2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

■ Current trade receivables of 78 million euros (87 million euros at December 31, 2005): these relate to receivables resulting from<br />

the revenues discussed above.<br />

Transactions with other related parties<br />

The principal transaction in this category relates to an amount of 14 million euros (13 million euros in 2005) classified in cost<br />

of sales; included in this balance is the purchase of goods of 12 million euros for the high range and de-luxe upholstery<br />

of the Group’s automobiles (12 million euros in 2005) from Poltrona Frau S.p.A., a company listed on the Milan Stock Exchange<br />

in which the chairman of the Board of Directors of <strong>Fiat</strong> S.p.A., Luca Cordero di Montezemolo, has an indirect investment.<br />

Emoluments to Directors, Statutory Auditors and Key Management<br />

The fees of the Director and Statutory Auditors of <strong>Fiat</strong> S.p.A. for carrying out their respective functions, including those in other<br />

consolidated companies, are as follows:<br />

(in thousands of euros) <strong>2006</strong> 2005<br />

Directors 16,006 16,273<br />

Statutory auditors 190 177<br />

Total Emoluments 16,196 16,450<br />

The aggregate expense incurred in <strong>2006</strong> and accrued at year end for the compensation of executives with strategic responsibilities<br />

of the Group amounts to approximately 23 million euros. This amount is inclusive of the following:<br />

■ the provision charged by the Group in respect of mandatory severance indemnity, amounting to 1 million euros;<br />

■ the amount contributed by the <strong>Fiat</strong> Group to State and employer defined contribution pension funds amounting to approximately<br />

4 million euros;<br />

■ the amount contributed by the <strong>Fiat</strong> Group to a special defined benefit plan for certain senior Executives amounting to 0.7 million<br />

euros.<br />

These costs consist of compensation of 15 million euros for Executives with strategic responsibilities who were already working<br />

for the Group in 2005 and continue with the Group at present, and 8 million euros for management personnel who took on key<br />

responsibilities in <strong>2006</strong> and managers who left the Group in the year, including the severance pay of the latter.<br />

36. Acquisitions and Disposals of subsidiaries<br />

Acquisitions<br />

The Group did not acquire any significant subsidiary in <strong>2006</strong>. It acquired instead minority interests in companies in which it already<br />

held control, leading to the recognition of the following cash outflows and goodwill:<br />

190<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

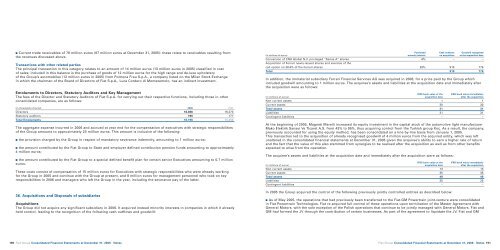

Purchased Cash outflows Goodwill recognised<br />

(in millions of euros) minority interest on acquisition at the acquisition date<br />

Conversion of CNH Global N.V. privileged “Series A” shares 6% – –<br />

Acquisition of Ferrari newly-issued shares and exercise of the<br />

call option on 28.6% of the Ferrari shares 29% 919 776<br />

Total 919 776<br />

In addition, the immaterial subsidiary Ferrari Financial Services AG was acquired in <strong>2006</strong>, for a price paid by the Group which<br />

included goodwill amounting to 1 million euros. The acquiree’s assets and liabilities at the acquisition date and immediately after<br />

the acquisition were as follows:<br />

IFRS book value at the IFRS book value immediately<br />

(in millions of euros) acquisition date after the acquisition<br />

Non current assets 1 1<br />

Current assets 30 30<br />

Total assets 31 31<br />

Liabilities 31 31<br />

Contingent liabilities – –<br />

At the beginning of 2005, Magneti Marelli increased its equity investment in the capital stock of the automotive light manufacturer<br />

Mako Elektrik Sanayi Ve Ticaret A.S. from 43% to 95%, thus acquiring control from the Turkish group Koç. As a result, the company,<br />

previously accounted for using the equity method, has been consolidated on a line-by-line basis from January 1, 2005.<br />

This transaction led to the acquisition of already recognised goodwill of 4 million euros from the acquired entity, which was left<br />

unaltered in the consolidated financial statements at December 31, 2005 given the acquiree’s ability to earn a higher rate of return<br />

and the fact that the value of this also stemmed from synergies to be realised after the acquisition as well as from other benefits<br />

expected to arise from the operation.<br />

The acquiree’s assets and liabilities at the acquisition date and immediately after the acquisition were as follows:<br />

IFRS book value at the IFRS book value immediately<br />

(in millions of euros) acquisition date after the acquisition<br />

Non current assets 13 13<br />

Current assets 35 35<br />

Total assets 48 48<br />

Liabilities 25 25<br />

Contingent liabilities – –<br />

In 2005 the Group acquired the control of the following previously jointly controlled entities as described below:<br />

■ As of May 2005, the operations that had previously been transferred to the <strong>Fiat</strong>-GM Powertrain joint-venture were consolidated<br />

in <strong>Fiat</strong> Powertrain Technologies. <strong>Fiat</strong> re-acquired full control of these operations upon termination of the Master Agreement with<br />

General Motors, with the sole exception of the Polish operations that continue to be jointly managed with General Motors. <strong>Fiat</strong> and<br />

GM had formed the JV through the contribution of certain businesses. As part of the agreement to liquidate the JV, <strong>Fiat</strong> and GM<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 191