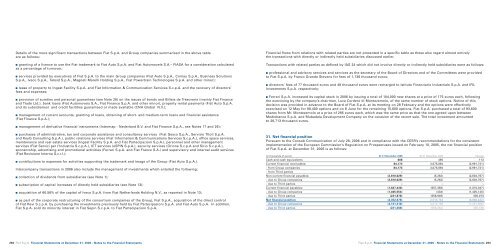

Details of the more significant transactions between <strong>Fiat</strong> S.p.A. and Group companies summarised in the above table are as follows: ■ granting of a licence to use the <strong>Fiat</strong> trademark to <strong>Fiat</strong> Auto S.p.A. and <strong>Fiat</strong> Automoveis S.A.– FIASA for a consideration calculated as a percentage of turnover; ■ services provided by executives of <strong>Fiat</strong> S.p.A. to the main Group companies (<strong>Fiat</strong> Auto S.p.A., Comau S.p.A., Business Solutions S.p.A., Iveco S.p.A., Teksid S.p.A., Magneti Marelli Holding S.p.A., <strong>Fiat</strong> Powertrain Technologies S.p.A. and other minor); ■ lease of property to Ingest Facility S.p.A. and <strong>Fiat</strong> Information & Communication Services S.c.p.A. and the recovery of directors’ fees and expenses; ■ provision of sureties and personal guarantees (see Note 28) on the issues of bonds and Billets de Trésorerie (mainly <strong>Fiat</strong> Finance and Trade Ltd.), bank loans (<strong>Fiat</strong> Automoveis S.A., <strong>Fiat</strong> Finance S.p.A. and other minor), property rental payments (<strong>Fiat</strong> Auto S.p.A. and its subsidiaries) and credit facilities guaranteed or made available (CNH Global N.V.); ■ management of current accounts, granting of loans, obtaining of short- and medium-term loans and financial assistance (<strong>Fiat</strong> Finance S.p.A.); ■ management of derivative financial instruments (Intermap - Nederland B.V. and <strong>Fiat</strong> Finance S.p.A., see Notes 17 and 26); ■ purchases of administrative, tax and corporate assistance and consultancy services (<strong>Fiat</strong> Gesco S.p.A., Servizio Titoli S.p.A. and KeyG Consulting S.p.A.), public relations services (<strong>Fiat</strong> Information & Communications Services S.c.p.A.), office space services, maintenance and real estate services (Ingest Facility S.p.A. and <strong>Fiat</strong> Partecipazioni S.p.A.), personnel and other management services (<strong>Fiat</strong> Servizi per l’Industria S.c.p.A.), ICT services (eSPIN S.p.A.), security services (Orione S.c.p.A and Sirio S.c.p.A.), sponsorship, advertising and promotional activities (Ferrari S.p.A. and <strong>Fiat</strong> France S.A.) and supervisory and internal audit services (<strong>Fiat</strong> Revisione Interna S.c.r.l.); ■ contributions to expenses for activities supporting the trademark and image of the Group (<strong>Fiat</strong> Auto S.p.A.). Intercompany transactions in <strong>2006</strong> also include the management of investments which entailed the following: ■ collection of dividends from subsidiaries (see Note 1); ■ subscription of capital increases of directly held subsidiaries (see Note 13); ■ acquisition of 60.56% of the capital of Iveco S.p.A. from <strong>Fiat</strong> Netherlands Holding N.V., as reported in Note 13; ■ as part of the corporate restructuring of the consortium companies of the Group, <strong>Fiat</strong> S.p.A., acquisition of the direct control of <strong>Fiat</strong> Revi