2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Other and<br />

Magneti Business elimina- FIAT<br />

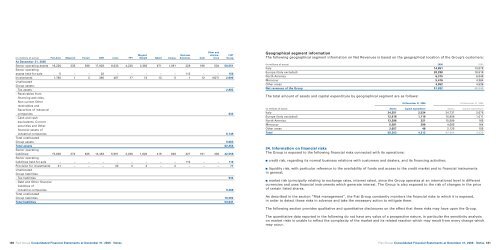

(in millions of euros) <strong>Fiat</strong> Auto Maserati Ferrari CNH Iveco FPT Marelli Teksid Comau Solutions Itedi tions Group<br />

At December 31, 2005<br />

Sector operating assets 16,226 235 936 17,828 6,033 4,220 2,363 671 1,091 228 186 534 50,551<br />

Sector operating<br />

assets held-for-sale 5 – – 32 – – – – – 113 – – 150<br />

Investments 1,780 1 3 385 487 17 13 13 5 1 12 (627) 2,090<br />

Unallocated<br />

Group assets:<br />

- Tax assets 2,882<br />

- Receivables from<br />

financing activities,<br />

Non-current Other<br />

receivables and<br />

Securities of industrial<br />

companies 632<br />

- Cash and cash<br />

equivalents, Current<br />

securities and Other<br />

financial assets of<br />

industrial companies 6,149<br />

Total unallocated<br />

Group assets 9,663<br />

Total assets 62,454<br />

Sector operating<br />

liabilities: 15,638 270 625 14,483 5,591 2,258 1,620 419 828 327 161 338 42,558<br />

Sector operating<br />

liabilities held-for-sale – – – – – – – – – 110 – – 110<br />

Provision for investments 21 – – – 43 3 2 – 2 – – – 71<br />

Unallocated<br />

Group liabilities:<br />

- Tax liabilities 934<br />

- Debt and Other financial<br />

liabilities of<br />

industrial companies 9,368<br />

Total unallocated<br />

Group liabilities 10,302<br />

Total liabilities 53,041<br />

180<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

Geographical segment information<br />

The following geographical segment information on Net Revenues is based on the geographical location of the Group’s customers:<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Italy 14,851 13,078<br />

Europe (Italy excluded) 20,298 18,518<br />

North America 6,315 6,048<br />

Mercosur 5,416 4,364<br />

Other areas 4,952 4,536<br />

Net revenues of the Group 51,832 46,544<br />

The total amount of assets and capital expenditure by geographical segment are as follows:<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

(in millions of euros) Assets Capital expenditure Assets Capital expenditure<br />

Italy 24,351 2,534 24,737 2,075<br />

Europe (Italy excluded) 12,918 1,110 15,908 1,011<br />

North America 13,396 321 15,599 165<br />

Mercosur 5,581 299 4,085 164<br />

Other areas 2,057 48 2,125 105<br />

Total 58,303 4,312 62,454 3,520<br />

34. Information on financial risks<br />

The Group is exposed to the following financial risks connected with its operations:<br />

■ credit risk, regarding its normal business relations with customers and dealers, and its financing activities;<br />

■ liquidity risk, with particular reference to the availability of funds and access to the credit market and to financial instruments<br />

in general;<br />

■ market risk (principally relating to exchange rates, interest rates), since the Group operates at an international level in different<br />

currencies and uses financial instruments which generate interest. The Group is also exposed to the risk of changes in the price<br />

of certain listed shares.<br />

As described in the section “Risk management”, the <strong>Fiat</strong> Group constantly monitors the financial risks to which it is exposed,<br />

in order to detect those risks in advance and take the necessary action to mitigate them.<br />

The following section provides qualitative and quantitative disclosures on the effect that these risks may have upon the Group.<br />

The quantitative data reported in the following do not have any value of a prospective nature, in particular the sensitivity analysis<br />

on market risks is unable to reflect the complexity of the market and its related reaction which may result from every change which<br />

may occur.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 181