2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

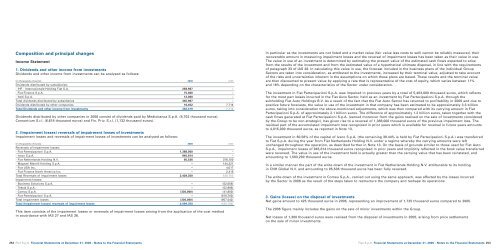

Composition and principal changes<br />

Income Statement<br />

1. Dividends and other income from investments<br />

Dividends and other income from investments can be analysed as follows:<br />

(in thousands of euros) <strong>2006</strong> 2005<br />

Dividends distributed by subsidiaries:<br />

- IHF - Internazionale Holding <strong>Fiat</strong> S.A. 258,967 –<br />

- <strong>Fiat</strong> Finance S.p.A. 75,000 –<br />

- Itedi S.p.A. 12,000 –<br />

Total dividends distributed by subsidiaries 345,967 –<br />

Dividends distributed by other companies 16,452 7,714<br />

Total Dividends and other income from investments 362,419 7,714<br />

Dividends distributed by other companies in <strong>2006</strong> consist of dividends paid by Mediobanca S.p.A. (8,702 thousand euros),<br />

Consortium S.r.l. (6,618 thousand euros) and Fin. Priv. S.r.l. (1,132 thousand euros).<br />

2. (Impairment losses) reversals of impairment losses of investments<br />

Impairment losses and reversals of impairment losses of investments can be analysed as follows:<br />

(in thousands of euros) <strong>2006</strong> 2005<br />

Reversals of impairment losses:<br />

- <strong>Fiat</strong> Partecipazioni S.p.A. 1,388,000 –<br />

- Iveco S.p.A. 945,814 –<br />

- <strong>Fiat</strong> Netherlands Holding N.V. 95,536 376,100<br />

- Magneti Marelli Holding S.p.A. – 144,221<br />

- <strong>Fiat</strong> USA Inc. – 4,017<br />

- <strong>Fiat</strong> Finance North America Inc. – 2,415<br />

Total Reversals of impairment losses 2,429,350 526,753<br />

Impairment losses:<br />

- Business Solutions S.p.A. – (52,056)<br />

- Teksid S.p.A. – (52,986)<br />

- Comau S.p.A. (330,000) (41,800)<br />

- <strong>Fiat</strong> Partecipazioni S.p.A. – (810,700)<br />

Total Impairment losses (330,000) (957,542)<br />

Total (Impairment losses) reversals of impairment losses 2,099,350 (430,789)<br />

This item consists of the impairment losses or reversals of impairment losses arising from the application of the cost method<br />

in accordance with IAS 27 and IAS 36.<br />

252 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements<br />

In particular as the investments are not listed and a market value (fair value less costs to sell) cannot be reliably measured, their<br />

recoverable amount in measuring impairment losses and the reversal of impairment losses has been taken as their value in use.<br />

The value in use of an investment is determined by estimating the present value of the estimated cash flows expected to arise<br />

from the results of the investment and from the estimated value of a hypothetical ultimate disposal, in line with the requirements<br />

of paragraph 33 of IAS 28. In calculating this value in use, the forecast included in the business plans of the individual Group<br />

Sectors are taken into consideration, as attributed to the investments, increased by their terminal value, adjusted to take account<br />

of the risks and uncertainties inherent in the assumptions on which these plans are based. These results and the terminal value<br />

are then discounted to present value by applying a rate that is representative of the cost of equity, which varies between 11%<br />

and 16% depending on the characteristics of the Sector under consideration.<br />

The investment in <strong>Fiat</strong> Partecipazioni S.p.A. was impaired in previous years by a total of 5,403,000 thousand euros, which reflects<br />

for the most part losses incurred in the <strong>Fiat</strong> Auto Sector, held as an investment by <strong>Fiat</strong> Partecipazioni S.p.A. through the<br />

subholding <strong>Fiat</strong> Auto Holdings B.V. As a result of the fact that the <strong>Fiat</strong> Auto Sector has returned to profitability in <strong>2006</strong> and due to<br />

positive future forecasts, the value in use of the investment in that company has been estimated to be approximately 3.3 billion<br />

euros, taking into consideration the above-mentioned adjustments, which was then compared with its carrying amount in <strong>Fiat</strong><br />

Partecipazioni S.p.A. of approximately 2.1 billion euros. The difference of approximately 1.2 billion euros, taken together with the<br />

cash flows generated at <strong>Fiat</strong> Partecipazioni S.p.A. (earned moreover from the gains realised on the sale of investments considered<br />

by the Group to be non-strategic), has given rise to a reversal of 1,388,000 thousand euros of the previous impairment loss. The<br />

residual part of the accumulated impairment loss recognised in prior years which is available for reversal in future years amounts<br />

to 4,015,000 thousand euros, as reported in Note 13.<br />

The investment in 60.56% of the capital of Iveco S.p.A. (the remaining 39.44% is held by <strong>Fiat</strong> Partecipazioni S.p.A.) was transferred<br />

to <strong>Fiat</strong> S.p.A. during the year from <strong>Fiat</strong> Netherlands Holding N.V. under a regime whereby the carrying amounts were left<br />

unchanged throughout the operation, as described further in Note 13. On the basis of grounds similar to those used for <strong>Fiat</strong> Auto<br />

S.p.A., impairment losses of 945,814 thousand euros recognised in prior years and implicitly reflected in the book value transferred<br />

were reversed. The value in use of the investment held is actually greater than the carrying value that has been reinstated, and<br />

amounting to 1,593,290 thousand euros.<br />

In a similar manner the part of the write-down of the investment in <strong>Fiat</strong> Netherlands Holding N.V. attributable to its holding<br />

in CNH Global N.V. and amounting to 95,536 thousand euros has been fully reversed.<br />

The write-down of the investment in Comau S.p.A., carried out using the same approach, was affected by the losses incurred<br />

by the Sector in <strong>2006</strong> as the result of the steps taken to restructure the company and reshape its operations.<br />

3. Gains (losses) on the disposal of investments<br />

Net gains amount to 425 thousand euros in <strong>2006</strong>, representing an improvement of 1,725 thousand euros compared to 2005.<br />

The <strong>2006</strong> figure mainly includes the gains on the sale of minor investments within the Group.<br />

Net losses of 1,300 thousand euros were realised from the disposal of investments in 2005, arising from price settlements<br />

on the sale of minor investments.<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 253