2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

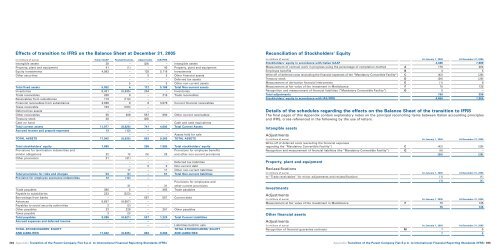

Effects of transition to IFRS on the Balance Sheet at December 31, 2005<br />

(in millions of euros) Italian GAAP Reclassifications Adjustments IAS/IFRS<br />

Intangible assets 28 – (28) – Intangible assets<br />

Property, plant and equipment 41 (1) – 40 Property, plant and equipment<br />

Equity investments 4,983 – 135 5,118 Investments<br />

Other securities – 5 5 Other financial assets<br />

– – – Deferred tax assets<br />

5 – 5 Other non-current assets<br />

Total fixed assets 5,052 4 112 5,168 Total Non-current assets<br />

Inventories 8,431 (8,635) 204 – Inventories<br />

Trade receivables 208 8 – 216 Trade receivables<br />

Receivables from subsidiaries 113 (113) –<br />

Financial receivables from subsidiaries 3,059 9 8 3,076 Current financial receivables<br />

Taxes receivable 103 (103) –<br />

Deferred tax assets – – –<br />

Other receivables 35 208 557 800 Other current receivables<br />

Treasury stock 28 – (28)<br />

Cash on hand – – – – Cash and cash equivalents<br />

Total current assets 11,977 (8,626) 741 4,092 Total Current Assets<br />

Accrued income and prepaid expenses 13 (13) –<br />

– – – Assets held for sale<br />

TOTAL ASSETS 17,042 (8,635) 853 9,260 TOTAL ASSETS<br />

Total stockholders’ equity 7,689 – 296 7,985 Total stockholders’ equity<br />

Provisions for termination indemnities and Provisions for employee benefits<br />

similar obligations 22 12 (5) 29 and other non-current provisions<br />

Other provisions 31 (31) –<br />

– – – Deferred tax liabilities<br />

– 5 5 Non-current debt<br />

17 – 17 Other non-current liabilities<br />

Total provisions for risks and charges 53 (2) – 51 Total Non-current liabilities<br />

Provision for employee severance indemnities 12 (12) –<br />

Provisions for employees and<br />

31 – 31 other current provisions<br />

Trade payables 380 5 – 385 Trade payables<br />

Payable to subsidiaries 223 (223) –<br />

Borrowings from banks – – 557 557 Current debt<br />

Advances 8,657 (8,657) –<br />

Payables to social security authorities 2 (2) –<br />

Other payables 23 228 – 251 Other payables<br />

Taxes payable 3 (3) –<br />

Total payables 9,288 (8,621) 557 1,224 Total Current Liabilities<br />

Accrued expenses and deferred income – – –<br />

– – Liabilities held for sale<br />

TOTAL STOCKHOLDERS’ EQUITY TOTAL STOCKHOLDERS’ EQUITY<br />

AND LIABILITIES 17,042 (8,635) 853 9,260 AND LIABILITIES<br />

304 Appendix Transition of the Parent Company <strong>Fiat</strong> S.p.A. to International Financial <strong>Report</strong>ing Standards (IFRS)<br />

Reconciliation of Stockholders’ Equity<br />

(in millions of euros) At January 1, 2005 At December 31, 2005<br />

Stockholders’ equity in accordance with Italian GAAP 4,466 7,689<br />

Measurement of contract work in progress using the percentage of completion method A 176 204<br />

Employee benefits B 3 5<br />

Write-off of deferred costs (excluding the financial expenses of the “Mandatory Convertible Facility”) C (42) (28)<br />

Treasury stock D (26) (28)<br />

Measurement of derivative financial instruments E (1) 8<br />

Measurement at fair value of the investment in Mediobanca F 75 135<br />

Recognition and measurement of financial liabilities (“Mandatory Convertible Facility”) G 5 –<br />

Total adjustments 190 296<br />

Stockholders’ equity in accordance with IAS/IFRS 4,656 7,985<br />

Details of the schedules regarding the effects on the Balance Sheet of the transition to IFRS<br />

The final pages of this Appendix contain explanatory notes on the principal reconciling items between Italian accounting principles<br />

and IFRS, cross-referenced in the following by the use of letters.<br />

Intangible assets<br />

Adjustments<br />

(in millions of euros) At January 1, 2005 At December 31, 2005<br />

Write-off of deferred costs (excluding the financial expenses<br />

regarding the “Mandatory Convertible Facility”) C (42) (28)<br />

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G (8) –<br />

(50) (28)<br />

Property, plant and equipment<br />

Reclassifications<br />

(in millions of euros) At January 1, 2005 At December 31, 2005<br />

to “Trade receivables” for minor adjustments and reclassifications (1) (1)<br />

(1) (1)<br />

Investments<br />

Adjustments<br />

(in millions of euros) At January 1, 2005 At December 31, 2005<br />

Measurement at fair value of the investment in Mediobanca F 75 135<br />

75 135<br />

Other financial assets<br />

Adjustments<br />

(in millions of euros) At January 1, 2005 At December 31, 2005<br />

Recognition of financial guarantee contracts M 7 5<br />

7 5<br />

Appendix Transition of the Parent Company <strong>Fiat</strong> S.p.A. to International Financial <strong>Report</strong>ing Standards (IFRS) 305