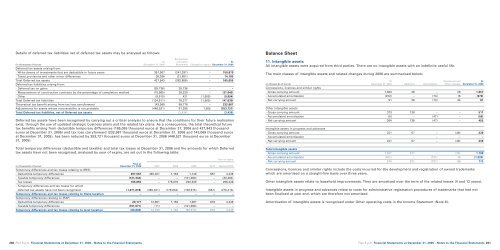

Details of deferred tax liabilities net of deferred tax assets may be analysed as follows: Recognised At in Income At (in thousands of euros) December 31, 2005 Statement Charged to equity December 31, <strong>2006</strong> Deferred tax assets arising from: - Write-downs of investments that are deductible in future years 391,907 (241,037) – 150,870 - Taxed provisions and other minor differences 36,036 (21,851) – 14,185 Total Deferred tax assets 427,943 (262,888) – 165,055 Deferred tax liabilities arising from: - Deferred tax on gains (39,736) 39,736 – – - Measurement of construction contracts by the percentage of completion method (75,865) 38,220 – (37,645) - Other (8,910) 421 (1,505) (9,994) Total Deferred tax liabilities (124,511) 78,377 (1,505) (47,639) Theoretical tax benefit arising from tax loss carryforward 143,089 89,778 – 232,867 Adjustments for assets whose recoverability is not probable (446,521) 91,295 1,505 (353,721) Total Deferred tax liabilities, net of Deferred tax assets – (3,438) – (3,438) Deferred tax assets have been recognised by carrying out a critical analysis to ensure that the conditions for their future realisation exist, through the use of updated strategic business plans and the related tax plans. As a consequence, the total theoretical future tax benefits arising from deductible temporary differences (165,055 thousand euros at December 31, <strong>2006</strong> and 427,943 thousand euros at December 31, 2005) and tax loss carryforward (232,867 thousand euros at December 31, <strong>2006</strong> and 143,089 thousand euros at December 31, 2005), has been reduced by 353,721 thousand euros at December 31, <strong>2006</strong> (446,521 thousand euros at December 31, 2005). Total temporary differences (deductible and taxable) and total tax losses at December 31, <strong>2006</strong> and the amounts for which Deferred tax assets have not been recognised, analysed by year of expiry, are set out in the following table: Year of expiry Total at (in thousands of euros) December 31, <strong>2006</strong> 2007 2008 2009 2010 Beyond 2010 Temporary differences and tax losses relating to IRES: - Deductible temporary differences 497,567 490,321 1,164 1,146 687 4,249 - Taxable temporary differences (131,344) – – (101,060) – (30,284) - Tax losses 705,655 – 178,678 230,529 – 296,448 - Temporary differences and tax losses for which deferred tax assets have not been recognised (1,071,878) (490,321) (179,842) (130,615) (687) (270,413) Temporary differences and tax losses relating to State taxation – – – – – – Temporary differences relating to IRAP: - Deductible temporary differences 20,177 12,801 1,162 1,087 878 4,249 - Taxable temporary differences (101,071) (11) – (101,060) – – Temporary differences and tax losses relating to local taxation (80,894) 12,790 1,162 (99,973) 878 4,249 260 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements Balance Sheet 11. Intangible assets All intangible assets were acquired from third parties. There are no intangible assets with an indefinite useful life. The main classes of intangible assets and related changes during <strong>2006</strong> are summarised below: At (Decreases) and At (in thousands of euros) December 31, 2005 Additions Amortisation Other changes December 31, <strong>2006</strong> Concessions, licences and similar rights - Gross carrying amount 1,003 26 – 28 1,057 - Accumulated amortisation (912) – (74) 16 (970) - Net carrying amount 91 26 (74) 44 87 Other intangible assets - Gross carrying amount 373 138 – – 511 - Accumulated amortisation (9) – (47) – (56) - Net carrying amount 364 138 (47) – 455 Intangible assets in progress and advances - Gross carrying amount 221 57 – (48) 230 - Accumulated amortisation – – – – – - Net carrying amount 221 57 – (48) 230 Total intangible assets - Gross carrying amount 1,597 221 – (20) 1,798 - Accumulated amortisation (921) – (121) 16 (1,026) - Net carrying amount 676 221 (121) (4) 772 Concessions, licences and similar rights include the costs incurred for the development and registration of owned trademarks which are amortised on a straight-line basis over three years. Other intangible assets relate to leasehold improvements. They are amortised over the term of the related leases (4 and 12 years). Intangible assets in progress and advances relate to costs for administrative registration procedures of trademarks that had not been finalised at year end, which are therefore not amortised. Amortisation of intangible assets is recognised under Other operating costs in the Income Statement (Note 6). <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 261

