2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Trucks and Commercial Vehicles<br />

Iveco<br />

Operating Performance<br />

Since January 1, <strong>2006</strong>, Iveco powertrain activities have been<br />

included in the <strong>Fiat</strong> Powertrain Technologies Sector. As<br />

envisaged in IAS 14 – Segment <strong>Report</strong>ing, the figures for<br />

2005 have consequently been reclassified by excluding the<br />

powertrain activities from Iveco and allocating them to FPT.<br />

In <strong>2006</strong>, demand for commercial vehicles in Western Europe<br />

(GVW > 2.8 tons) totalled 1,132,300 units, up 2.3% from 2005.<br />

On the principal markets, demand rose in France (+3.6%) and<br />

Germany (+3.2%), while contracting slightly in Italy (-1.9%),<br />

Great Britain (-1.1%), and Spain (-0.2%).<br />

The light-vehicle segment (GVW of between 2.8 and 6 tons)<br />

grew by 1.8% from 2005. Among the main countries, a market<br />

increase was reported in France (+6.4%), while in Great Britain<br />

the market remained stable with virtually the same volumes as<br />

2005, and it contracted in Italy (-2.8%), Germany (-0.6%), and<br />

Spain (-1.2%).<br />

Demand for medium-vehicles (GVW of between 6.1 and 15.9<br />

tons) was also up (+1.9%) from 2005. This improvement was<br />

influenced principally by the German market (+7.4%) and<br />

Spanish market (+2.3%). Demand fell on the British (-8.2%),<br />

Italian (-3.4%), and French (-2.3%) markets.<br />

Demand for heavy-vehicles (GVW >16 tons) rose by 3.7%<br />

from the previous year. The greatest increase was reported<br />

in Germany (+11.9%); modest growth was reported in Spain<br />

(+1.9%) and Italy (+1.5%), while demand fell in France (-3.9%)<br />

and Great Britain (-2.7%).<br />

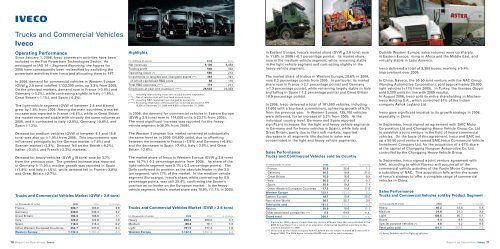

Trucks and Commercial Vehicles Market (GVW ≥ 2.8 tons)<br />

(in thousands of units) <strong>2006</strong> 2005 % change<br />

France 200.7 193.8 3.6<br />

Germany 246.0 238.3 3.2<br />

Great Britain 194.4 196.6 -1.1<br />

Italy 120.2 122.6 -1.9<br />

Spain 118.3 118.4 -0.2<br />

Other Western European Countries 252.7 237.6 6.4<br />

Western Europe 1,132.3 1,107.3 2.3<br />

70 <strong>Report</strong> on Operations Iveco<br />

Highlights<br />

(in millions of euros) <strong>2006</strong> 2005<br />

Net revenues 9,136 8,483<br />

Trading profit 546 332<br />

Operating result (*) 565 212<br />

Investments in tangible and intangible assets (**) 342 321<br />

- of which capitalised R&D costs 88 115<br />

Total R&D expenses (***) 174 211<br />

Employees at year-end (number) (****) 24,533 24,323<br />

(*) Including restructuring costs and unusual income (expenses).<br />

(**) Net of vehicles sold with buy-back commitments.<br />

(***) Including R&D capitalised and charged to operations.<br />

(****) Excluding employees of the powertrain activities conveyed in FPT<br />

(8,256 at December 31, <strong>2006</strong> and 8,050 at December 31, 2005).<br />

In <strong>2006</strong>, the demand for commercial vehicles in Eastern Europe<br />

(GVW > 2.8 tons) rose to 114,000 units (+23.7% from 2005).<br />

The most significant increase was reported for the heavyvehicle<br />

segment (+36.3% from 2005).<br />

The Western European bus market remained at substantially<br />

the same level as in 2005 (34,600 units), due to offsetting<br />

between the increases in France (+7.5%) and Germany (+6.9%)<br />

and the decreases in Spain (-7.4%), Italy (-3.9%), and Great<br />

Britain (-2.6%).<br />

The market share of Iveco in Western Europe (GVW > 2.8 tons)<br />

was 10.7% (-0.2 percentage points from 2005). Its share of the<br />

light-vehicle segment was 9.1% (-0.2 percentage points). The<br />

Daily confirmed its position as the absolute leader in the 3.5<br />

ton segment, with 17% of the market. In the medium-vehicle<br />

segment (Eurocargo), Iveco’s share, while contracting by 0.9<br />

percentage points, was still 25.4%, confirming the Sector’s<br />

position as co-leader on the European market. In the heavyvehicle<br />

segment, Iveco’s market share was 10.9% (11.1% in 2005).<br />

Trucks and Commercial Vehicles Market (GVW ≥ 2.8 tons)<br />

(in thousands of units) <strong>2006</strong> 2005 % change<br />

Heavy 260.2 250.8 3.7<br />

Medium 80.6 79.1 1.9<br />

Light 791.5 777.4 1.8<br />

Western Europe 1,132.3 1,107.3 2.3<br />

In Eastern Europe, Iveco’s market share (GVW > 2.8 tons) rose<br />

to 11.8% in <strong>2006</strong> (+0.1 percentage points). Its market share<br />

