2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

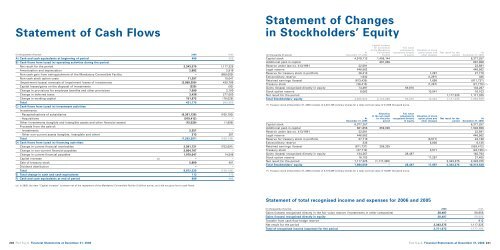

Statement of Cash Flows<br />

(in thousands of euros) <strong>2006</strong> 2005<br />

A) Cash and cash equivalents at beginning of period 495 325<br />

B) Cash flows from (used in) operating activities during the period:<br />

Net result for the period 2,343,375 1,117,325<br />

Amortisation and depreciation 2,882 2,918<br />

Non-cash gain from extinguishment of the Mandatory Convertible Facility – (859,000)<br />

Non-cash stock option costs 11,297 10,041<br />

(Impairment losses) reversals of impairment losses of investments (2,099,350) 430,789<br />

Capital losses/gains on the disposal of investments (329) (93)<br />

Change in provisions for employee benefits and other provisions 7,990 2,100<br />

Change in deferred taxes 3,438 277,000<br />

Change in working capital 151,872 (76,028)<br />

Total 421,175 905,052<br />

C) Cash flows from (used in) investment activities:<br />

Investments:<br />

- Recapitalisations of subsidiaries (6,361,126) (165,193)<br />

- Acquisitions (919,412) –<br />

Other investments (tangible and intangible assets and other financial assets) (15,529) (1,808)<br />

Proceeds from the sale of:<br />

- Investments 2,357 –<br />

- Other non-current assets (tangible, intangible and other) 313 261<br />

Total (7,293,397) (166,740)<br />

D) Cash flows from (used in) financing activities:<br />

Change in current financial receivables 2,991,721 (753,091)<br />

Change in non-current financial payables 2,804,767 –<br />

Change in current financial payables 1,070,047 14,548<br />

Capital increase (a) – –<br />

Sale of treasury stock 5,800 401<br />

Dividend distribution – –<br />

Total 6,872,335 (738,142)<br />

E) Total change in cash and cash equivalents 113 170<br />

F) Cash and cash equivalents at end of period 608 495<br />

(a) In 2005, the item “Capital increase” is shown net of the repayment of the Mandatory Convertible Facility (3 billion euros), as it did not give rise to cash flows.<br />

240 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong><br />

Statement of Changes<br />

in Stockholders’ Equity<br />

Capital increase<br />

for conversion Fair value<br />

of the Mandatory adjustments Valuation of stock<br />

At Convertible recognised directly option plans and Net result for the At<br />

(in thousands of euros) December 31, 2004 Facility in equity other changes period December 31, 2005<br />

Capital stock 4,918,113 1,459,144 6,377,257<br />

Additional paid-in capital – 681,856 681,856<br />

Reserve under law no. 413/1991 22,591 22,591<br />

Legal reserve 446,562 446,562<br />

Reserve for treasury stock in portfolio 26,413 1,297 27,710<br />

Extraordinary reserve 1,632 (1,297) 335<br />

Retained earnings (losses) (813,435) 1,698 (811,737)<br />

Treasury stock (26,413) (1,297) (27,710) (*)<br />

Gains (losses) recognised directly in equity 74,397 59,870 134,267<br />

Stock option reserve 6,062 10,041 16,103<br />

Net result for the period 1,117,325 1,117,325<br />

Total Stockholders’ equity 4,655,922 2,141,000 59,870 10,442 1,117,325 7,984,559<br />

(*) Treasury stock at December 31, 2005 consists of 4,331,708 ordinary shares for a total nominal value of 21,659 thousand euros.<br />

Allocation Fair value<br />

of the net result adjustments Valuation of stock<br />

At for the prior recognised directly option plans and Net result for the At<br />

December 31, 2005 period in equity other changes period December 31, <strong>2006</strong><br />

Capital stock 6,377,257 6,377,257<br />

Additional paid-in capital 681,856 859,000 1,540,856<br />

Reserve under law no. 413/1991 22,591 22,591<br />

Legal reserve 446,562 446,562<br />

Reserve for treasury stock in portfolio 27,710 (3,571) 24,139<br />

Extraordinary reserve 335 5,800 6,135<br />

Retained earnings (losses) (811,737) 258,325 (553,412)<br />

Treasury stock (27,710) 3,571 (24,139) (*)<br />

Gains (losses) recognised directly in equity 134,267 28,497 162,764<br />

Stock option reserve 16,103 11,297 27,400<br />

Net result for the period 1,117,325 (1,117,325) 2,343,375 2,343,375<br />

Total Stockholders’ equity 7,984,559 – 28,497 17,097 2,343,375 10,373,528<br />

(*) Treasury stock at December 31, <strong>2006</strong> consists of 3,773,458 ordinary shares for a total nominal value of 18,867 thousand euros.<br />

Statement of total recognised income and expenses for <strong>2006</strong> and 2005<br />

(in thousands of euros) <strong>2006</strong> 2005<br />

Gains (losses) recognised directly in the fair value reserve (investments in other companies) 28,497 58,958<br />

Gains (losses) recognised directly in equity 28,497 58,958<br />

Transfer from cash flow hedge reserve – 912<br />

Net result for the period 2,343,375 1,117,325<br />

Total of recognised income (expense) for the period 2,371,872 1,177,195<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> 241