2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

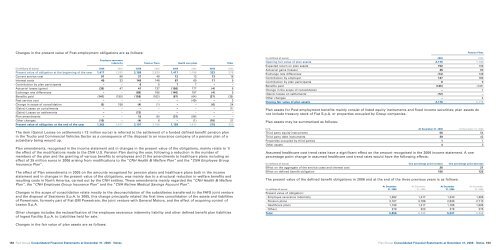

Changes in the present value of Post-employment obligations are as follows:<br />

Employee severance<br />

indemnity Pension Plans Health care plans Other<br />

(in millions of euros) <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Present value of obligation at the beginning of the year 1,417 1,243 3,186 2,830 1,417 1,186 323 278<br />

Current service cost 91 86 37 48 12 12 13 16<br />

Interest costs 49 33 149 146 67 60 11 9<br />

Contribution by plan participants – – 6 5 7 7 – –<br />

Actuarial losses (gains) (39) 47 41 137 (156) 177 (4) 8<br />

Exchange rate differences – – (89) 185 (140) 187 (4) 5<br />

Benefits paid (141) (150) (158) (162) (67) (64) (37) (39)<br />

Past service cost – – – – – (49) – 2<br />

Change in scope of consolidation (5) 158 (4) (1) – – (6) 24<br />

(Gains) Losses on curtailments – – – – – – – (1)<br />

(Gains) Losses on settlements – – (72) – – – – –<br />

Plan amendments – – 15 (8) (31) (98) – –<br />

Other changes (10) – (4) 6 – (1) (18) 21<br />

Present value of obligation at the end of the year 1,362 1,417 3,107 3,186 1,109 1,417 278 323<br />

The item (Gains) Losses on settlements (-72 million euros) is referred to the settlement of a funded defined benefit pension plan<br />

in the Trucks and Commercial Vehicles Sector as a consequence of the disposal to an insurance company of a pension plan of a<br />

subsidiary being wound up.<br />

Plan amendments, recognised in the income statement and in changes in the present value of the obligations, mainly relate to 1)<br />

the effect of the modifications made to the CNH U.S. Pension Plan during the year, following a reduction in the number of<br />

members of the plan and the granting of various benefits to employees and 2) the amendments to healthcare plans including an<br />

effect of 25 million euros in <strong>2006</strong> arising from modifications to the “CNH Health & Welfare Plan” and the “CNH Employee Group<br />

Insurance Plan”.<br />

The effect of Plan amendments in 2005 on the amounts recognised for pension plans and healthcare plans both in the income<br />

statement and in changes in the present value of the obligations, was mainly due to a structural reduction in welfare benefits and<br />

resulting costs in North America, carried out by the CNH entities. These amendments mainly regarded the “CNH Health & Welfare<br />

Plan”, the “CNH Employee Group Insurance Plan” and the “CNH Retiree Medical Savings Account Plan”.<br />

Changes in the scope of consolidation relate mostly to the deconsolidation of the subsidiaries transferred to the FAFS joint venture<br />

and the disposal of Sestrieres S.p.A. In 2005, this change principally related the first-time consolidation of the assets and liabilities<br />

of Powertrain, formerly part of <strong>Fiat</strong>-GM Powertrain, the joint venture with General Motors, and the effect of acquiring control of<br />

Leasys S.p.A.<br />

Other changes includes the reclassification of the employee severance indemnity liability and other defined benefit plan liabilities<br />

of Ingest Facility S.p.A. to Liabilities held for sale.<br />

Changes in the fair value of plan assets are as follows:<br />

162<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

Pension Plans<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Opening fair value of plan assets 2,115 1,709<br />

Expected return on plan assets 152 133<br />

Actuarial gains (losses) 46 80<br />

Exchange rate differences (74) 146<br />

Contribution by employer 147 180<br />

Contribution by plan participants 6 9<br />

Benefits paid (145) (147)<br />

Change in the scope of consolidation – 1<br />

(Gains) losses on settlements (72) –<br />

Other changes – 4<br />

Closing fair value of plan assets 2,176 2,115<br />

Plan assets for Post-employment benefits mainly consist of listed equity instruments and fixed income securities; plan assets do<br />

not include treasury stock of <strong>Fiat</strong> S.p.A. or properties occupied by Group companies.<br />

Plan assets may be summarised as follows:<br />

In % At December 31, <strong>2006</strong> At December 31, 2005<br />

Third party equity instruments 56 54<br />

Third party debt instruments 39 42<br />

Properties occupied by third parties 1 1<br />

Other assets 4 3<br />

Assumed healthcare cost trend rates have a significant effect on the amount recognised in the <strong>2006</strong> income statement. A one<br />

percentage point change in assumed healthcare cost trend rates would have the following effects:<br />

(in millions of euros) One percentage point increase One percentage point decrease<br />

Effect on the aggregate of the service costs and interest cost 26 21<br />

Effect on defined benefit obligation 156 122<br />

The present value of the defined benefit obligations in <strong>2006</strong> and at the end of the three previous years is as follows:<br />

At December At December At December At December<br />

(in millions of euros) 31, <strong>2006</strong> 31, 2005 31, <strong>2006</strong> 31, 2005<br />

Present value of obligation:<br />

- Employee severance indemnity 1,362 1,417 1,243 1,265<br />

- Pension plans 3,107 3,186 2,830 2,713<br />

- Healthcare plans 1,109 1,417 1,186 1,095<br />

- Others 278 323 278 275<br />

Total 5,856 6,343 5,537 5,348<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 163