S.c.p.A. by purchasing the investments previously held by <strong>Fiat</strong> Partecipazioni S.p.A. and <strong>Fiat</strong> Auto S.p.A. In addition, <strong>Fiat</strong> S.p.A. sold its minority interest in <strong>Fiat</strong> Sepin S.c.p.A. to <strong>Fiat</strong> Partecipazioni S.p.A. 292 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements Financial flows from relations with related parties are not presented in a specific table as these also regard almost entirely the transactions with directly or indirectly held subsidiaries discussed earlier. Transactions with related parties as defined by IAS 24 which did not involve directly or indirectly held subsidiaries were as follows: ■ professional and advisory services and services as the secretary of the Board of Directors and of the Committees were provided to <strong>Fiat</strong> S.p.A. by Franzo Grande Stevens for fees of 1,136 thousand euros; ■ directors’ fees of 77 thousand euros and 48 thousand euros were recharged to Istituto Finanziario Industriale S.p.A. and IFIL Investments S.p.A. respectively; ■ Ferrari S.p.A. increased its capital stock in <strong>2006</strong> by issuing a total of 104,000 new shares at a price of 175 euros each, following the exercising by the company’s chairman, Luca Cordero di Montezemolo, of the same number of stock options. Notice of this decision was provided in advance to the Board of <strong>Fiat</strong> S.p.A. at its meeting on 28 February and the options were effectively exercised on 12 May for 88,400 options and on 8 June for the remaining 15,600 options. <strong>Fiat</strong> S.p.A. purchased a total of 93,600 shares from Mr. Montezemolo at a price of 285 euros each, which was the same price as that the one agreed upon between Mediobanca S.p.A. and Mubadala Development Company on the occasion of the recent sale. The total investment amounted to 26,713 thousand euros. 31. Net financial position Pursuant to the Consob Communication of July 28, <strong>2006</strong> and in compliance with the CESR’s recommendations for the consistent implementation of the European Commission’s Regulation on Prospectuses issued on February 10, 2005, the net financial position of <strong>Fiat</strong> S.p.A. at December 31, <strong>2006</strong> is as follows: (in thousands of euros) At 31 December <strong>2006</strong> At 31 December 2005 Change Cash and cash equivalents 608 495 113 Current financial receivables: 84,173 3,075,894 (2,991,721) - from Group companies 84,173 3,075,894 (2,991,721) - from Third parties – – – Non-current financial payables: (2,810,029) (5,262) (2,804,767) - due to Group companies (2,810,029) (5,262) (2,804,767) - due to Third parties – – – Current financial payables: (1,627,430) (557,383) (1,070,047) - due to Group companies (1,405,554) (434) (1,405,120) - due to Third parties (221,876) (556,949) 335,073 Net financial position (4,352,678) 2,513,744 (6,866,422) - due to Group companies (4,131,410) 3,070,198 (7,201,608) - due to Third parties (221,268) (556,454) 335,186 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 293

