2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Changes that occurred in <strong>2006</strong> may be summarised as follows:<br />

■ In May <strong>2006</strong>, in order to re-balance the equity structure inside the Group, the capital stock of the subsidiaries <strong>Fiat</strong> Partecipazioni<br />

S.p.A and <strong>Fiat</strong> Netherlands Holding N.V. was increased by 6,000,000 thousand euros and 121,126 thousand euros respectively.<br />

■ In May <strong>2006</strong>, Ferrari S.p.A. increased its capital stock through the issuance of 104,000 new shares servicing its stock option plans.<br />

<strong>Fiat</strong> S.p.A. subsequently acquired 93,600 newly-issued shares of Ferrari S.p.A. for 26,713 thousand euros and sold 5,200 shares for<br />

1,484 thousand euros, the latter as part of its agreements with Mubadala Development Company PJSC, bringing its interest therein<br />

to 56.4%.<br />

■ At the end of September <strong>2006</strong>, <strong>Fiat</strong> S.p.A. exercised its call option and repurchased 28.6% of the capital stock of Ferrari S.p.A. from<br />

Mediobanca S.p.A. (and the other members of the syndicate), increasing its interest therein from 56.4% to 85%. The call option was<br />

part of the agreements signed with Mediobanca S.p.A. in connection with the sale in 2002 aimed at listing the Ferrari S.p.A. shares.<br />

The above transaction led to an increase in the carrying amount of the investment equal to the purchase price of 892,555 thousand<br />

euros, including related charges, net of the release of the provision of 23,256 thousand euros accrued in previous years against the<br />

company’s obligation to Mediobanca S.p.A. which was subject to the latter’s execution of the listing of Ferrari S.p.A. shares (see<br />

Note 24). The remaining rights agreed with Mediobanca S.p.A. have now ceased. <strong>Fiat</strong> has a call option exercisable from January 1,<br />

2008 to July 31, 2008 on a further 5% of the Ferrari shares held by Mubadala Development Company at a pre-determined price of<br />

303 euros per share (for a total of 122,776 thousand euros) less any dividend that may be distributed.<br />

■ In December <strong>2006</strong>, <strong>Fiat</strong> Netherlands Holding N.V. decreased its capital stock and transferred its 100% investment in Iveco S.p.A.<br />

to its stockholders (<strong>Fiat</strong> S.p.A. and <strong>Fiat</strong> Partecipazioni S.p.A.) on the basis of their ownership percentage. <strong>Fiat</strong> S.p.A. thus obtained<br />

519,871,290 Iveco S.p.A. shares, equal to 60.56% of the capital stock, at the same value as the previous carrying amount in the<br />

financial statements of <strong>Fiat</strong> Netherlands Holding N.V. (approximately 1.245 euros per share). At the same time it decreased its<br />

investment in <strong>Fiat</strong> Netherlands Holding N.V. by the same amount (647,476 thousand euros). Since the transaction involved directly<br />

and indirectly wholly owned subsidiaries of <strong>Fiat</strong> S.p.A., carrying amounts were left unchanged throughout the operation. As a<br />

result, the accumulated impairment losses recognised by <strong>Fiat</strong> S.p.A. in previous years due to the impairment losses related to<br />

Iveco S.p.A. have not been adjusted.<br />

Impairment losses and the reversals of impairment losses arise from the application of the cost method (see Note 2).<br />

A full list of investments with the additional disclosures required by Consob in its communication no. DEM/6064293 of July 28,<br />

<strong>2006</strong> is attached.<br />

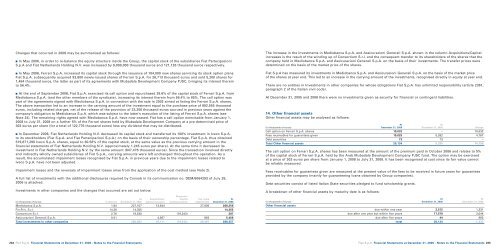

Investments in other companies and the changes that occurred are set out below:<br />

Disposals/<br />

At Acquisitions/ Capital Fair value At<br />

(in thousands of euros) % interest December 31, 2005 Capital increases reimbursements adjustments December 31, <strong>2006</strong><br />

Mediobanca S.p.A. 1.84 227,107 13,544 27,605 268,256<br />

Fin.Priv. S.r.l. 14.28 14,355 14,355<br />

Consortium S.r.l. 2.76 19,530 (19,243) 287<br />

Assicurazioni Generali S.p.A. 0.01 4,567 892 5,459<br />

Total investments in other companies 260,992 18,111 (19,243) 28,497 288,357<br />

264 <strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements<br />

The increase in the investments in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. shown in the column Acquisitions/Capital<br />

increases is the result of the winding up of Consortium S.r.l. and the consequent transfer to its shareholders of the shares that the<br />

company held in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. on the basis of their investments. The transfer prices were<br />

determined on the basis of the market price of the shares.<br />

<strong>Fiat</strong> S.p.A has measured its investments in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. on the basis of the market price<br />

of the shares at year end. This led to an increase in the carrying amount of the investments, recognised directly in equity at year end.<br />

There are no entities in Investments in other companies for whose obligations <strong>Fiat</strong> S.p.A. has unlimited responsibility (article 2361,<br />

paragraph 2 of the Italian civil code).<br />

At December 31, 2005 and <strong>2006</strong> there were no investments given as security for financial or contingent liabilities.<br />

14. Other financial assets<br />

Other financial assets may be analysed as follows:<br />

At At<br />

(in thousands of euros) December 31, <strong>2006</strong> December 31, 2005 Change<br />

Call option on Ferrari S.p.A. shares 10,032 – 10,032<br />

Fees receivables for guarantees given 10,029 5,262 4,767<br />

Debt securities 73 73 –<br />

Total Other financial assets 20,134 5,335 14,799<br />

The call option on Ferrari S.p.A. shares has been measured at the amount of the premium paid in October <strong>2006</strong> and relates to 5%<br />

of the capital stock of Ferrari S.p.A. held by the Arab Mubadala Development Company PJSC fund. The option may be exercised<br />

at a price of 303 euros per share from January 1, 2008 to July 31, 2008. It has been recognised at cost since its fair value cannot<br />

be reliably measured.<br />

Fees receivables for guarantees given are measured at the present value of the fees to be received in future years for guarantees<br />

provided by the company (mainly for guaranteeing loans obtained by Group companies).<br />

Debt securities consist of listed Italian State securities pledged to fund scholarship grants.<br />

A breakdown of other financial assets by maturity date is as follows:<br />

At At<br />

(in thousands of euros) December 31, <strong>2006</strong> December 31, 2005<br />

Other financial assets<br />

due within one year 2,512 1,331<br />

due after one year but within five years 17,578 3,044<br />

due after five years 44 960<br />

total 20,134 5,335<br />

<strong>Fiat</strong> S.p.A. Financial Statements at December 31, <strong>2006</strong> - Notes to the Financial Statements 265