2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

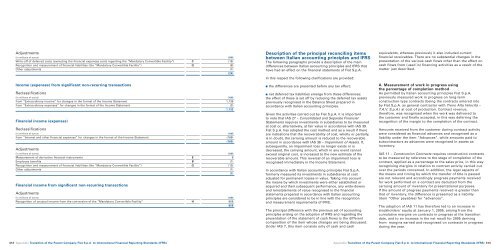

Adjustments<br />

(in millions of euros) 2005<br />

Write-off of deferred costs (excluding the financial expenses costs regarding the “Mandatory Convertible Facility”) C (15)<br />

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G (8)<br />

Other adjustments (1)<br />

(24)<br />

Income (expenses) from significant non-recurring transactions<br />

Reclassifications<br />

(in millions of euros) 2005<br />

from “Extraordinary income” for changes in the format of the Income Statement 1,135<br />

from “Extraordinary expenses” for changes in the format of the Income Statement (2)<br />

1,133<br />

Financial income (expenses)<br />

Reclassifications<br />

(in millions of euros) 2005<br />

from “Interest and other financial expenses” for changes in the format of the Income Statement (169)<br />

(169)<br />

Adjustments<br />

(in millions of euros) 2005<br />

Measurement of derivative financial instruments E 8<br />

Employee benefits B (1)<br />

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G (13)<br />

Other adjustments (1)<br />

(7)<br />

Financial income from significant non-recurring transactions<br />

Adjustments<br />

(in millions of euros) 2005<br />

Recognition of unusual income from the conversion of the “Mandatory Convertible Facility” H 858<br />

858<br />

312 Appendix Transition of the Parent Company <strong>Fiat</strong> S.p.A. to International Financial <strong>Report</strong>ing Standards (IFRS)<br />

Description of the principal reconciling items<br />

between Italian accounting principles and IFRS<br />

The following paragraphs provide a description of the main<br />

differences between Italian accounting principles and IFRS that<br />

have had an effect on the financial statements of <strong>Fiat</strong> S.p.A.<br />

In this respect the following clarifications are provided:<br />

■ the differences are presented before any tax effect;<br />

■ net deferred tax liabilities emerge from these differences;<br />

the effect of these is set off by reducing the deferred tax assets<br />

previously recognised in the Balance Sheet prepared in<br />

accordance with Italian accounting principles.<br />

Given the activities carried out by <strong>Fiat</strong> S.p.A. it is important<br />

to note that IAS 27 – Consolidated and Separate Financial<br />

Statements requires investments in subsidiaries to be measured<br />

at cost or, alternatively, at fair value in accordance with IAS 39.<br />

<strong>Fiat</strong> S.p.A. has adopted the cost method and as a result if there<br />

are indications that the recoverability of cost, wholly or partially,<br />

is in doubt, the carrying amount is reduced to the recoverable<br />

amount in accordance with IAS 36 – Impairment of Assets. If,<br />

subsequently, an impairment loss no longer exists or is<br />

decreased, the carrying amount, which in any event cannot<br />

exceed original cost, is increased to the new estimate of the<br />

recoverable amount. This reversal of an impairment loss is<br />

recognised immediately in the Income Statement.<br />

In accordance with Italian accounting principles <strong>Fiat</strong> S.p.A.<br />

formerly measured its investments in subsidiaries at cost<br />

adjusted for permanent losses in value. Taking into account<br />

the means by which investments were either established or<br />

acquired and their subsequent performance, any write-downs<br />

and reinstatements of value recognised in the financial<br />

statements prepared in accordance with Italian accounting<br />

principles are considered to be in line with the recognition<br />

and measurement requirements of IFRS.<br />

The principal difference with the previous set of accounting<br />

principles arising on the adoption of IFRS and regarding the<br />

presentation of the statement of cash flows is the different<br />

composition of the item whose changes are being discussed.<br />

Under IAS 7, this item consists only of cash and cash<br />

equivalents, whereas previously it also included current<br />

financial receivables. There are no substantial changes in the<br />

presentation of the various cash flows other than the effect on<br />

cash flows from (used in) financing activities as a result of the<br />

matter just described.<br />

A. Measurement of work in progress using<br />

the percentage of completion method<br />

As permitted by Italian accounting principles <strong>Fiat</strong> S.p.A.<br />

previously measured work in progress on long-term<br />

construction-type contracts (being the contracts entered into<br />

by <strong>Fiat</strong> S.p.A. as general contractor with Treno Alta Velocità –<br />

T.A.V. S.p.A.) at cost of production. Contract revenue,<br />

therefore, was recognised when the work was delivered to<br />

the customer and finally accepted, in this way deferring the<br />

recognition of the margin to the completion of the contract.<br />

Amounts received from the customer during contract activity<br />

were considered as financial advances and recognised as a<br />

liability under the item “Advances”, while amounts paid to<br />

subcontractors as advances were recognised in assets as<br />

inventory.<br />

IAS 11 – Construction Contracts requires construction contracts<br />

to be measured by reference to the stage of completion of the<br />

contract, applied as a percentage to the sales price, in this way<br />

recognising margins in relation to contract activity carried out<br />

over the periods concerned. In addition, the legal aspects of<br />

the means and timing by which the transfer of title is passed<br />

are not relevant and accordingly progress payments received<br />

for work performed on a contract are deducted from the<br />

carrying amount of inventory for presentational purposes.<br />

If the amount of progress payments received is greater than<br />

that of inventory, the difference is presented as a liability<br />

(item “Other payables) for “advances”.<br />

The adoption of IAS 11 has therefore led to an increase in<br />

stockholders’ equity at January 1, 2005, arising from the<br />

cumulative margins on contracts in progress at the transition<br />

date, and to an increase in the net result for 2005 deriving<br />

from margins earned and recognised on contracts in progress<br />

during the year.<br />

Appendix Transition of the Parent Company <strong>Fiat</strong> S.p.A. to International Financial <strong>Report</strong>ing Standards (IFRS) 313