2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The carrying amount of other current receivables is deemed to approximate their fair value.<br />

Almost all other current receivables are due within one year, except for an amount of 59 thousand euros which is due between<br />

one and five years.<br />

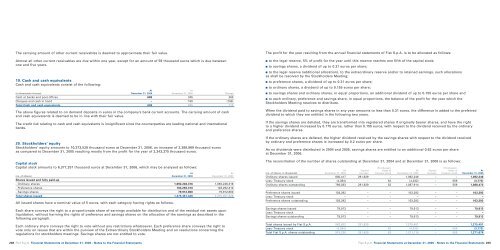

19. Cash and cash equivalents<br />

Cash and cash equivalents consist of the following:<br />

At At<br />

(in thousands of euros) December 31, <strong>2006</strong> December 31, 2005 Change<br />

Cash at banks and post offices 608 345 263<br />

Cheques and cash in hand – 150 (150)<br />

Total Cash and cash equivalents 608 495 113<br />

The above figures related to on demand deposits in euros in the company’s bank current accounts. The carrying amount of cash<br />

and cash equivalents is deemed to be in line with their fair value.<br />

The credit risk relating to cash and cash equivalents is insignificant since the counterparties are leading national and international<br />

banks.<br />

20. Stockholders’ equity<br />

Stockholders’ equity amounts to 10,373,528 thousand euros at December 31, <strong>2006</strong>, an increase of 2,388,969 thousand euros<br />

as compared to December 31, 2005 resulting mostly from the profit for the year of 2,343,375 thousand euros.<br />

Capital stock<br />

Capital stock amounts to 6,377,257 thousand euros at December 31, <strong>2006</strong>, which may be analysed as follows:<br />

At At<br />

(no. of shares) December 31, <strong>2006</strong> December 31, 2005<br />

Shares issued and fully paid-up<br />

- Ordinary shares 1,092,246,316 1,092,246,316<br />

- Preference shares 103,292,310 103,292,310<br />

- Savings shares 79,912,800 79,912,800<br />

Total shares issued 1,275,451,426 1,275,451,426<br />

All issued shares have a nominal value of 5 euros, with each category having rights as follows.<br />

Each share conveys the right to a proportionate share of earnings available for distribution and of the residual net assets upon<br />

liquidation, without harming the rights of preference and savings shares on the allocation of the earnings as described in the<br />

following paragraph.<br />

Each ordinary share conveys the right to vote without any restrictions whatsoever. Each preference share conveys the right to<br />

vote only on issues that are within the purview of the Extraordinary Stockholders Meeting and on resolutions concerning the<br />

regulations for stockholders meetings. Savings shares are not entitled to vote.<br />

268 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements<br />

The profit for the year resulting from the annual financial statements of <strong>Fiat</strong> S.p.A. is to be allocated as follows:<br />

■ to the legal reserve, 5% of profit for the year until this reserve reaches one fifth of the capital stock;<br />

■ to savings shares, a dividend of up to 0.31 euros per share;<br />

■ to the legal reserve (additional allocation), to the extraordinary reserve and/or to retained earnings, such allocations<br />

as shall be resolved by the Stockholders Meeting;<br />

■ to preference shares, a dividend of up to 0.31 euros per share;<br />

■ to ordinary shares, a dividend of up to 0.155 euros per share;<br />

■ to savings shares and ordinary shares, in equal proportions, an additional dividend of up to 0.155 euros per share and<br />

■ to each ordinary, preference and savings share, in equal proportions, the balance of the profit for the year which the<br />

Stockholders Meeting resolves to distribute.<br />

When the dividend paid to savings shares in any year amounts to less than 0.31 euros, the difference is added to the preferred<br />

dividend to which they are entitled in the following two years.<br />

If the savings shares are delisted, they are transformed into registered shares if originally bearer shares, and have the right<br />

to a higher dividend increased by 0.175 euros, rather than 0.155 euros, with respect to the dividend received by the ordinary<br />

and preference shares.<br />

If the ordinary shares are delisted, the higher dividend received by the savings shares with respect to the dividend received<br />

by ordinary and preference shares is increased by 0.2 euros per share.<br />

As no dividends were distributed in 2004 and 2005, savings shares are entitled to an additional 0.62 euros per share<br />

at December 31, <strong>2006</strong>.<br />

The reconciliation of the number of shares outstanding at December 31, 2004 and at December 31, <strong>2006</strong> is as follows:<br />

(Purchases)/ (Purchases)/<br />

At Capital Sales of At Capital Sales of At<br />

(no. of shares, in thousands) December 31, 2004 increase treasury stock December 31, 2005 increase treasury stock December 31, <strong>2006</strong><br />

Ordinary shares issued 800,417 291,829 – 1,092,246 – – 1,092,246<br />

Less: Treasury stock (4,384) – 52 (4,332) – 559 (3,773)<br />

Ordinary shares outstanding 796,033 291,829 52 1,087,914 – 559 1,088,473<br />

Preference shares issued 103,292 – – 103,292 – – 103,292<br />

Less: Treasury stock – – – – – – –<br />

Preference shares outstanding 103,292 – – 103,292 – – 103,292<br />

Savings shares issued 79,913 – – 79,913 – – 79,913<br />

Less: Treasury stock – – – – – – –<br />

Savings shares outstanding 79,913 – – 79,913 – – 79,913<br />

Total shares issued by <strong>Fiat</strong> S.p.A. 983,622 291,829 – 1,275,451 – – 1,275,451<br />

Less: Treasury stock (4,384) – 52 (4,332) – 559 (3,773)<br />

Total <strong>Fiat</strong> S.p.A. shares outstanding 979,238 291,829 52 1,271,119 – 559 1,271,678<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 269