2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Composition and principal changes<br />

Income Statement<br />

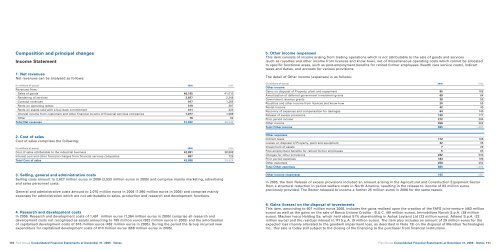

1. Net revenues<br />

Net revenues can be analysed as follows:<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Revenues from:<br />

- Sales of goods 46,105 41,013<br />

- Rendering of services 2,827 2,346<br />

- Contract revenues 917 1,285<br />

- Rents on operating leases 519 397<br />

- Rents on assets sold with a buy-back commitment 311 323<br />

- Interest income from customers and other financial income of financial services companies 1,077 1,088<br />

- Other 76 92<br />

Total Net revenues 51,832 46,544<br />

2. Cost of sales<br />

Cost of sales comprises the following:<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Cost of sales attributable to the industrial business 42,991 38,898<br />

Interest cost and other financial charges from financial services companies 897 726<br />

Total Cost of sales 43,888 39,624<br />

3. Selling, general and administrative costs<br />

Selling costs amount to 2,627 million euros in <strong>2006</strong> (2,533 million euros in 2005) and comprise mainly marketing, advertising<br />

and sales personnel costs.<br />

General and administrative costs amount to 2,070 million euros in <strong>2006</strong> (1,980 million euros in 2005) and comprise mainly<br />

expenses for administration which are not attributable to sales, production and research and development functions.<br />

4. Research and development costs<br />

In <strong>2006</strong>, Research and development costs of 1,401 million euros (1,364 million euros in 2005) comprise all research and<br />

development costs not recognised as assets amounting to 785 million euros (902 million euros in 2005) and the amortisation<br />

of capitalised development costs of 616 million euros (462 million euros in 2005). During the period the Group incurred new<br />

expenditure for capitalised development costs of 813 million euros (656 million euros in 2005).<br />

110<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

5. Other income (expenses)<br />

This item consists of income arising from trading operations which is not attributable to the sale of goods and services<br />

(such as royalties and other income from licences and know-how), net of miscellaneous operating costs which cannot be allocated<br />

to specific functional areas, such as post-employment benefits for retired former employees (health care service costs), indirect<br />

taxes and duties, and accruals for various provisions.<br />

The detail of Other income (expenses) is as follows:<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Other income<br />

Gains on disposal of Property, plant and equipment 95 166<br />

Amortisation of deferred government investment grants 68 64<br />

Government revenue grants 38 58<br />

Royalties and other income from licences and know-how 20 55<br />

Rental income 42 40<br />

Recovery of expenses and compensation for damages 64 145<br />

Release of excess provisions 130 177<br />

Prior period income 272 294<br />

Other income 256 362<br />

Total Other income 985 1,361<br />

Other expenses<br />

Indirect taxes 112 106<br />

Losses on disposal of Property, plant and equipment 32 35<br />

Impairment of assets 7 29<br />

Post-employment benefits for retired former employees 5 63<br />

Charges for other provisions 282 533<br />

Prior period expenses 184 186<br />

Other expenses 258 452<br />

Total Other expenses 880 1,404<br />

Other income (expenses) 105 (43)<br />

In 2005, the item Release of excess provisions included an amount arising in the Agricultural and Construction Equipment Sector<br />

from a structural reduction in period welfare costs in North America, resulting in the release to income of 83 million euros<br />

previously provided. The Sector released to income a further 25 million euros in <strong>2006</strong> for the same reason.<br />

6. Gains (losses) on the disposal of investments<br />

This item, amounting to 607 million euros <strong>2006</strong>, includes the gains realised upon the creation of the FAFS joint-venture (463 million<br />

euros) as well as the gains on the sale of Banca Unione Credito - B.U.C. (80 million euros), Immobiliare Novoli S.p.A. (39 million<br />

euros), Machen Iveco Holding Sa, which held about 51% shareholding in Ashok Leyland Ltd (23 million euros), Atlanet S.p.A. (22<br />

million euros) and the residual interest in IPI S.p.A. (9 million euros). The item also includes an amount of 29 million euros for the<br />

expected loss (mainly allocated to the goodwill impairment loss, as described in Note 13) on the disposal of Meridian Technologies<br />

Inc.; this sale is today still subject to the closing of the financing to the purchaser from financial institutions.<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 111