32. Significant non-recurring transactions Pursuant to the Consob Communication of July 28, <strong>2006</strong>, the only significant non-recurring transaction carried out by <strong>Fiat</strong> S.p.A. in <strong>2006</strong> was the purchase of 28.6% of the shares of Ferrari S.p.A.. The effects of this transaction are discussed in Note 13. 33. Transactions resulting from unusual and/or abnormal operations Pursuant to the Consob Communication of July 28, <strong>2006</strong>, <strong>Fiat</strong> S.p.A. has not taken part in any unusual and/or abnormal operations as defined in that Communication, under which unusual and abnormal transactions are those which because of their significance or importance, the nature of the parties involved, the object of the transaction, the means of determining the transfer price or the timing of the event (close to the year end) may give rise to doubts regarding the accuracy/completeness of the information in the financial statements, conflicts of interest, the safeguarding of an entity’s assets or the protection of minority interests. 34. Subsequent Events As reported in Note 20, following the exercise of 4,676 “<strong>Fiat</strong> Ordinary Share Warrants 2007” (issued on the occasion of the capital increase on December 10, 2001), 1,169 shares (nominal value 5 euros each) were issued on February 1, 2007 at a price of 34,326.51 euros. The subscribed and paid-in capital of <strong>Fiat</strong> S.p.A. consequently increased by 5,845 euros from 6,377,257,292,130 euros to 6,377,262,975 euros. The difference of 28,481.51 euros was allocated to Additional paid-in capital. The remaining warrants have expired and have accordingly been cancelled. Following the contribution of the shares in Magneti Marelli Holding S.p.A. and Teksid S.p.A. by <strong>Fiat</strong> S.p.A., the stockholders of <strong>Fiat</strong> Partecipazioni S.p.A. resolved in an extraordinary meeting on February 9, 2007 in favour of a capital increase of 1,002 million euros (consisting of an increase in capital stock of 50 million euros and additional paid-in capital of 952 million euros), through the issuance of shares to be assigned to the contributing stockholder <strong>Fiat</strong> S.p.A.. The transaction was carried out as part of the programme to streamline and simplify the Group’s corporate structure, in which <strong>Fiat</strong> Partecipazioni S.p.A. is assigned the role of parent company for the principal Italian industrial sectors. 294 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements List of investments in subsidiaries and associated companies with additional information required by Consob (communication no. DEM/6064293 of July 28, <strong>2006</strong>) ■ Subsidiaries Result for the Stockholders’ Capital last fiscal year equity % owned by Accounting value Company and registered office (in euros) (in euros) (in euros) <strong>Fiat</strong> S.p.A. Number of shares (in euros) <strong>Fiat</strong> Partecipazioni S.p.A. – Turin At 12/31/05 3,924,685,869 (862,234,014) 306,158,302 100.00 3,924,685,869 580,792,082 ■ reduction of capital stock through cancellation of shares (3,618,527,567) ■ capital contribution 6,000,000,000 ■ reversal of impairment loss 1,388,000,000 At 12/31/06 306,158,302 942,776,463 7,248,934,765 100.00 306,158,302 7,968,792,082 <strong>Fiat</strong> Netherlands Holding N.V. – Amsterdam (Netherlands) At 12/31/05 4,366,482,748 207,060,528 4,255,797,815 60.56 57,488,376 2,725,682,656 ■ capital contribution 121,125,650 ■ transfer of investment in Iveco S.p.A. to stockholders (647,475,682) ■ reversal of impairment loss 95,536,000 At 12/31/06 2,610,397,295 937,119,160 3,361,946,033 60.56 57,488,376 2,294,868,624 +39.44 ind. Iveco S.p.A. – Turin At 12/31/05 – – – ■ transfer from <strong>Fiat</strong> Netherlands Holding N.V. to stockholders 519,871,290 647,475,682 ■ restoration of carrying amount 945,814,000 At 12/31/06 858,400,000 141,459,227 819,519,720 60.56 519,871,290 1,593,289,682 +39.44 ind. Ferrari S.p.A. – Modena At 12/31/05 20,000,000 52,962,628 218,805,827 56.00 4,480,000 160,675,480 ■ purchases 2,413,600 896,012,409 ■ sale (5,200) (1,484,066) At 12/31/06 20,260,000 94,470,228 331,476,056 85.00 6,888,400 1,055,203,823 Magneti Marelli Holding S.p.A. – Corbetta At 12/31/05 254,324,998 (64,320,893) 548,153,279 99.99 254,301,607 811,153,400 Ordinary shares At 12/31/05 100.00 250,500,601 799,002,413 At 12/31/06 100.00 250,500,601 799,002,413 Preference shares At 12/31/05 99.39 3,801,006 12,150,987 At 12/31/06 99.39 3,801,006 12,150,987 At 12/31/06 254,324,998 (42,698,723) 505,454,556 99.99 254,301,607 811,153,400 Teksid S.p.A. – Turin At 12/31/05 145,817,739 (43,497,815) 102,319,924 84.79 123,640,010 75,851,000 At 12/31/06 145,817,739 (30,916,663) 71,403,261 84.79 123,640,010 75,851,000 Comau S.p.A. – Grugliasco At 12/31/05 140,000,000 (55,231,582) 156,954,825 100.00 140,000,000 140,613,200 ■ reduction of capital stock (85,516,556) ■ capital stock increase 45,516,556 ■ capital contribution 240,000,000 ■ impairment loss (330,000,000) At 12/31/06 100,000,000 (348,940,866) 48,013,959 100.00 100,000,000 50,613,200 Business Solutions S.p.A. – Turin At 12/31/05 10,000,000 (31,547,213) 4,791,396 100.00 10,000,000 36,304,200 At 12/31/06 4,791,396 18,086,645 22,878,041 100.00 10,000,000 36,304,200 Itedi - Italiana Edizioni S.p.A. – Turin At 12/31/05 5,980,000 1,919,935 40,354,885 100.00 5,980,000 25,899,105 At 12/31/06 5,980,000 8,694,788 37,049,673 100.00 5,980,000 25,899,105 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 295

