2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

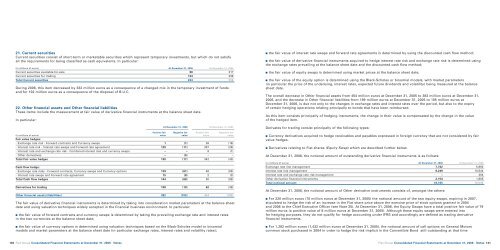

21. Current securities<br />

Current securities consist of short-term or marketable securities which represent temporary investments, but which do not satisfy<br />

all the requirements for being classified as cash equivalents. In particular:<br />

(in millions of euros) At December 31, <strong>2006</strong> At December 31, 2005<br />

Current securities available-for-sale 90 317<br />

Current securities for trading 134 239<br />

Total Current securities 224 556<br />

During <strong>2006</strong>, this item decreased by 332 million euros as a consequence of a changed mix in the temporary investment of funds<br />

and for 102 million euros as a consequence of the disposal of B.U.C.<br />

22. Other financial assets and Other financial liabilities<br />

These items include the measurement at fair value of derivative financial instruments at the balance sheet date.<br />

In particular:<br />

At December 31, <strong>2006</strong> At December 31, 2005<br />

Positive fair Negative fair Positive fair Negative fair<br />

(in millions of euros) value value value value<br />

Fair value hedges:<br />

- Exchange rate risk - Forward contracts and Currency swaps 1 (1) 26 (16)<br />

- Interest rate risk - Interest rate swaps and Forward rate agreement 129 (11) 307 (26)<br />

- Interest rate and exchange rate risk - Combined interest rate and currency swaps – – 9 (1)<br />

- Other derivatives – (5) – –<br />

Total Fair value hedges 130 (17) 342 (43)<br />

Cash flow hedge:<br />

- Exchange rate risks - Forward contracts, Currency swaps and Currency options 129 (61) 48 (95)<br />

- Interest rate swaps and Forward rate agreement 15 (8) 2 (3)<br />

Total Cash flow hedges 144 (69) 50 (98)<br />

Derivatives for trading 108 (19) 62 (48)<br />

Other financial assets/(liabilities) 382 (105) 454 (189)<br />

The fair value of derivative financial instruments is determined by taking into consideration market parameters at the balance sheet<br />

date and using valuation techniques widely accepted in the financial business environment. In particular:<br />

■ the fair value of forward contracts and currency swaps is determined by taking the prevailing exchange rate and interest rates<br />

in the two currencies at the balance sheet date;<br />

■ the fair value of currency options is determined using valuation techniques based on the Black-Scholes model or binomial<br />

models and market parameters at the balance sheet date (in particular exchange rates, interest rates and volatility rates);<br />

140<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes<br />

■ the fair value of interest rate swaps and forward rate agreements is determined by using the discounted cash flow method;<br />

■ the fair value of derivative financial instruments acquired to hedge interest rate risk and exchange rate risk is determined using<br />

the exchange rates prevailing at the balance sheet date and the discounted cash flow method;<br />

■ the fair value of equity swaps is determined using market prices at the balance sheet date;<br />

■ the fair value of the equity option is determined using the Black-Scholes or binomial models, with market parameters<br />

(in particular the price of the underlying, interest rates, expected future dividends and volatility) being measured at the balance<br />

sheet date.<br />

The overall decrease in Other financial assets from 454 million euros at December 31, 2005 to 382 million euros at December 31,<br />

<strong>2006</strong>, and the decrease in Other financial liabilities from 189 million euros at December 31, 2005 to 105 million euros at<br />

December 31, <strong>2006</strong>, is due not only to the changes in exchange rates and interest rates over the period, but also to the expiry<br />

of certain hedging operations relating principally to bonds that have been reimbursed.<br />

As this item consists principally of hedging instruments, the change in their value is compensated by the change in the value<br />

of the hedged item.<br />

Derivates for trading consist principally of the following types:<br />

■ Currency derivatives acquired to hedge receivables and payables expressed in foreign currency that are not considered by fair<br />

value hedges.<br />

■ Derivatives relating to <strong>Fiat</strong> shares (Equity Swap) which are described further below.<br />

At December 31, <strong>2006</strong>, the notional amount of outstanding derivative financial instruments is as follows:<br />

(in millions of euros) At December 31, <strong>2006</strong> At December 31, 2005<br />

Exchange rate risk management 7,702 5,992<br />

Interest rate risk management 8,249 10,544<br />

Interest rate and exchange rate risk management – 204<br />

Other derivative financial instruments 2,154 1,805<br />

Total notional amount 18,105 18,545<br />

At December 31, <strong>2006</strong>, the notional amount of Other derivative instruments consists of, amongst the others:<br />

■ For 220 million euros (70 million euros at December 31, 2005) the notional amount of the two equity swaps, expiring in 2007,<br />

stipulated to hedge the risk of an increase in the <strong>Fiat</strong> share price above the exercise price of stock options granted in 2004<br />

and <strong>2006</strong> to the Chief Executive Officer (see Note 25). At December 31, <strong>2006</strong>, the Equity Swaps have a total positive fair value of 79<br />

million euros (a positive value of 8 million euros at December 31, 2005). Although these equity swaps were entered into<br />

for hedging purposes, they do not qualify for hedge accounting under IFRS and accordingly are defined as trading derivative<br />

financial instruments.<br />

■ For 1,282 million euros (1,432 million euros at December 31, 2005), the notional amount of call options on General Motors<br />

common stock purchased in 2004 in order to hedge the risk implicit in the Convertible Bond still outstanding at that time<br />

<strong>Fiat</strong> Group Consolidated Financial Statements at December 31, <strong>2006</strong> - Notes 141