2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

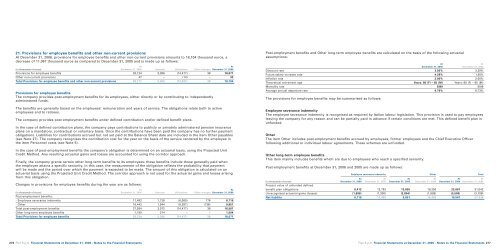

21. Provisions for employee benefits and other non-current provisions<br />

At December 31, <strong>2006</strong>, provisions for employee benefits and other non-current provisions amounts to 18,104 thousand euros, a<br />

decrease of 11,067 thousand euros as compared to December 31, 2005 and is made up as follows:<br />

At At<br />

(in thousands of euros) December 31, 2005 Accruals Utilisations Other changes December 31, <strong>2006</strong><br />

Provisions for employee benefits 29,124 3,386 (14,477) 38 18,071<br />

Other non-current provisions 47 – (14) – 33<br />

Total Provisions for employee benefits and other non-current provisions 29,171 3,386 (14,491) 38 18,104<br />

Provisions for employee benefits<br />

The company provides post-employment benefits for its employees, either directly or by contributing to independently<br />

administered funds.<br />

The benefits are generally based on the employees’ remuneration and years of service. The obligations relate both to active<br />

employees and to retirees.<br />

The company provides post-employment benefits under defined contribution and/or defined benefit plans.<br />

In the case of defined contribution plans, the company pays contributions to publicly or privately administered pension insurance<br />

plans on a mandatory, contractual or voluntary basis. Once the contributions have been paid the company has no further payment<br />

obligations. Liabilities for contributions accrued but not yet paid at the Balance Sheet date are included in the item Other payables<br />

(see Note 27). The company recognises the contribution cost for the year on the basis of the service rendered by the employee in<br />

the item Personnel costs (see Note 5).<br />

In the case of post-employment benefits the company’s obligation is determined on an actuarial basis, using the Projected Unit<br />

Credit Method. Any resulting actuarial gains and losses are accounted for using the corridor approach.<br />

Finally, the company grants certain other long-term benefits to its employees; these benefits include those generally paid when<br />

the employee attains a specific seniority. In this case, the measurement of the obligation reflects the probability that payment<br />

will be made and the period over which the payment is expected to be made. The amount of this obligation is calculated on an<br />

actuarial basis using the Projected Unit Credit Method. The corridor approach is not used for the actuarial gains and losses arising<br />

from this obligation.<br />

Changes in provisions for employee benefits during the year are as follows:<br />

At At<br />

(in thousands of euros) December 31, 2005 Accruals Utilisations Other changes December 31, <strong>2006</strong><br />

Post-employment benefits:<br />

- Employee severance indemnity 11,492 1,128 (6,080) 176 6,716<br />

- Other 16,442 1,944 (8,397) (138) 9,851<br />

Total post-employment benefits 27,934 3,072 (14,477) 38 16,567<br />

Other long-term employee benefits 1,190 314 – – 1,504<br />

Total Provisions for employee benefits 29,124 3,386 (14,477) 38 18,071<br />

276 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements<br />

Post-employment benefits and Other long-term employee benefits are calculated on the basis of the following actuarial<br />

assumptions:<br />

At At<br />

December 31, <strong>2006</strong> December 31, 2005<br />

Discount rate 3.93% 3.29%<br />

Future salary increase rate 4.28% 1.95%<br />

Inflation rate 2.00% 2.00%<br />

Theoretical retirement age Years: 60 (F) – 65 (M) Years: 60 (F) – 65 (M)<br />

Mortality rate SI99 SI99<br />

Average annual departure rate 9.79% 8.73%<br />

The provisions for employee benefits may be summarised as follows:<br />

Employee severance indemnity<br />

The employee severance indemnity is recognised as required by Italian labour legislation. This provision is used to pay employees<br />

leaving the company for any reason and can be partially paid in advance if certain conditions are met. This defined benefit plan is<br />

unfunded.<br />

Other<br />

The item Other includes post-employment benefits accrued by employees, former employees and the Chief Executive Officer<br />

following additional or individual labour agreements. These schemes are unfunded.<br />

Other long-term employee benefits<br />

This item mainly includes benefits which are due to employees who reach a specified seniority.<br />

Post-employment benefits at December 31, <strong>2006</strong> and 2005 are made up as follows:<br />

Employee severance indemnity Other Total<br />

At At At At At At<br />

(in thousands of euros) December 31, <strong>2006</strong> December 31, 2005 December 31, <strong>2006</strong> December 31, 2005 December 31, <strong>2006</strong> December 31, 2005<br />

Present value of unfunded defined<br />

benefit plan obligations 8,412 12,792 13,655 18,250 22,067 31,042<br />

Unrecognised actuarial gains (losses) (1,696) (1,300) (3,804) (1,808) (5,500) (3,108)<br />

Net liability 6,716 11,492 9,851 16,442 16,567 27,934<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 277