2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

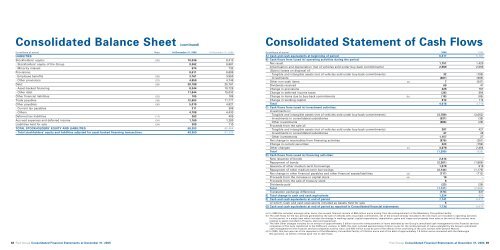

Consolidated Balance Sheet (continued)<br />

(in millions of euros) Note At December 31, <strong>2006</strong> At December 31, 2005<br />

LIABILITIES<br />

Stockholders’ equity: (25) 10,036 9,413<br />

- Stockholders’ equity of the Group 9,362 8,681<br />

- Minority interest 674 732<br />

Provisions: 8,611 8,698<br />

- Employee benefits (26) 3,761 3,950<br />

- Other provisions (27) 4,850 4,748<br />

Debt: (28) 20,188 25,761<br />

- Asset-backed financing 8,344 10,729<br />

- Other debt 11,844 15,032<br />

Other financial liabilities (22) 105 189<br />

Trade payables (29) 12,603 11,777<br />

Other payables: (30) 5,019 4,821<br />

- Current tax payables 311 388<br />

- Others 4,708 4,433<br />

Deferred tax liabilities (11) 263 405<br />

Accrued expenses and deferred income (31) 1,169 1,280<br />

Liabilities held for sale (24) 309 110<br />

TOTAL STOCKHOLDERS’ EQUITY AND LIABILITIES 58,303 62,454<br />

- Total stockholders’ equity and liabilities adjusted for asset-backed financing transactions 49,959 51,725<br />

88 <strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong><br />

Consolidated Statement of Cash Flows<br />

(in millions of euros) <strong>2006</strong> 2005<br />

A) Cash and cash equivalents at beginning of period 6,417 5,767<br />

B) Cash flows from (used in) operating activities during the period:<br />

Net result 1,151 1,420<br />

Amortisation and depreciation (net of vehicles sold under buy-back commitments) 2,969 2,590<br />

(Gains) losses on disposal of:<br />

- Tangible and intangible assets (net of vehicles sold under buy-back commitments) 32 (109)<br />

- Investments (607) (905)<br />

Other non-cash items (a) 7 (547)<br />

Dividends received 69 47<br />

Change in provisions 229 797<br />

Change in deferred income taxes (26) 394<br />

Change in items due to buy-back commitments (b) (18) (85)<br />

Change in working capital 812 114<br />

Total 4,618 3,716<br />

C) Cash flows from (used in) investment activities:<br />

Investments in:<br />

- Tangible and intangible assets (net of vehicles sold under buy-back commitments) (3,789) (3,052)<br />

- Investments in consolidated subsidiaries (931) (39)<br />

- Other investments (686) (28)<br />

Proceeds from the sale of:<br />

- Tangible and intangible assets (net of vehicles sold under buy-back commitments) 387 427<br />

- Investments in consolidated subsidiaries 47 46<br />

- Other investments 1,157 27<br />

Net change in receivables from financing activities (876) (251)<br />

Change in current securities 223 (159)<br />

Other changes (c) 3,078 2,494<br />

Total (1,390) (535)<br />

D) Cash flows from (used in) financing activities:<br />

New issuance of bonds 2,414 –<br />

Repayment of bonds (2,361) (1,868)<br />

Issuance of other medium-term borrowings 1,078 916<br />

Repayment of other medium-term borrowings (2,144) (1,175)<br />

Net change in other financial payables and other financial assets/liabilities (d) (717) (712)<br />

Proceeds from the increase in capital stock (d) 16 –<br />

Proceeds from the sale of treasury stock 6 –<br />

Dividends paid (23) (29)<br />

Total (1,731) (2,868)<br />

Translation exchange differences (173) 337<br />

E) Total change in cash and cash equivalents 1,324 650<br />

F) Cash and cash equivalents at end of period 7,741 6,417<br />

of which: Cash and cash equivalents included as Assets held for sale 5 –<br />

G) Cash and cash equivalents at end of period as reported in Consolidated financial statements 7,736 6,417<br />

(a) In 2005 this included, amongst other items, the unusual financial income of 858 million euros arising from the extinguishment of the Mandatory Convertible Facility.<br />

(b) The cash flows for the two periods generated by the sale of vehicles with a buy-back commitment, net of the amount already included in the net result, are included in operating activities<br />

for the period, in a single item which includes the change in working capital, capital expenditures, depreciation, gains and losses and proceeds from sales at the end of the contract term,<br />

relating to assets included in Property, plant and equipment.<br />

(c) The item Other changes includes for an amount of approximately 3 billion euros the reimbursement of loans extended by the Group’s centralised cash management to the financial services<br />

companies of <strong>Fiat</strong> Auto transferred to the FAFS joint venture. In 2005, this item included approximately 2 billion euros for the reimbursement of loans extended by the Group’s centralised<br />

cash management to the financial services companies sold by Iveco, and 500 million euros as part of the effects of the unwinding of the joint venture with General Motors.<br />

(d) In 2005, this item was net of the repayment of the Mandatory Convertible Facility of 3 billion euros and of the debt of approximately 1.8 billion euros connected with the Italenergia<br />

Bis operation, as neither of these gave rise to cash flows.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> 89