12. Property, plant and equipment The main classes of property, plant and equipment and related changes during <strong>2006</strong> are summarised below: At (Decreases) and At (in thousands of euros) December 31, 2005 Additions Amortisation Other changes December 31, <strong>2006</strong> Land and buildings - Gross carrying amount 45,946 – – – 45,946 - Accumulated depreciation (11,516) – (1,304) – (12,820) - Net carrying amount 34,430 – (1,304) – 33,126 Plant and machinery - Gross carrying amount 10,086 30 – – 10,116 - Accumulated depreciation (8,161) – (989) – (9,150) - Net carrying amount 1,925 30 (989) – 966 Other tangible assets - Gross carrying amount 5,630 483 – (61) 6,052 - Accumulated depreciation (2,327) – (468) (96) (2,891) - Net carrying amount 3,303 483 (468) (157) 3,161 Total property, plant and equipment - Gross carrying amount 61,662 513 – (61) 62,114 - Accumulated depreciation (22,004) – (2,761) (96) (24,861) - Net carrying amount 39,658 513 (2,761) (157) 37,253 Land and buildings include land for 610 thousand euros (unchanged with respect to the previous year) while buildings mainly comprise the company’s headquarters in Turin, Via Nizza 250. Plant and machinery is principally made up of general plant used in the buildings. Other tangible assets comprise cars, office furniture and equipment. At December 31, <strong>2006</strong>, there are no tangible assets in progress or contractual commitments to purchase items of property, plant and equipment of a significant amount. There are no buildings charged as collateral or whose use is restricted. Depreciation of property, plant and equipment is recognised under Other operating costs in the Income Statement (Note 6). 13. Investments At December 31, <strong>2006</strong>, investments total 14,499,595 thousand euros and underwent the following changes during the year: (Impairment losses) Disposals/ reversal of imp. At Acquisitions/ Capital losses/ adjustments At (in thousands of euros) December 31, 2005 Capital increases reimbursements to fair value December 31, <strong>2006</strong> Investments in subsidiaries 4,856,540 7,904,758 (649,410) 2,099,350 14,211,238 Investments in other companies 260,992 18,111 (19,243) 28,497 288,357 Total Investments 5,117,532 7,922,869 (668,653) 2,127,847 14,499,595 262 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements Investments in subsidiaries and changes that occurred during the year are set out in the following table: At Acquisitions/ Disposals/ Capital (Imp. losses)/ At (in thousands of euros) % interest December 31,2005 Capital increases reimbursements rev. of imp. losses December 31, <strong>2006</strong> <strong>Fiat</strong> Partecipazioni S.p.A. 100.00 580,792 6,000,000 1,388,000 7,968,792 - Gross carrying amount 5,983,792 6,000,000 11,983,792 - Accumulated impairment losses (5,403,000) 1,388,000 (4,015,000) <strong>Fiat</strong> Netherlands Holding N.V. 60.56 2,725,683 121,126 (647,476) 95,536 2,294,869 - Gross carrying amount 3,767,033 121,126 (1,593,290) 2,294,869 - Accumulated impairment losses (1,041,350) 945,814 95,536 – Iveco S.p.A. 60.56 647,476 945,814 1,593,290 - Gross carrying amount 1,593,290 1,593,290 - Accumulated impairment losses (945,814) 945,814 – Ferrari S.p.A. 85.00 160,675 896,012 (1,484) 1,055,203 - Gross carrying amount 160,675 896,012 (1,484) 1,055,203 - Accumulated impairment losses – – Magneti Marelli Holding S.p.A. 99.99 811,153 811,153 - Gross carrying amount 811,153 811,153 - Accumulated impairment losses – – Teksid S.p.A. 84.79 75,851 75,851 - Gross carrying amount 128,837 128,837 - Accumulated impairment losses (52,986) (52,986) Comau S.p.A. 100.00 140,613 240,000 (330,000) 50,613 - Gross carrying amount 182,413 240,000 422,413 - Accumulated impairment losses (41,800) (330,000) (371,800) Business Solutions S.p.A. 100.00 36,304 36,304 - Gross carrying amount 88,360 88,360 - Accumulated impairment losses (52,056) (52,056) Itedi - Italiana Edizioni S.p.A. 100.00 25,899 25,899 - Gross carrying amount 25,899 25,899 - Accumulated impairment losses – – IHF - Internazionale Holding <strong>Fiat</strong> S.A. 100.00 33,445 33,445 - Gross carrying amount 33,445 33,445 - Accumulated impairment losses – – <strong>Fiat</strong> Finance S.p.A. 100.00 222,263 222,263 - Gross carrying amount 222,263 222,263 - Accumulated impairment losses – – <strong>Fiat</strong> Finance North America Inc. 39.47 15,557 15,557 - Gross carrying amount 17,118 17,118 - Accumulated impairment losses (1,561) (1,561) <strong>Fiat</strong> U.S.A. Inc. 100.00 27,258 27,258 - Gross carrying amount 34,645 34,645 - Accumulated impairment losses (7,387) (7,387) Other minor 1,047 144 (450) 741 - Gross carrying amount 1,935 144 (1,216) 863 - Accumulated impairment losses (888) 766 (122) Total investments in subsidiaries 4,856,540 7,904,758 (649,410) 2,099,350 14,211,238 - Gross carrying amount 11,457,568 8,850,572 (1,595,990) – 18,712,150 - Accumulated impairment losses (6,601,028) (945,814) 946,580 2,099,350 (4,500,912) <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 263

