2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

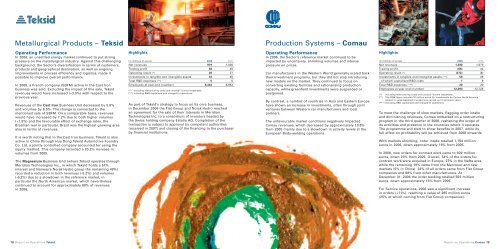

Metallurgical Products – Teksid Production Systems – Comau<br />

Operating Performance<br />

In <strong>2006</strong>, an unsettled energy market continued to put strong<br />

pressure on the metallurgical industry. Against this challenging<br />

background, the Sector’s diversification in terms of customers,<br />

products and geographical destination, as well as ongoing<br />

improvements in process efficiency and logistics, made it<br />

possible to improve overall performance.<br />

In <strong>2006</strong>, a French company (SBFM) active in the Cast Iron<br />

business was sold. Excluding the impact of this sale, Teksid<br />

revenues would have increased (+3.5%) with respect to the<br />

previous year.<br />

Revenues of the Cast Iron Business Unit decreased by 5.6%<br />

and volumes by 6.5%. The change is connected to the<br />

mentioned sale of SBFM. On a comparable basis, revenues<br />

would have increased by 7.2% due to both higher volumes<br />

(+1.5%) and the favourable effect of exchange rates, the<br />

Brazilian real in particular. Brazil was the highest growing area<br />

also in terms of revenues.<br />

It is worth noting that in the Cast Iron business, Teksid is also<br />

active in China through Hua Dong Teksid Automotive Foundry<br />

Co. Ltd, a jointly controlled company accounted for using the<br />

equity method. This company recorded a 20.2% increase in<br />

volumes from 2005.<br />

The Magnesium Business Unit (where Teksid operates through<br />

Meridian Technologies Inc., in which Teksid holds a 51%<br />

interest and Norway’s Norsk Hydro group the remaining 49%)<br />

recorded a reduction in both revenues (-5.2%) and volumes<br />

(-6.2%) due to a slowdown in the reference market, in<br />

particular the North American market, which nevertheless<br />

continued to account for approximately 80% of revenues<br />

in <strong>2006</strong>.<br />

78 <strong>Report</strong> on Operations Teksid<br />

Highlights<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Net revenues 979 1,036<br />

Trading profit 56 45<br />

Operating result (*) 26 27<br />

Investments in tangible and intangible assets 32 45<br />

Total R&D expenses (**) 5 5<br />

Employees at year-end (number) 8,342 8,952<br />

(*) Including restructuring costs and unusual income (expenses).<br />

(**) Including R&D capitalised and charged to operations.<br />

As part of Teksid’s strategy to focus on its core business,<br />

in December <strong>2006</strong> the <strong>Fiat</strong> Group and Norsk Hydro reached<br />

an agreement for the sale of their interests in Meridian<br />

Technologies Inc. to a consortium of investors headed by<br />

the Swiss holding company Estatia AG. Completion of the<br />

transaction is subject to approval by competent authorities<br />

(received in 2007) and closing of the financing to the purchaser<br />

by financial institutions.<br />

Operating Performance<br />

In <strong>2006</strong>, the Sector’s reference market continued to be<br />

impacted by uncertainty, shrinking volumes and intense<br />

pressure on prices.<br />

Car manufacturers in the Western World generally scaled back<br />

their investment programs, but they did not stop introducing<br />

new models on the market. They continued to focus on<br />

converting existing facilities and rationalising production<br />

capacity, while greenfield investments were suspended or<br />

postponed.<br />

By contrast, a number of countries in Asia and Eastern Europe<br />

have shown an increase in investments, often through joint<br />

ventures between Western car manufacturers and local<br />

partners.<br />

The unfavourable market conditions negatively impacted<br />

Comau revenues, which decreased by approximately 18.6%<br />

from 2005 mainly due to a slowdown in activity levels at the<br />

European Body-welding operations.<br />

Highlights<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Net revenues 1,280 1,573<br />

Trading profit (66) 42<br />

Operating result (*) (272) (8)<br />

Investments in tangible and intangible assets (**) 56 38<br />

- of which capitalised R&D costs 7 9<br />

Total R&D expenses (***) 20 20<br />

Employees at year-end (number) 12,293 12,725<br />

(*) Including restructuring costs and unusual income (expenses).<br />

(**) The <strong>2006</strong> figure includes 34 million euros for investments by Comau North America<br />

related to sales/leaseback transactions carried out in previous years.<br />

(***) Including R&D capitalised and charged to operations.<br />

To meet the challenge of slow markets, flagging order intake<br />

and diminishing revenues, Comau embarked on a restructuring<br />

program in the third quarter of <strong>2006</strong>, reshaping the scope of<br />

its activities and presence in the countries where it operates.<br />

The programme will start to show benefits in 2007, while its<br />

full effect on profitability will be achieved from 2008 onwards.<br />

With markets shrinking, order intake totalled 1,194 million<br />

euros in <strong>2006</strong>, down approximately 16% from 2005.<br />

In <strong>2006</strong>, new orders for contract work came to 929 million<br />

euros, down 23% from 2005. Overall, 54% of the orders for<br />

contract work were acquired in Europe, 27% in the Nafta area,<br />

while the remaining 19% came from the Mercosur and new<br />

markets (5% in China). 32% of all orders came from <strong>Fiat</strong> Group<br />

companies and 68% from other manufacturers. At<br />

December 31, <strong>2006</strong> the order backlog totalled 593 million<br />

euros, down approximately 15% from 2005.<br />

For Service operations, <strong>2006</strong> saw a significant increase<br />

in orders (+11%), reaching a value of 265 million euros<br />

(25% of which coming from <strong>Fiat</strong> Group companies).<br />

<strong>Report</strong> on Operations Comau 79