2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

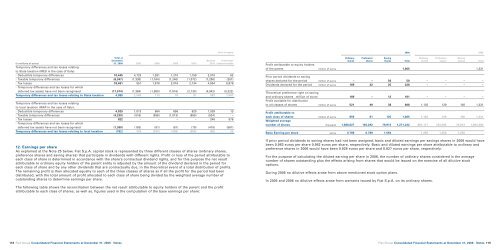

Year of expiry<br />

Total at<br />

December Beyond Unlimited/<br />

(in millions of euros) 31, <strong>2006</strong> 2007 2008 2009 2010 2010 indeterminable<br />

Temporary differences and tax losses relating<br />

to State taxation (IRES in the case of Italy):<br />

- Deductible temporary differences 10,445 4,723 1,281 1,210 1,159 2,010 62<br />

- Taxable temporary differences (6,347) (1,330) (1,164) (1,240) (1,072) (1,290) (251)<br />

- Tax losses 18,461 551 1,978 2,016 2,134 4,804 6,978<br />

- Temporary differences and tax losses for which<br />

deferred tax assets have not been recognised (17,574) (1,384) (1,980) (1,916) (2,130) (4,942) (5,222)<br />

Temporary differences and tax losses relating to State taxation 4,985 2,560 115 70 91 582 1,567<br />

Temporary differences and tax losses relating<br />

to local taxation (IRAP in the case of Italy):<br />

- Deductible temporary differences 4,025 1,013 684 656 620 1,039 13<br />

- Taxable temporary differences (4,239) (516) (936) (1,013) (850) (924) –<br />

- Tax losses 822 – – – – 246 576<br />

- Temporary differences and tax losses for which<br />

deferred tax assets have not been recognised (1,390) (163) (81) (81) (79) (419) (567)<br />

Temporary differences and tax losses relating to local taxation (782) 334 (333) (438) (309) (58) 22<br />

12. Earnings per share<br />

As explained at the Note 25 below, <strong>Fiat</strong> S.p.A. capital stock is represented by three different classes of shares (ordinary shares,<br />

preference shares and saving shares) that participate in dividends with different rights. Profit or loss of the period attributable to<br />

each class of share is determined in accordance with the share’s contractual dividend rights, and for this purpose the net result<br />

attributable to ordinary equity holders of the parent entity is adjusted by the amount of the dividend declared in the period for<br />

each class of share and by any other dividends that are contractually due, in the theoretical event of a total distribution of profits.<br />

The remaining profit is then allocated equally to each of the three classes of shares as if all the profit for the period had been<br />

distributed, with the total amount of profit allocated to each class of share being divided by the weighted average number of<br />

outstanding shares to determine earnings per share.<br />

The following table shows the reconciliation between the net result attributable to equity holders of the parent and the profit<br />

attributable to each class of shares, as well as, figures used in the computation of the base earnings per share:<br />

118<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

<strong>2006</strong> 2005<br />

Ordinary Preference Saving Ordinary Preference Saving<br />

shares shares shares Total shares shares shares Total<br />

Profit attributable to equity holders<br />

of the parent million of euros 1,065 1,331<br />

Prior period dividends to saving<br />

shares declared for the period million of euros – – 50 50 – – – –<br />

Dividends declared for the period million of euros 169 32 25 226 – – – –<br />

Theoretical preference right on saving<br />

and ordinary shares million of euros 169 – 12 181 – – – –<br />

Profit available for distribution<br />

to all classes of shares million of euros 521 49 38 608 1,102 129 100 1,331<br />

Profit attributable to<br />

each class of shares million of euros 859 81 125 1,065 1,102 129 100 1,331<br />

Weighted average<br />

number of shares thousand 1,088,027 103,292 79,913 1,271,232 881,177 103,292 79,913 1,064,382<br />

Basic Earning per share euros 0.789 0.789 1.564 1.250 1.250 1.250<br />

If prior period dividends to saving shares had not been assigned, basic and diluted earnings per savings shares in <strong>2006</strong> would have<br />

been 0.983 euros per share 0.982 euros per share, respectively. Basic and diluted earnings per share attributable to ordinary and<br />

preference shares in <strong>2006</strong> would have been 0.828 euros per share and 0.827 euros per share, respectively.<br />

For the purpose of calculating the diluted earning per share in <strong>2006</strong>, the number of ordinary shares considered is the average<br />

number of shares outstanding plus the effects arising from shares that would be issued on the exercise of all dilutive stock<br />

options.<br />

During 2005 no dilutive effects arose from above mentioned stock option plans.<br />

In 2005 and <strong>2006</strong> no dilutive effects arose from warrants issued by <strong>Fiat</strong> S.p.A. on its ordinary shares.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 119