- Page 1 and 2:

Annual Report Consolidated and Stat

- Page 3 and 4:

But it does move. Galileo Galilei

- Page 5 and 6:

Letter from the Chairman and the Ch

- Page 7 and 8:

The Fiat Group The Fiat Group perfo

- Page 9 and 10:

Stockholders Financial communicatio

- Page 11 and 12:

in 2003, and now the Panda Hydrogen

- Page 13 and 14:

The meeting with the EWC Selected C

- Page 15 and 16:

Revenues by Business Area (in milli

- Page 17 and 18:

The breakdown of trading profit by

- Page 19 and 20:

Investment income was 156 million e

- Page 21 and 22:

If working capital is restated to i

- Page 23 and 24:

Financial Services Revenues (in mil

- Page 25 and 26:

Statement of Changes in Net Industr

- Page 27 and 28:

strategic consistency, economic fea

- Page 29 and 30:

The Board of Directors, at its meet

- Page 31 and 32:

There can be no motion without some

- Page 33 and 34:

Fiat Auto - Fiat, Alfa Romeo, Lanci

- Page 35 and 36:

Maserati Operating Performance In 2

- Page 37 and 38:

Trucks and Commercial Vehicles Ivec

- Page 39 and 40:

Fiat Powertrain Technologies Operat

- Page 41 and 42:

Metallurgical Products - Teksid Pro

- Page 43 and 44:

Motion for Approval of the Financia

- Page 45 and 46:

