2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

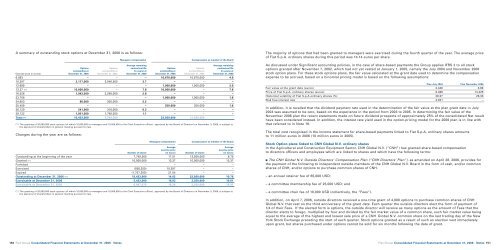

A summary of outstanding stock options at December 31, <strong>2006</strong> is as follows:<br />

Managers compensation Compensation as member of the Board<br />

Average remaining Average remaining<br />

Options Options contractual life Options Options contractual life<br />

outstanding at outstanding at (in years) at outstanding at outstanding at (in years) at<br />

Exercise price (in euros) December 31, <strong>2006</strong> December 31, 2005 December 31, <strong>2006</strong> December 31, <strong>2006</strong> December 31, 2005 December 31, <strong>2006</strong><br />

6.583 – – – 10,670,000 10,670,000 4.0<br />

10.397 2,117,000 3,046,500 3.7 – – –<br />

12.699 – – – 1,000,000 1,000,000 3.0<br />

13.37 (*) 10,000,000 – 7.8 10,000,000 – 7.8<br />

16.526 1,943,500 2,299,000 2.8 – – –<br />

23.708 – – – 1,000,000 1,000,000 1.8<br />

24.853 80,000 300,000 2.2 – – –<br />

25.459 – – – 250.000 250.000 1.6<br />

26.120 241,900 316,000 0.3 – – –<br />

28.122 1,051,500 1,788,000 1.1 – – –<br />

Total (*) 15,433,900 7,749,500 22,920,000 12,920,000<br />

(*) The granting of 20,000,000 stock options (of which 10,000,000 to managers and 10,000,000 to the Chief Executive officer), approved by the Board of Directors on November 3, <strong>2006</strong>, is subject to<br />

the approval of shareholders in general meeting pursuant to law.<br />

Changes during the year are as follows:<br />

Managers compensation Compensation as member of the Board<br />

Average Average<br />

exercise price exercise price<br />

Number of shares (in euros) Number of shares (in euros)<br />

Outstanding at the beginning of the year 7,749,500 17.51 12,920,000 8.75<br />

Granted (*) 10,000,000 13.37 10,000,000 13.37<br />

Forfeited – – – –<br />

Exercised (558,250) 10.397 – –<br />

Expired (1,757,350) 21.54 – –<br />

Outstanding at December 31, <strong>2006</strong> (*) 15,433,900 14.62 22,920,000 10.76<br />

Exercisable at December 31, <strong>2006</strong> 5,433,900 16.93 2,250,000 19.01<br />

Exercisable at December 31, 2005 6,987,875 18.28 2,250,000 19.01<br />

(*) The granting of 20,000,000 stock options (of which 10,000,000 to managers and 10,000,000 to the Chief Executive officer), approved by the Board of Directors on November 3, <strong>2006</strong>, is subject to<br />

the approval of shareholders in general meeting pursuant to law.<br />

150<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

The majority of options that had been granted to managers were exercised during the fourth quarter of the year. The average price<br />

of <strong>Fiat</strong> S.p.A. ordinary shares during this period was 14.14 euros per share.<br />

As discussed under Significant accounting policies, in the case of share-based payments the Group applies IFRS 2 to all stock<br />

options granted after November 7, 2002, which had not yet vested at January 1, 2005, namely the July 2004 and November <strong>2006</strong><br />

stock option plans. For these stock options plans, the fair value calculated at the grant date used to determine the compensation<br />

expense to be accrued, based on a binomial pricing model is based on the following assumptions:<br />

Plan July 2004 Plan November <strong>2006</strong><br />

Fair value at the grant date (euros) 2.440 3.99<br />

Price of <strong>Fiat</strong> S.p.A. ordinary shares (euros) 6.466 14.425<br />

Historical volatility of <strong>Fiat</strong> S.p.A ordinary shares (%) 29.37 28,33<br />

Risk free interest rate 4.021 –<br />

In addition, it is recalled that the dividend payment rate used in the determination of the fair value at the plan grant date in July<br />

2004 was assumed to be zero, based on the experience in the period from 2003 to 2005. In determining the fair value of the<br />

November <strong>2006</strong> plan the recent statements made on future dividend prospects of approximately 25% of the consolidated Net result<br />

have been considered instead. In addition, the interest rate yield used in the option-pricing model for the <strong>2006</strong> plan is in line with<br />

that referred to in Note 19.<br />

The total cost recognised in the income statement for share-based payments linked to <strong>Fiat</strong> S.p.A. ordinary shares amounts<br />

to 11 million euros in <strong>2006</strong> (10 million euros in 2005).<br />

Stock Option plans linked to CNH Global N.V. ordinary shares<br />

In the Agricultural and Construction Equipment Sector, CNH Global N.V. (“CNH”) has granted share-based compensation<br />

to directors officers and employees which are linked to shares and which have the following terms:<br />

■ The CNH Global N.V. Outside Directors’ Compensation Plan (“CNH Directors’ Plan”), as amended on April 28, <strong>2006</strong>, provides for<br />

the payment of the following to independent outside members of the CNH Global N.V. Board in the form of cash, and/or common<br />

shares of CNH, and/or options to purchase common shares of CNH.<br />

– an annual retainer fee of 65,000 USD;<br />

– a committee membership fee of 25,000 USD; and<br />

– a committee chair fee of 10,000 USD (collectively, the “Fees”).<br />

In addition, on April 7, <strong>2006</strong>, outside directors received a one-time grant of 4,000 options to purchase common shares of CNH<br />

Global N.V. that vest on the third anniversary of the grant date. Each quarter the outside directors elect the form of payment of<br />

1/4 of their Fees. If the elected form is options, the outside director will receive as many options as the amount of Fees that the<br />

director elects to forego, multiplied by four and divided by the fair market value of a common share, such fair market value being<br />

equal to the average of the highest and lowest sale price of a CNH Global N.V. common share on the last trading day of the New<br />

York Stock Exchange preceding the start of each quarter. Stock options granted as a result of such an election vest immediately<br />

upon grant, but shares purchased under options cannot be sold for six months following the date of grant.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 151