rose in the medium-vehicle segment, while remaining stable<br />

in the light-vehicle segment and contracting slightly in the<br />

heavy-vehicle segment.<br />

The market share of Irisbus in Western Europe, 20.6% in <strong>2006</strong>,<br />

rose 0.3 percentage points from 2005. In particular, its market<br />

share rose in France (+2.7 percentage points) and Germany<br />

(+1.3 percentage points), while remaining largely stable in Italy<br />

and falling in Spain (-1.2 percentage points) and Great Britain<br />

(-0.9 percentage points).<br />

In <strong>2006</strong>, Iveco delivered a total of 181,500 vehicles, including<br />

17,600 with a buy-back commitment, achieving growth of 5.2%<br />

from the previous year. In Western Europe, 135,100 vehicles<br />

were delivered, for an increase of 3.2% from 2005. At the<br />

individual country level, Germany and Spain reported<br />

significant increases (for the light and heavy vehicle segments<br />

in Germany and for heavy vehicles in Spain), while Italy and<br />

Great Britain, partly due to their soft markets, reported<br />

decreases in all segments (the decline in sales was<br />

concentrated in the light and heavy vehicle segments).<br />

Sales Performance<br />

Trucks and Commercial Vehicles sold by Country<br />

(in thousands of units) <strong>2006</strong> 2005 (*) % change<br />

- France 25.9 25.6 1.1<br />

- Germany 20.3 16.8 21.0<br />

- Great Britain 15.0 16.6 -9.9<br />

- Italy 36.0 37.9 -5.1<br />

- Spain 20.6 19.3 7.1<br />

- Other Western European Countries 17.3 14.8 17.5<br />

Western Europe 135.1 131.0 3.2<br />

Eastern Europe 19.7 15.8 25.0<br />

Rest of the World 26.7 25.7 3.5<br />

Total units sold 181.5 172.5 5.2<br />

Naveco 20.0 18.0 11.1<br />

Other associated companies (**) 5.2 64.8 n.s.<br />

Grand total 206.7 255.3 n.s.<br />

(*) Figures for 2005 present a break-down by country different from the one published in the<br />

2005 <strong>Annual</strong> <strong>Report</strong> as a result of an allocation of deliveries modified according to the<br />

criterion adopted for <strong>2006</strong>.<br />

(**) Units sold by the Indian company Ashok Leyland are no longer included as it was sold in<br />

August <strong>2006</strong>. The 2005 figure included 59,600 units sold by said company.<br />

Outside Western Europe, sales volumes were up sharply<br />

in Eastern Europe, rising in Africa and the Middle East, and<br />

virtually stable in Latin America.<br />

Iveco delivered a total of 9,300 buses, marking a 9.4%<br />

improvement over 2005.<br />

In China, Naveco, the 50-50 joint venture with the NAC Group<br />

(Nanjing Automotive Corporation), sold approximately 20,000<br />

light vehicles (+11% from 2005). In Turkey, the licensee Otoyol<br />

sold 5,200 units (in line with 2005 results).<br />

In August <strong>2006</strong>, Iveco sold its entire shareholding in Machen-<br />

Iveco Holding S.A., which controlled 51% of the Indian<br />

company Ashok Leyland Ltd.<br />

Iveco gave significant impetus to its growth strategy in <strong>2006</strong>,<br />

especially in China.<br />

In September, Iveco signed an agreement with SAIC Motor<br />

Corporation Ltd and Chongqing Heavy Vehicle Group Co. Ltd<br />

to establish a joint venture in the field of heavy commercial<br />

vehicles. On the basis of this agreement, Iveco and SAIC set<br />

up a 50-50 joint venture named SAIC Iveco Commercial Vehicle<br />

Investment Company Ltd, for the acquisition of a 67% share<br />

of the capital of Chongqing Hongyan Automotive Co. Ltd,<br />

controlled by the Chongqing Heavy Vehicle Group.<br />

In September, Iveco signed a joint venture agreement with<br />

NAC, according to which Naveco will acquire all of the<br />

commercial vehicle activities of the Yuejin Motor Company,<br />

a subsidiary of NAC. This acquisition falls within the scope<br />

of Iveco’s strategy to offer a complete range of commercial<br />

vehicles in China.<br />

Sales Performance<br />

Trucks and Commercial Vehicles sold by Product Segment<br />

(in thousands of units) <strong>2006</strong> 2005 % change<br />

Heavy 45.2 42.8 5.6<br />

Medium 21.8 21.3 2.3<br />

Light 100.6 95.7 5.1<br />

Buses 9.3 8.5 9.4<br />

Special purpose vehicles (*) 4.6 4.2 9.5<br />

Total units sold 181.5 172.5 5.2<br />

(*) Astra, Defence and Fire-fighting vehicles.<br />

<strong>Report</strong> on Operations Iveco 71