Consolidated Income Statement (*) (

- Page 47 and 48:

Statement of Changes in Stockholder

- Page 49 and 50:

partially from the market: the rema

- Page 51 and 52:

Measurement Investments in unconsol

- Page 53 and 54:

charges for risk provisions and wri

- Page 55 and 56:

Union market for the Fiat Auto and

- Page 57 and 58:

Composition and principal changes I

- Page 59 and 60:

Net financial expenses in 2006 (exc

- Page 61 and 62:

Year of expiry Total at December Be

- Page 63 and 64:

The net carrying amount of Intangib

- Page 65 and 66:

14. Property, plant and equipment I

- Page 67 and 68:

In 2005 Changes in accumulated depr

- Page 69 and 70:

esulting in a reduction of 1,213 mi

- Page 71 and 72:

Receivables from financing activiti

- Page 73 and 74:

(the residual debt of the Exchangea

- Page 75 and 76:

The reconciliation of the number of

- Page 77 and 78:

A summary of outstanding stock opti

- Page 79 and 80:

Under the CNH EIP, performance-base

- Page 81 and 82: 26. Provisions for employee benefit

- Page 83 and 84: Changes in the present value of Pos

- Page 85 and 86: ■ Commercial risks - This provisi

- Page 87 and 88: 31, 2006 (872 million euros at Dece

- Page 89 and 90: Fidis Retail Italia (FRI) All the r

- Page 91 and 92: Other and Magneti Business elimina-

- Page 93 and 94: Credit risk The maximum credit risk

- Page 95 and 96: The increase over the prior year re

- Page 97 and 98: ■ Current trade receivables of 78

- Page 99 and 100: The book value at the disposal date

- Page 101 and 102: 198 Appendix The Companies of the F

- Page 103 and 104: Subsidiaries consolidated on a line

- Page 105 and 106: Subsidiaries consolidated on a line

- Page 107 and 108: Subsidiaries consolidated on a line

- Page 109 and 110: Subsidiaries consolidated on a line

- Page 111 and 112: % of Group % of consoli- Interest %

- Page 113 and 114: Subsidiaries accounted for using th

- Page 115 and 116: % of Group % of consoli- Interest %

- Page 117 and 118: % of Group % of consoli- Interest %

- Page 119 and 120: 234 Financial Review of Fiat S.p.A.

- Page 121 and 122: (*) (*) Income Statement Balance Sh

- Page 123 and 124: Income Statement pursuant to Consob

- Page 125 and 126: When an impairment loss on assets s

- Page 127 and 128: Provisions The company recognises p

- Page 129 and 130: 4. Other operating income Other ope

- Page 131: Net income from derivative financia

- Page 135 and 136: 15. Other non-current assets At Dec

- Page 137 and 138: Regarding changes in 2005, the Mand

- Page 139 and 140: A summary of outstanding stock opti

- Page 141 and 142: The amounts recognised in the Incom

- Page 143 and 144: The item Payables to Group companie

- Page 145 and 146: These relate to: ■ guarantees of

- Page 147 and 148: Counterparty Other Current Other No

- Page 149 and 150: 32. Significant non-recurring trans

- Page 151 and 152: Fees paid to Members of the Board o

- Page 153 and 154: Financial statement format Fiat S.p

- Page 155 and 156: Deferred tax assets Reclassificatio

- Page 157 and 158: Reconciliation of net profit (loss)

- Page 159 and 160: B. Employee benefits The employees

- Page 161 and 162: Auditors’ Reports Auditors’ Rep

- Page 163 and 164: Reports of the Board of Statutory A

- Page 165 and 166: that numerous transactions involvin

- Page 167 and 168: Motion for Approval of the Financia

- Page 169 and 170: Motion to amend Articles 9, 11, 12,

- Page 171 and 172: Stockholders Meeting and will be ef

- Page 173 and 174: Graphic design Atelier Roger Pfund,