2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In order to render the reconciliation between income taxes recorded in the financial statements and theoretical income taxes more<br />

meaningful, the IRAP tax is not taken into consideration. Since the IRAP tax has a taxable basis that is different from income before<br />

taxes, it generates distortions between one year and another. Accordingly, theoretical income taxes are determined by applying<br />

only the tax rate in effect in Italy (IRES equal to 33% in <strong>2006</strong> and in 2005) to income before taxes.<br />

Permanent differences in the above reconciliation include the tax effect of non-taxable income of 206 million euros in <strong>2006</strong><br />

(677 million euros in 2005) and of non-deductible costs of 204 million euros in <strong>2006</strong> (225 million euros in 2005). In particular, in<br />

2005 the tax effect of permanent differences arose principally from the theoretical tax effect of 283 million euros on the unusual<br />

financial income relating to the Mandatory Convertible Facility (gross 858 million euros) and that of 290 million euros arising from<br />

the sale of Italenergia Bis S.p.A. (gross 878 million euros).<br />

The reconciliation includes a positive effect of 189 million euros resulting from the recognition of net deferred tax assets not<br />

recognised in prior years (the effect of this was negative in 2005 as the deferred tax assets originating during the year were not<br />

recognised).<br />

In <strong>2006</strong>, Other differences included unrecoverable withholding tax for 20 million euros (21 million euros in 2005).<br />

Net deferred tax assets at December 31, <strong>2006</strong> consist of deferred tax assets, net of deferred tax liabilities, which have been offset<br />

where possible by the individual consolidated companies. The net balance of Deferred tax assets and Deferred tax liabilities may<br />

be analysed as follows:<br />

(in millions of euros) At December 31, <strong>2006</strong> At December 31, 2005 Change<br />

Deferred tax assets 1,860 2,104 (244)<br />

Deferred tax liabilities (263) (405) 142<br />

Net deferred tax assets 1,597 1,699 (102)<br />

The reduction in net deferred tax assets, as analysed in the following table, is mainly due to:<br />

■ negative exchange differences and other changes amounting to 105 million euros;<br />

■ the corresponding tax effect of items recorded directly in equity amounting to 35 million euros;<br />

■ changes in the scope of consolidation due to the sale of a subsidiary (B.U.C.) and to the deconsolidation of the <strong>Fiat</strong> Auto Sector<br />

financial subsidiaries which were transferred to the FAFS joint venture for 23 million euros.<br />

These components of the reduction were partly offset by the recognition of deferred tax assets, net of the realisation of deferred<br />

tax assets recognised in prior years.<br />

116<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

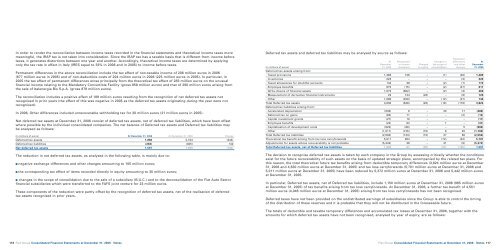

Deferred tax assets and deferred tax liabilities may be analysed by source as follows:<br />

Translation<br />

At Recognised Changes in differences At<br />

December in income Charged the scope of and other December<br />

(in millions of euros) 31, 2005 statement to equity consolidation changes 31, <strong>2006</strong><br />

Deferred tax assets arising from:<br />

- Taxed provisions 1,396 126 – (1) (32) 1,489<br />

- Inventories 223 – – – (3) 220<br />

- Taxed allowances for doubtful accounts 142 39 – (2) (7) 172<br />

- Employee benefits 675 (15) – (2) (47) 611<br />

- Write-downs of financial assets 1,073 (602) – (2) (3) 466<br />

- Measurement of derivative financial instruments 22 124 (20) – (6) 120<br />

- Other 1,099 (320) – (12) (21) 746<br />

Total Deferred tax assets 4,630 (648) (20) (19) (119) 3,824<br />

Deferred tax liabilities arising from:<br />

- Accelerated depreciation (533) 8 – 20 17 (488)<br />

- Deferred tax on gains (83) 71 – – (2) (14)<br />

- Capital investment grants (27) 10 – – – (17)<br />

- Employee benefits (24) (8) – 1 – (31)<br />

- Capitalisation of development costs (822) (89) – – 5 (906)<br />

- Other (1,011) (125) (15) 6 45 (1,100)<br />

Total Deferred tax liabilities (2,500) (133) (15) 27 65 (2,556)<br />

Theoretical tax benefit arising from tax loss carryforwards 5,011 804 – (72) (42) 5,701<br />

Adjustments for assets whose recoverability is not probable (5,442) 38 – 41 (9) (5,372)<br />

Total Deferred tax assets, net of Deferred tax liabilities 1,699 61 (35) (23) (105) 1,597<br />

The decision to recognise deferred tax assets is taken by each company in the Group by assessing critically whether the conditions<br />

exist for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax plans. For<br />

this reason, the total theoretical future tax benefits arising from deductible temporary differences (3,824 million euros at December<br />

31, <strong>2006</strong> and 4,630 million euros at December 31, 2005) and tax loss carryforwards (5,701 million euros at December 31, <strong>2006</strong> and<br />

5,011 million euros at December 31, 2005) have been reduced by 5,372 million euros at December 31, <strong>2006</strong> and 5,442 million euros<br />

at December 31, 2005.<br />

In particular, Deferred tax assets, net of Deferred tax liabilities, include 1,150 million euros at December 31, <strong>2006</strong> (965 million euros<br />

at December 31, 2005) of tax benefits arising from tax loss carryforwards. At December 31, <strong>2006</strong>, a further tax benefit of 4,551<br />

million euros (4,046 million euros at December 31, 2005) arising from tax loss carryforwards has not been recognised.<br />

Deferred taxes have not been provided on the undistributed earnings of subsidiaries since the Group is able to control the timing<br />

of the distribution of these reserves and it is probable that they will not be distributed in the foreseeable future.<br />

The totals of deductible and taxable temporary differences and accumulated tax losses at December 31, <strong>2006</strong>, together with the<br />

amounts for which deferred tax assets have not been recognised, analysed by year of expiry, are as follows:<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 117