2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

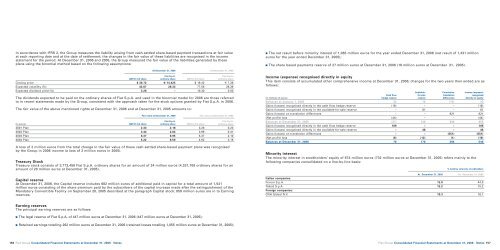

In accordance with IFRS 2, the Group measures the liability arising from cash-settled share-based payment transactions at fair value<br />

at each reporting date and at the date of settlement; the changes in the fair value of these liabilities are recognised in the income<br />

statement for the period. At December 31, <strong>2006</strong> and 2005, the Group measured the fair value of the liabilities generated by these<br />

plans using the binomial method based on the following assumptions:<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

<strong>Fiat</strong> S.p.A. <strong>Fiat</strong> S.p.A.<br />

GM $1 2/3 share ordinary share GM $1 2/3 share ordinary share<br />

Closing price $ 30.72 € 14.425 $ 19.42 € 7.36<br />

Expected volatility (%) 42.67 28.33 77.56 28.39<br />

Expected dividend yield (%) 3.26 – 10.30 0.00<br />

The dividends expected to be paid on the ordinary shares of <strong>Fiat</strong> S.p.A. and used in the binomial model for <strong>2006</strong> are those referred<br />

to in recent statements made by the Group, consistent with the approach taken for the stock options granted by <strong>Fiat</strong> S.p.A. in <strong>2006</strong>.<br />

The fair value of the above mentioned rights at December 31, <strong>2006</strong> and at December 31, 2005 amounts to:<br />

Fair value at December 31, <strong>2006</strong> Fair value at December 31, 2005<br />

<strong>Fiat</strong> S.p.A. <strong>Fiat</strong> S.p.A.<br />

(in euros) GM $1 2/3 share ordinary share GM $1 2/3 share ordinary share<br />

2001 Plan 2.33 2.18 3.28 0.23<br />

2002 Plan 3.44 2.64 3.99 0.41<br />

2003 Plan 6.37 6.95 5.37 2.10<br />

2004 Plan 5.22 8.59 4.92 3.15<br />

A loss of 2 million euros from the total change in the fair value of these cash-settled share-based payment plans was recognised<br />

by the Group in <strong>2006</strong> income (a loss of 2 million euros in 2005).<br />

Treasury Stock<br />

Treasury stock consists of 3,773,458 <strong>Fiat</strong> S.p.A. ordinary shares for an amount of 24 million euros (4,331,708 ordinary shares for an<br />

amount of 28 million euros at December 31, 2005).<br />

Capital reserve<br />

At December 31, <strong>2006</strong>, the Capital reserve includes 682 million euros of additional paid-in capital for a total amount of 1,541<br />

million euros consisting of the share premium paid by the subscribers of the capital increase made after the extinguishment of the<br />

Mandatory Convertible Facility on September 20, 2005 described at the paragraph Capital stock; 859 million euros are in to Earning<br />

reserves.<br />

Earning reserves<br />

The principal earning reserves are as follows:<br />

■ The legal reserve of <strong>Fiat</strong> S.p.A. of 447 million euros at December 31, <strong>2006</strong> (447 million euros at December 31, 2005);<br />

■ Retained earnings totalling 262 million euros at December 31, <strong>2006</strong> (retained losses totalling 1,055 million euros at December 31, 2005);<br />

156<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

■ The net result before minority interest of 1,065 million euros for the year ended December 31, <strong>2006</strong> (net result of 1,331 million<br />

euros for the year ended December 31, 2005);<br />

■ The share based payments reserve of 27 million euros at December 31, <strong>2006</strong> (16 million euros at December 31, 2005).<br />

Income (expense) recognised directly in equity<br />

This item consists of accumulated other comprehensive income at December 31, <strong>2006</strong>; changes for the two years then ended are as<br />

follows:<br />

Available- Cumulative Income (expense)<br />

Cash flow for-sale translation recognised<br />

(in millions of euros) hedge reserve reserve differences directly in equity<br />

Balances at January 1, 2005 33 75 (75) 33<br />

Gains (losses) recognised directly in the cash flow hedge reserve (16) – – (16)<br />

Gains (losses) recognised directly in the available-for-sale reserve – 61 – 61<br />

Gains (losses) on translation differences – – 921 921<br />

(Net profit) loss (44) – – (44)<br />

Balances at December 31, 2005 (27) 136 846 955<br />

Gains (losses) recognised directly in the cash flow hedge reserve 109 – – 109<br />

Gains (losses) recognised directly in the available-for-sale reserve – 46 – 46<br />

Gains (losses) on translation differences – – (551) (551)<br />

(Net profit) loss (6) (12) (1) (19)<br />

Balances at December 31, <strong>2006</strong> 76 170 294 540<br />

Minority interest<br />

The minority interest in stockholders’ equity of 674 million euros (732 million euros at December 31, 2005) refers mainly to the<br />

following companies consolidated on a line-by-line basis:<br />

% held by minority stockholders<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

Italian companies:<br />

Ferrari S.p.A. 15.0 44.0<br />

Teksid S.p.A. 15.2 15.2<br />

Foreign companies:<br />

CNH Global N.V. 10.3 16.1<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 157