2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26. Provisions for employee benefits<br />

Group companies provide post-employment benefits for their employees, either directly or by contributing to independently<br />

administered funds.<br />

The way these benefits are provided varies according to the legal, fiscal and economic conditions of each country in which the<br />

Group operates, the benefits generally being based on the employees’ remuneration and years of service. The obligations relate<br />

both to active employees and to retirees.<br />

Group companies provide post-employment benefits under defined contribution and/or defined benefit plans.<br />

In the case of defined contribution plans, the company pays contributions to publicly or privately administered pension insurance<br />

plans on a mandatory, contractual or voluntary basis. Once the contributions have been paid, the company has no further payment<br />

obligations. Liabilities for contributions accrued but not paid are included in the item Other payables (see Note 30). The entity<br />

recognise the contribution cost when the employee has rendered his service and includes this cost by destination in Cost of Sales,<br />

Selling, General and Administrative costs and Research and development costs. In <strong>2006</strong>, these expenses totalled 1,161 million<br />

euros (1,080 million euros in 2005).<br />

Defined benefit plans may be unfunded, or they may be wholly or partly funded by contributions by an entity, and sometimes by<br />

its employees, into an entity, or fund, that is legally separate from the employer and from which the employee benefits are paid.<br />

In the case of funded and unfunded post employment benefits, included in the item Post-employment benefits, the Group<br />

obligation is determined on an actuarial basis, using the Projected Unit Credit Method and is offset against the fair value of plan<br />

assets, if any. Where the fair value of plan assets exceed the post-employment benefits obligation, and the group has a right of<br />

reimbursement or a right to reduce future contributions, the surplus amount is recognised in accordance with IAS 19 as an asset.<br />

As discussed in the paragraph Significant accounting policies, actuarial gains and losses are accounted for from January 1, 2004<br />

using the corridor approach.<br />

Finally, the Group grants certain other long-term benefits to its employees; these benefits include those generally paid when the<br />

employee attains a specific seniority or in the case of disability. In this case the measurement of the obligation reflects the<br />

probability that payment will be required and the length of time for which payment is expected to be made. The amount of this<br />

obligation is calculated on an actuarial basis using the Projected Unit Credit Method. The corridor approach is not used for<br />

actuarial gains and losses arising from this obligation.<br />

The item Other provisions for employees consists of the best estimate at the balance sheet date of short-term employee benefits<br />

payable (such as bonuses for example) by the Group within twelve months after the end of the period in which the employees<br />

render the related.<br />

158<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

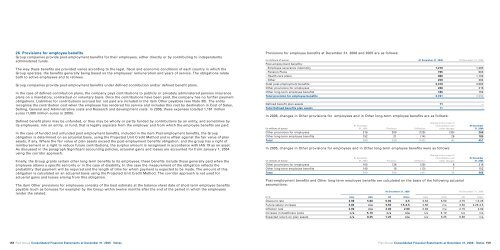

Provisions for employee benefits at December 31, <strong>2006</strong> and 2005 are as follows:<br />

(in millions of euros) At December 31, <strong>2006</strong> At December 31, 2005<br />

Post-employment benefits:<br />

- Employee severance indemnity 1,270 1,283<br />

- Pension Plans 795 903<br />

- Health care plans 986 1,102<br />

- Other 259 294<br />

Total post-employment benefits 3,310 3,582<br />

Other provisions for employees 266 216<br />

Other long-term employee benefits 185 152<br />

Total provision for employee benefits 3,761 3,950<br />

Defined benefit plan assets 11 –<br />

Total Defined benefits plan assets 11 –<br />

In <strong>2006</strong>, changes in Other provisions for employees and in Other long-term employee benefits are as follows:<br />

Change in the scope of<br />

At December consolidation and At December<br />

(in millions of euros) 31, 2005 Provision Utilisation other changes 31, <strong>2006</strong><br />

Other provisions for employees 216 209 (129) (30) 266<br />

Other long-term employee benefits 152 21 (14) 26 185<br />

Total 368 230 (143) (4) 451<br />

In 2005, changes in Other provisions for employees and in Other long-term employee benefits were as follows:<br />

Change in the scope of<br />

At December consolidation and At December<br />

(in millions of euros) 31, 2004 Provision Utilisation other changes 31, 2005<br />

Other provisions for employees 100 136 (28) 8 216<br />

Other long-term employee benefits 140 18 (13) 7 152<br />

Total 240 154 (41) 15 368<br />

Post-employment benefits and Other long-term employee benefits are calculated on the basis of the following actuarial<br />

assumptions:<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

In % Italy USA UK Other Italy USA UK Other<br />

Discount rate 3.98 5.80 5.00 4-5 3.53 5.50 4.75 1-5.25<br />

Future salary increase 3.65 n/a 3.50 1.5-3.5 2.58 n/a 3.50 2.25-3.5<br />

Inflation rate 2.00 n/a 3.00 2.00 2.00 n/a 2.75 2.00<br />

Increase in healthcare costs n/a 5-10 n/a n/a n/a 5-10 n/a n/a<br />

Expected return on plan assets n/a 8.25 7.25 n/a n/a 8.25 6.88 n/a<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 159