2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Under the CNH EIP, performance-based restricted shares may also be granted. CNH establishes the period and conditions<br />

of performance for each award and holds the shares during the performance period. Performance-based restricted shares vest<br />

upon the attainment of specified performance objectives. Certain performance-based restricted shares vest no later than seven<br />

years from the award date.<br />

In 2004, a LTI award for which payout is tied to achievement of specified performance objectives was approved under the CNH EIP<br />

for selected key employees and executive officers. The LTI awards are subject to the achievement of certain performance criteria over<br />

a 3-year performance cycle. At the end of the 3-year performance cycle, any earned awards will be satisfied equally with cash and<br />

CNH common shares as determined at the beginning of the performance cycle, for minimum, target, and maximum award levels.<br />

As a transition to the LTI, the first award for the 2004-<strong>2006</strong> performance cycle provided an opportunity to receive an accelerated<br />

payment of 50% of the targeted award after the first two years of the performance cycle. Objectives for the first two years of the<br />

performance cycle were met and an accelerated payment of cash and 66,252 shares were issued in <strong>2006</strong>. Ultimately, the<br />

cumulative results for the 2004-<strong>2006</strong> performance cycle were achieved and the remaining award will be issued in early 2007.<br />

A second 3 year LTI award for the 2005-2007 performance cycle was granted in 2005. Vesting will occur after 2007 results are<br />

approved by the CNH Global N.V. Board of Directors.<br />

In connection with changes to the LTI, CNH granted approximately 2.2 million performance based, non-vested share awards under<br />

its EIP to approximately 200 of the Company’s top executives. These shares were to cliff vest when 2008 audited results are<br />

approved by the CNH Global N.V. Board of Directors (estimated to be February 2009) if specified fiscal year 2008 targets were<br />

achieved. In December <strong>2006</strong>, CNH extended this grant by providing participants an additional opportunity for potential partial<br />

payouts should these targets not be achieved until 2009 or 2010. All other terms remained unchanged. The grant date fair value<br />

on the date of the modification ranges from 27.35 USD per share to 26.27 USD depending on the service period over which the<br />

grant ultimately vests. The fair value is based on the market value of CNH’s common shares on the date of the grant modification<br />

and is adjusted for the estimated value of dividends which are not available to participants during the vesting period. Depending<br />

on the period during which targets are achieved, the estimated expense over the service period can range from approximately<br />

28 USD million to 52 USD million (current estimate is 38 USD million). If specified targets are not achieved by 2010, the shares<br />

granted will not vest.<br />

As of December 31, <strong>2006</strong>, outstanding performance shares under the <strong>2006</strong>, 2005, and 2004 awards under the CNH EIP were as<br />

follows:<br />

<strong>2006</strong> 2005 2004<br />

(number of shares) award award award<br />

Granted 4,475,000 195,946 235,134<br />

Exercised – – (66,252)<br />

Cancelled (2,237,500) – –<br />

Forfeited – (45,834) (119,442)<br />

Outstanding at December 31. <strong>2006</strong> 2,237,500 150,112 49,440<br />

As of December 31, <strong>2006</strong> and 2005, there were 10,642,793 common shares available for issuance under the CNH EIP.<br />

The total cost recognised in the <strong>2006</strong> income statement for all share-based compensation linked to CNH Global N.V. ordinary<br />

shares amounted to 4 million euros (1 million euros in 2005).<br />

154<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

Stock Option linked to Ferrari S.p.A. ordinary shares<br />

Under this scheme, certain employees of Ferrari S.p.A., and the Chairman and the Chief Executive Officer of the company at the<br />

time, have the option to acquire respectively 207,200 and 184,000 Ferrari S.p.A. ordinary shares at a strike price of 175 euros per<br />

share. Under the scheme the options may be exercised until December 31, 2010, wholly or partially, and are subject to a limited<br />

extent to the company’s listing process. A total of 104,000 options granted to the Chairman of Ferrari S.p.A. were exercised in <strong>2006</strong><br />

and settled by carrying out an increase in capital stock, while a further 140,800 options were forfeited. At December 31, <strong>2006</strong> the<br />

employees and the Chairman held respective totals of 66,400 and 80,000 stock option rights under this scheme, all of whose<br />

exercise rights are subordinated to the listing of the company.<br />

Cash-settled share-based payments<br />

Certain entities of the <strong>Fiat</strong> Powertrain Technologies Sector have agreed in 2001, 2002, 2003 and 2004 with a number of employees<br />

a total of four cash-settled share-based payment defined Stock Appreciation Rights (SAR) plans. Under these plans, certain<br />

employees involved have the right to receive a payment corresponding to the increase in share price between the grant date and<br />

the exercise date of General Motors $1 2/3 shares listed in New York and <strong>Fiat</strong> S.p.A. ordinary shares listed in Milan. The right is<br />

exercisable from the vesting date to the expiry date of the plans and is subordinated to certain conditions (Non-Market Conditions<br />

“NMC”). The contractual terms of these rights are as follows:<br />

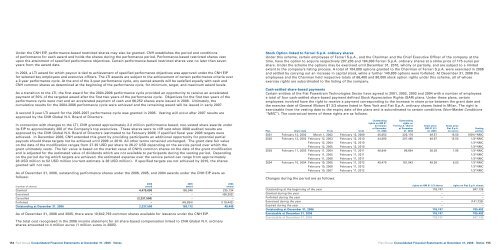

Outstanding Outstanding<br />

rights on GM $1 rights on<br />

2/3 shares <strong>Fiat</strong> S.p.A. shares Grant price Grant price<br />

at December at December GM $1 2/3 <strong>Fiat</strong> S.p.A. Vesting<br />

Plan Grant date From Until 31, <strong>2006</strong> 31, <strong>2006</strong> (in USD) (in euros) portion<br />

2001 February 12, 2002 March 1, 2002 February 12, 2009 45,053 220,176 49.57 15.50 100%*NMC<br />

2002 February 12, 2002 February 12, 2003 February 12, 2010 44,580 207,490 49.57 15.50 1/3*NMC<br />

February 12, 2004 February 12, 2010 1/3*NMC<br />

February 12, 2005 February 12, 2010 1/3*NMC<br />

2003 February 11, 2003 February 11, 2004 February 11, 2011 46,644 96,694 36.26 7.95 1/3*NMC<br />

February 11, 2005 February 11, 2011 1/3*NMC<br />

February 11, <strong>2006</strong> February 11, 2011 1/3*NMC<br />

2004 February 10, 2004 February 10, 2005 February 11, 2012 40,470 181,042 49.26 6.03 1/3*NMC<br />

February 10, <strong>2006</strong> February 11, 2012 1/3*NMC<br />

February 10, 2007 February 11, 2012 1/3*NMC<br />

Changes during the period are as follows:<br />

rights on GM $1 2/3 shares rights on <strong>Fiat</strong> S.p.A. shares<br />

Outstanding at the beginning of the year 176,747 847,135<br />

Granted during the year – –<br />

Forfeited during the year – –<br />

Exercised during the year – (141,733)<br />

Expired during the year – –<br />

Outstanding at December 31, <strong>2006</strong> 176,747 705,402<br />

Exercisable at December 31, <strong>2006</strong> 176,747 705,402<br />

Exercisable at December 31, 2005 176,747 847,135<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 155