- Page 1 and 2:

Annual Report Consolidated and Stat

- Page 3 and 4:

But it does move. Galileo Galilei

- Page 5 and 6:

Letter from the Chairman and the Ch

- Page 7 and 8:

The Fiat Group The Fiat Group perfo

- Page 9 and 10:

Stockholders Financial communicatio

- Page 11 and 12:

in 2003, and now the Panda Hydrogen

- Page 13 and 14:

The meeting with the EWC Selected C

- Page 15 and 16:

Revenues by Business Area (in milli

- Page 17 and 18:

The breakdown of trading profit by

- Page 19 and 20:

Investment income was 156 million e

- Page 21 and 22:

If working capital is restated to i

- Page 23 and 24:

Financial Services Revenues (in mil

- Page 25 and 26:

Statement of Changes in Net Industr

- Page 27 and 28:

strategic consistency, economic fea

- Page 29 and 30:

The Board of Directors, at its meet

- Page 31 and 32:

There can be no motion without some

- Page 33 and 34:

Fiat Auto - Fiat, Alfa Romeo, Lanci

- Page 35 and 36:

Maserati Operating Performance In 2

- Page 37 and 38:

Trucks and Commercial Vehicles Ivec

- Page 39 and 40:

Fiat Powertrain Technologies Operat

- Page 41 and 42:

Metallurgical Products - Teksid Pro

- Page 43 and 44:

Motion for Approval of the Financia

- Page 45 and 46:

Consolidated Income Statement (*) (

- Page 47 and 48:

Statement of Changes in Stockholder

- Page 49 and 50:

partially from the market: the rema

- Page 51 and 52:

Measurement Investments in unconsol

- Page 53 and 54:

charges for risk provisions and wri

- Page 55 and 56:

Union market for the Fiat Auto and

- Page 57 and 58:

Composition and principal changes I

- Page 59 and 60:

Net financial expenses in 2006 (exc

- Page 61 and 62:

Year of expiry Total at December Be

- Page 63 and 64:

The net carrying amount of Intangib

- Page 65 and 66:

14. Property, plant and equipment I

- Page 67 and 68:

In 2005 Changes in accumulated depr

- Page 69 and 70:

esulting in a reduction of 1,213 mi

- Page 71 and 72:

Receivables from financing activiti

- Page 73 and 74:

(the residual debt of the Exchangea

- Page 75 and 76:

The reconciliation of the number of

- Page 77 and 78:

A summary of outstanding stock opti

- Page 79 and 80:

Under the CNH EIP, performance-base

- Page 81 and 82:

26. Provisions for employee benefit

- Page 83 and 84:

Changes in the present value of Pos

- Page 85 and 86:

■ Commercial risks - This provisi

- Page 87 and 88:

31, 2006 (872 million euros at Dece

- Page 89 and 90:

Fidis Retail Italia (FRI) All the r

- Page 91 and 92:

Other and Magneti Business elimina-

- Page 93 and 94:

Credit risk The maximum credit risk

- Page 95 and 96:

The increase over the prior year re

- Page 97 and 98: ■ Current trade receivables of 78

- Page 99 and 100: The book value at the disposal date

- Page 101 and 102: 198 Appendix The Companies of the F

- Page 103 and 104: Subsidiaries consolidated on a line

- Page 105 and 106: Subsidiaries consolidated on a line

- Page 107 and 108: Subsidiaries consolidated on a line

- Page 109 and 110: Subsidiaries consolidated on a line

- Page 111 and 112: % of Group % of consoli- Interest %

- Page 113 and 114: Subsidiaries accounted for using th

- Page 115 and 116: % of Group % of consoli- Interest %

- Page 117 and 118: % of Group % of consoli- Interest %

- Page 119 and 120: 234 Financial Review of Fiat S.p.A.

- Page 121 and 122: (*) (*) Income Statement Balance Sh

- Page 123 and 124: Income Statement pursuant to Consob

- Page 125 and 126: When an impairment loss on assets s

- Page 127 and 128: Provisions The company recognises p

- Page 129 and 130: 4. Other operating income Other ope

- Page 131 and 132: Net income from derivative financia

- Page 133 and 134: 12. Property, plant and equipment T

- Page 135 and 136: 15. Other non-current assets At Dec

- Page 137 and 138: Regarding changes in 2005, the Mand

- Page 139 and 140: A summary of outstanding stock opti

- Page 141 and 142: The amounts recognised in the Incom

- Page 143 and 144: The item Payables to Group companie

- Page 145 and 146: These relate to: ■ guarantees of

- Page 147: Counterparty Other Current Other No

- Page 151 and 152: Fees paid to Members of the Board o

- Page 153 and 154: Financial statement format Fiat S.p

- Page 155 and 156: Deferred tax assets Reclassificatio

- Page 157 and 158: Reconciliation of net profit (loss)

- Page 159 and 160: B. Employee benefits The employees

- Page 161 and 162: Auditors’ Reports Auditors’ Rep

- Page 163 and 164: Reports of the Board of Statutory A

- Page 165 and 166: that numerous transactions involvin

- Page 167 and 168: Motion for Approval of the Financia

- Page 169 and 170: Motion to amend Articles 9, 11, 12,

- Page 171 and 172: Stockholders Meeting and will be ef

- Page 173 and 174: Graphic design Atelier Roger Pfund,