2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

At December 31, <strong>2006</strong> and 2005, there were 772,296 and 1 million common shares, respectively reserved for issuance under the<br />

CNH Directors’ Plan. Outside directors do not receive benefits upon termination of their service as directors.<br />

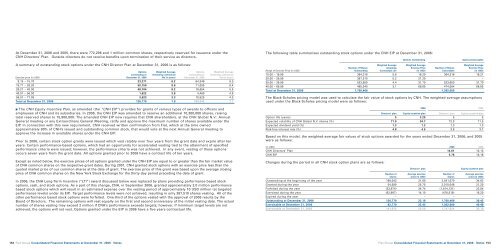

A summary of outstanding stock options under the CNH Director Plan at December 31, <strong>2006</strong> is as follows:<br />

Options Weighted Average Options Weighted Average<br />

outstanding at remaining contractual outstanding at remaining contractual<br />

Exercise price (in USD) December 31, <strong>2006</strong> life (in years) December 31, 2005 life (in years)<br />

9.15 – 15.70 23,271 6.2 64,348 8.3<br />

15.71 – 26.20 50,150 8.6 71,055 8.4<br />

26.21 – 40.00 48,104 8.2 18,654 5.5<br />

40.01 – 56.00 1,622 3.8 4,460 4.9<br />

56.01 – 77.05 3,623 3.3 10,525 4.3<br />

Total at December 31, <strong>2006</strong> 126,770 7.8 169,042 7.7<br />

■ The CNH Equity Incentive Plan, as amended (the “CNH EIP”) provides for grants of various types of awards to officers and<br />

employees of CNH and its subsidiaries. In <strong>2006</strong>, the CNH EIP was amended to reserve an additional 10,300,000 shares, raising<br />

total reserved shares to 15,900,000. The amended CNH EIP now requires that CNH shareholders, at the CNH Global N.V.: <strong>Annual</strong><br />

General meeting or any Extraordinary General Meeting, ratify and approve the maximum number of shares available under the<br />

EIP. In connection with this new requirement, CNH received written confirmation from <strong>Fiat</strong>, which at the time owned<br />

approximately 90% of CNH’s issued and outstanding common stock, that would vote at the next <strong>Annual</strong> General meeting to<br />

approve the increase in available shares under the CNH EIP.<br />

Prior to <strong>2006</strong>, certain stock option grants were issued which vest ratably over four years from the grant date and expire after ten<br />

years. Certain performance-based options, which had an opportunity for accelerated vesting tied to the attainment of specified<br />

performance criteria were issued; however, the performance criteria was not achieved. In any event, vesting of these options<br />

occurs seven years from the grant date. All options granted prior to <strong>2006</strong> have a contract life of ten years.<br />

Except as noted below, the exercise prices of all options granted under the CNH EIP are equal to or greater than the fair market value<br />

of CNH common shares on the respective grant dates. During 2001, CNH granted stock options with an exercise price less than the<br />

quoted market price of our common shares at the date of grant. The exercise price of this grant was based upon the average closing<br />

price of CNH common shares on the New York Stock Exchange for the thirty-day period preceding the date of grant.<br />

In <strong>2006</strong>, the CNH Long-Term Incentive (“LTI”) award discussed below was replaced by plans providing performance based stock<br />

options, cash, and stock options. As a part of this change, CNH, in September <strong>2006</strong>, granted approximately 2.0 million performance<br />

based stock options which will result in an estimated expense over the vesting period of approximately 10 USD million (at targeted<br />

performance levels) under its EIP. Target performance levels were not achieved, resulting in only 387,510 shares vesting. All of the<br />

other performance based stock options were forfeited. One-third of the options vested with the approval of <strong>2006</strong> results by the<br />

Board of Directors. The remaining options will vest equally on the first and second anniversary of the initial vesting date. The actual<br />

number of shares vesting may exceed 2 million if CNH’s performance exceeds targets; however, if minimum target levels are not<br />

achieved, the options will not vest. Options granted under the EIP in <strong>2006</strong> have a five years contractual life.<br />

152<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

The following table summarises outstanding stock options under the CNH EIP at December 31, <strong>2006</strong>:<br />

Options Outstanding Options Exercisable<br />

Weighted Average Weighted Average Weighted Average<br />

Number of Shares remaining Exercise Price Number of Shares Exercise Price<br />

Range of Exercise Price (in USD) Outstanding Contractual Life (in USD) Exercisable (in USD)<br />

10.00 – 19.99 364,316 5.6 16.20 364,316 16.21<br />

20.00 – 29.99 387,510 5.2 21.20 – –<br />

30.00 – 39.99 523,600 4.4 31.70 523,600 31.70<br />

40.00 – 69.99 485,040 3.1 68.85 474,084 68.85<br />

Total at December 31, <strong>2006</strong> 1,760,466 1,362,000<br />

The Black-Scholes pricing model was used to calculate the fair value of stock options by CNH. The weighted-average assumptions<br />

used under the Black-Scholes pricing model were as follows:<br />

<strong>2006</strong> 2005<br />

Directors’ plan Equity incentive plan Directors’ plan Equity incentive plan<br />

Option life (years) 5 3.25 5 5<br />

Expected volatility of CNH Global N.V. shares (%) 71.0 34.7 72.0 71.5<br />

Expected dividend yield (%) 1.3 1.3 1.3 1.3<br />

Risk-free interest rate (%) 4.8 4.5 3.9 3.7<br />

Based on this model, the weighted-average fair values of stock options awarded for the years ended December 31, <strong>2006</strong>, and 2005<br />

were as follows:<br />

(in USD) <strong>2006</strong> 2005<br />

CNH Directors’ Plan 14.61 10.13<br />

CNH EIP 5.78 10.18<br />

Changes during the period in all CNH stock option plans are as follows:<br />

Directors’ plan Equity incentive plan<br />

Number of Average exercise Number of Average exercise<br />

shares price (in USD) shares price (in USD)<br />

Outstanding at the beginning of the year 169,042 21.60 2,041,070 34.62<br />

Granted during the year 54,589 25.75 2,010,046 21.20<br />

Forfeited during the year (33,874) 34.74 (1,814,131) 22.84<br />

Exercised during the year (62,987) 14.10 (476,519) 16.20<br />

Expired during the year – – – –<br />

Outstanding at December 31, <strong>2006</strong> 126,770 23.19 1,760,466 36.42<br />

Exercisable at December 31, <strong>2006</strong> 82,770 22.43 1,362,000 40.48<br />

Exercisable at December 31, 2005 141,872 22.50 1,747,634 36.76<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 153