2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

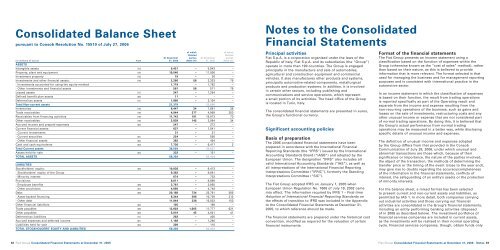

Consolidated Balance Sheet<br />

pursuant to Consob Resolution No. 15519 of July 27, <strong>2006</strong><br />

of which of which<br />

Related Related<br />

At December parties At December parties<br />

(in millions of euros) Note 31, <strong>2006</strong> (Note 35) 31, 2005 (Note 35)<br />

ASSETS<br />

Intangible assets (13) 6,421 – 5,943 –<br />

Property, plant and equipment (14) 10,540 – 11,006 –<br />

Investment property (15) 19 – 26 –<br />

Investments and other financial assets: (16) 2,280 58 2,333 79<br />

- Investments accounted for using the equity method 1,719 – 1,762 –<br />

- Other investments and financial assets 561 58 571 79<br />

Leased assets (17) 247 – 1,254 –<br />

Defined benefit plan assets (26) 11 – – –<br />

Deferred tax assets (11) 1,860 – 2,104 –<br />

Total Non-current assets 21,378 22,666<br />

Inventories (18) 8,447 24 7,881 38<br />

Trade receivables (19) 4,944 377 4,969 203<br />

Receivables from financing activities (19) 11,743 191 15,973 73<br />

Other receivables (19) 2,839 145 3,084 34<br />

Accrued income and prepaid expenses (20) 247 – 272 –<br />

Current financial assets: 637 – 1,041 –<br />

- Current investments 31 – 31 –<br />

- Current securities (21) 224 – 556 –<br />

- Other financial assets (22) 382 – 454 –<br />

Cash and cash equivalents (23) 7,736 – 6,417 2<br />

Total Current assets 36,593 39,637<br />

Assets held for sale (24) 332 – 151 –<br />

TOTAL ASSETS 58,303 62,454<br />

LIABILITIES<br />

Stockholders’ equity: (25) 10,036 – 9,413 –<br />

- Stockholders’ equity of the Group 9,362 – 8,681 –<br />

- Minority interest 674 – 732 –<br />

Provisions: 8,611 – 8,698 –<br />

- Employee benefits (26) 3,761 – 3,950 –<br />

- Other provisions (27) 4,850 – 4,748 –<br />

Debt: (28) 20,188 734 25,761 365<br />

- Asset-backed financing 8,344 396 10,729 212<br />

- Other debt 11,844 338 15,032 153<br />

Other financial liabilities (22) 105 – 189 –<br />

Trade payables (29) 12,603 1,005 11,777 621<br />

Other payables (30) 5,019 45 4,821 41<br />

Deferred tax liabilities (11) 263 – 405 –<br />

Accrued expenses and deferred income (31) 1,169 – 1,280 –<br />

Liabilities held for sale (24) 309 – 110 –<br />

TOTAL STOCKHOLDERS’ EQUITY AND LIABILITIES 58,303 62,454<br />

92 <strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong><br />

Notes to the Consolidated<br />

Financial Statements<br />

Principal activities<br />

<strong>Fiat</strong> S.p.A. is a corporation organised under the laws of the<br />

Republic of Italy. <strong>Fiat</strong> S.p.A. and its subsidiaries (the “Group”)<br />

operate in more than 190 countries. The Group is engaged<br />

principally in the manufacture and sale of automobiles,<br />

agricultural and construction equipment and commercial<br />

vehicles. It also manufactures other products and systems,<br />

principally automotive-related components, metallurgical<br />

products and production systems. In addition, it is involved<br />

in certain other sectors, including publishing and<br />

communications and service operations, which represent<br />

a small portion of its activities. The head office of the Group<br />

is located in Turin, Italy.<br />

The consolidated financial statements are presented in euros,<br />

the Group’s functional currency.<br />

Significant accounting policies<br />

Basis of preparation<br />

The <strong>2006</strong> consolidated financial statements have been<br />

prepared in accordance with the International Financial<br />

<strong>Report</strong>ing Standards (the “IFRS”) issued by the International<br />

Accounting Standards Board (“IASB”) and adopted by the<br />

European Union. The designation “IFRS” also includes all<br />

valid International Accounting Standards (“IAS”), as well as<br />

all interpretations of the International Financial <strong>Report</strong>ing<br />

Interpretations Committee (“IFRIC”), formerly the Standing<br />

Interpretations Committee (“SIC”).<br />

The <strong>Fiat</strong> Group adopted IFRS on January 1, 2005 when<br />

European Union Regulation No. 1606 of July 19, 2002 came<br />

into effect. The information required by IFRS 1 – First-time<br />

Adoption of International Financial <strong>Report</strong>ing Standards on<br />

the effects of transition to IFRS was included in the Appendix<br />

to the Consolidated Financial Statements at December 31,<br />

2005, to which reference should be made.<br />

The financial statements are prepared under the historical cost<br />

convention, modified as required for the valuation of certain<br />

financial instruments.<br />

Format of the financial statements<br />

The <strong>Fiat</strong> Group presents an income statement using a<br />

classification based on the function of expenses within the<br />

Group (otherwise known as the “cost of sales” method), rather<br />

than based on their nature, as this is believed to provide<br />

information that is more relevant. The format selected is that<br />

used for managing the business and for management reporting<br />

purposes and is consistent with international practice in the<br />

automotive sector.<br />

In an income statement in which the classification of expenses<br />

is based on their function, the result from trading operations<br />

is reported specifically as part of the Operating result and<br />

separate from the income and expense resulting from the<br />

non-recurring operations of the business, such as gains and<br />

losses on the sale of investments, restructuring costs and any<br />

other unusual income or expense that are not considered part<br />

of normal trading operations. By doing this, it is believed that<br />

the Group’s actual performance from normal trading<br />

operations may be measured in a better way, while disclosing<br />

specific details of unusual income and expenses.<br />

The definition of unusual income and expenses adopted<br />

by the Group differs from that provided in the Consob<br />

Communication of July 28, <strong>2006</strong>, under which unusual and<br />

abnormal transactions are those which, because of their<br />

significance or importance, the nature of the parties involved,<br />

the object of the transaction, the methods of determining the<br />

transfer price or the timing of the event (close to the year end),<br />

may give rise to doubts regarding the accuracy/completeness<br />

of the information in the financial statements, conflicts of<br />

interest, the safeguarding of an entity’s assets or the protection<br />

of minority interests.<br />

For the balance sheet, a mixed format has been selected<br />

to present current and non-current assets and liabilities, as<br />

permitted by IAS 1. In more detail, both companies carrying<br />

out industrial activities and those carrying out financial<br />

activities are consolidated in the Group’s financial statements,<br />

including an entity performing banking activities (disposed<br />

of in <strong>2006</strong> as described below). The investment portfolios of<br />

financial services companies are included in current assets,<br />

as the investments will be realised in their normal operating<br />

cycle. Financial services companies, though, obtain funds only<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 93