lease payments for 71 million euros (69 million euros during 2005).<br />

Contingent liabilities<br />

As a global company with a diverse business portfolio, the <strong>Fiat</strong> Group is exposed to numerous legal risks, particularly in the areas<br />

of product liability, competition and antitrust law, environmental risks and tax matters. The outcome of any current or future<br />

proceedings cannot be predicted with certainty. It is therefore possible that legal judgments could give rise to expenses that are<br />

not covered, or fully covered, by insurers’ compensation payments and could affect the Group financial position and results. At<br />

December 31, <strong>2006</strong>, contingent liabilities estimated by the Group amount to approximately 220 million euros (approximately 200<br />

million euros at December 31, 2005), for which no provisions have been recognised since an outflow of resources is not considered<br />

to be probable. Furthermore, contingent assets and expected reimbursement in connection with these contingent liabilities for<br />

approximately 30 million euros have been estimated but not recognised.<br />

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and<br />

this amount can be reliably estimated, the Group recognises specific provision for this purpose.<br />

174<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

Furthermore, in connection with significant asset divestitures carried out in <strong>2006</strong> and in prior years, the Group provided<br />

indemnities to purchasers with the maximum amount of potential liability under these contracts generally capped at a percentage<br />

of the purchase price. These liabilities primarily relate to potential liabilities arising from breach of representations and warranties<br />

provided in the contracts and, in certain instances, environmental or tax matters, generally for a limited period of time. At<br />

December 31, <strong>2006</strong>, potential obligations with respect to these indemnities are approximately 860 million euros (approximately 833<br />

million euros at December 31, 2005), against which provisions of 49 million euros (87 million euros December 31, 2005) have been<br />

made, classified as Other provisions. The Group has provided certain other indemnifications that do not limit potential payment;<br />

it is not possible to estimate a maximum amount of potential future payments that could result from claims made under these<br />

indemnities.<br />

In February <strong>2006</strong>, <strong>Fiat</strong> has received a subpoena from the SEC Division of Enforcement regarding a formal investigation entitled<br />

“In the Matter of Certain Participants in the Oil-for-Food Program”. Under this subpoena, the Group is required to provide the SEC<br />

with documents relating to certain <strong>Fiat</strong>-related entities, including certain CNH subsidiaries and Iveco, regarding matters relating to<br />

the United Nations Oil-for-Food Program. A substantial number of companies was mentioned in the “<strong>Report</strong> of the Independent<br />

Inquiry Committee into the United Nations Oil-for-Food Program”, which alleged that these companies engaged in transactions<br />

under this programme that involved inappropriate payments. Management is currently unable to predict what actions, if any, may<br />

result from the SEC investigation.<br />

33. Segment reporting<br />

Information by business and geographical area is disclosed in accordance with IAS 14 – Segment reporting, and is prepared in<br />

conformity with the accounting policies adopted for preparing and presenting the Consolidated financial statements of the Group.<br />

The primary reporting format is by business segment, while geographical segments represent the secondary reporting format.<br />

This decision is based on the identification of the source and nature of the Group’s risks and returns, which determine how the<br />

Group is organised and define its management structure and its internal financial reporting system.<br />

Business segment information<br />

The internal organisation and management structure of the <strong>Fiat</strong> Group throughout the world are based on the business segment to<br />

which entities and divisions belong. In addition, the Group has investments in holding entities and service providers whose activity<br />

is different from those of the industrial businesses. The following descriptions provide additional detail of this.<br />

The <strong>Fiat</strong> Auto Sector operates internationally with the major brands <strong>Fiat</strong>, Lancia, Alfa Romeo and <strong>Fiat</strong> Light Commercial Vehicles,<br />

and manufactures and markets automobiles and commercial vehicles. It also provides financial services through the <strong>Fiat</strong> Auto<br />

Financial Services joint venture with the Crédit Agricole group.<br />

The Maserati Sector produces and markets luxury sports cars with the brand Maserati.<br />

The Ferrari Sector consists of the manufacturing and marketing of luxury sports cars with the brand Ferrari and the management<br />

of the Formula One racing cars.<br />

The Agricultural and Construction Equipment (CNH) Sector manufactures and sells tractors and Agricultural equipment under the<br />

CaseIH and the New Holland brands and Construction equipment under the Case and New Holland brands. The Sector also<br />

provides financial services to its end customers and dealers.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 175