2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The item also includes an amount of 29 million euros (32 million euros at December 31, 2005) for certain properties and industrial<br />

buildings owned by CNH and no longer being used as a result of the restructuring process set up in prior years following the acquisition<br />

of the Case Group, and certain properties and industrial buildings of <strong>Fiat</strong> Auto and Iveco for an overall amount of 7 million euros.<br />

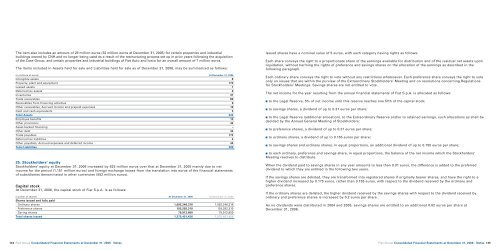

The items included in Assets held for sale and Liabilities held for sale as of December 31, <strong>2006</strong>, may be summarized as follows:<br />

(in millions of euros) At December 31, <strong>2006</strong><br />

Intangible assets 8<br />

Property, plant and equipment 173<br />

Leased assets 7<br />

Deferred tax assets 6<br />

Inventories 37<br />

Trade receivables 80<br />

Receivables from financing activities 6<br />

Other receivables, Accrued income and prepaid expenses 10<br />

Cash and cash equivalents 5<br />

Total Assets 332<br />

Employee benefits 13<br />

Other provisions 42<br />

Asset-backed financing –<br />

Other debt 34<br />

Trade payables 172<br />

Deferred tax liabilities 4<br />

Other payables, Accrued expenses and deferred income 44<br />

Total Liabilities 309<br />

25. Stockholders’ equity<br />

Stockholders’ equity at December 31, <strong>2006</strong> increased by 623 million euros over that at December 31, 2005 mainly due to net<br />

income for the period (1,151 million euros) and foreign exchange losses from the translation into euros of the financial statements<br />

of subsidiaries denominated in other currencies (552 million euros).<br />

Capital stock<br />

At December 31, <strong>2006</strong>, the capital stock of <strong>Fiat</strong> S.p.A. is as follows:<br />

(number of shares) At December 31, <strong>2006</strong> At December 31, 2005<br />

Shares issued and fully paid<br />

- Ordinary shares 1,092,246,316 1,092,246,316<br />

- Preference shares 103,292,310 103,292,310<br />

- Saving shares 79,912,800 79,912,800<br />

Total shares issued 1,275,451,426 1,275,451,426<br />

144<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

Issued shares have a nominal value of 5 euros, with each category having rights as follows:<br />

Each share conveys the right to a proportionate share of the earnings available for distribution and of the residual net assets upon<br />

liquidation, without harming the rights of preference and savings shares on the allocation of the earnings as described in the<br />

following paragraph.<br />

Each ordinary share conveys the right to vote without any restrictions whatsoever. Each preference share conveys the right to vote<br />

only on issues that are within the purview of the Extraordinary Stockholders’ Meeting and on resolutions concerning Regulations<br />

for Stockholders’ Meetings. Savings shares are not entitled to vote.<br />

The net income for the year resulting from the annual financial statements of <strong>Fiat</strong> S.p.A. is allocated as follows:<br />

■ to the Legal Reserve, 5% of net income until this reserve reaches one fifth of the capital stock;<br />

■ to savings shares, a dividend of up to 0.31 euros per share;<br />

■ to the Legal Reserve (additional allocation), to the Extraordinary Reserve and/or to retained earnings, such allocations as shall be<br />

decided by the <strong>Annual</strong> General Meeting of Stockholders;<br />

■ to preference shares, a dividend of up to 0.31 euros per share;<br />

■ to ordinary shares, a dividend of up to 0.155 euros per share;<br />

■ to savings shares and ordinary shares, in equal proportions, an additional dividend of up to 0.155 euros per share;<br />

■ to each ordinary, preference and savings share, in equal proportions, the balance of the net income which the Stockholders’<br />

Meeting resolves to distribute.<br />

When the dividend paid to savings shares in any year amounts to less than 0.31 euros, the difference is added to the preferred<br />

dividend to which they are entitled in the following two years.<br />

If the savings shares are delisted, they are transformed into registered shares if originally bearer shares, and have the right to a<br />

higher dividend increased by 0.175 euros, rather than 0.155 euros, with respect to the dividend received by the ordinary and<br />

preference shares.<br />

If the ordinary shares are delisted, the higher dividend received by the savings shares with respect to the dividend received by<br />

ordinary and preference shares is increased by 0.2 euros per share.<br />

As no dividends were distributed in 2004 and 2005, savings shares are entitled to an additional 0.62 euros per share at<br />

December 31, <strong>2006</strong>.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 145