2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

2006 Annual Report - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Board of Directors, at its meeting of November 3 <strong>2006</strong>,<br />

approved an incentive plan that will be submitted, pursuant<br />

to Article 114 bis of the Consolidated Law on Financial<br />

Intermediation, to the Stockholders’ Meeting that will be called<br />

to approve the <strong>2006</strong> Financial Statements. The plan will have a<br />

duration of eight years and envisages the granting of options<br />

for the purchase of 20 million <strong>Fiat</strong> ordinary shares at a strike<br />

price of 13.37 euros, equal to the arithmetical average of the<br />

official prices posted on the Borsa Italiana S.p.A.’s market in<br />

the thirty days preceding the Board resolution. Grantees of the<br />

plan are the Chief Executive Officer of <strong>Fiat</strong> S.p.A. Sergio<br />

Marchionne, for 10 million options corresponding to an equal<br />

number of outstanding ordinary shares, and for an additional<br />

10 million options, corresponding to an equal number of<br />

newly-issued shares, more than 300 executives who have a<br />

significant impact on business results. The options granted<br />

to employees and 50% of the options granted to Sergio<br />

Marchionne have a four-year vesting period, in equal annual<br />

quotas, predicated on the achievement of predetermined<br />

54 <strong>Report</strong> on Operations Stock Options Plans<br />

financial targets in the reference period and are exercisable<br />

starting from the approval of the 2010 Financial Statements.<br />

The residual 50% of the options granted to the Chief Executive<br />

Officer of <strong>Fiat</strong> S.p.A., which also has a four-year vesting period<br />

in equal annual quotas, is exercisable starting November 2010.<br />

The Board therefore exercised the powers granted to it<br />

pursuant to Article 2443 of the Italian Civil Code for the capital<br />

increase to service the incentive plan. The capital increase is<br />

reserved to employees of the Company and/or its subsidiaries,<br />

within a limit of 1% of the capital stock, i.e. for a maximum of<br />

50,000,000 (fifty million) euros through the issue of a<br />

maximum of 10,000,000 (ten million) ordinary shares with a<br />

par value of 5 (five) euros each, corresponding to 0.78% of the<br />

capital stock and 0.92% of the ordinary capital, at the<br />

abovementioned price of 13.37 euros. Execution of this capital<br />

increase is subject to the approval by the Stockholders Meeting<br />

of the incentive plan and is dependant on the conditions of the<br />

plan being satisfied.<br />

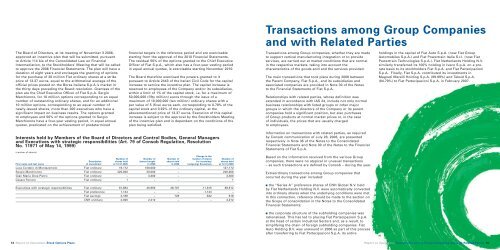

Interests held by Members of the Board of Directors and Control Bodies, General Managers<br />

and Executives with strategic responsibilities (Art. 79 of Consob Regulation, Resolution<br />

No. 11971 of May 14, 1999)<br />

(number of shares)<br />

Change in the<br />

Number of Number of Number of number of shares Number of<br />

Description shares held shares bought shares sold for incoming/ shares held<br />

First name and last name of investment at 12.31.2005 in <strong>2006</strong> in <strong>2006</strong> (outgoing) Executives at 12.31.<strong>2006</strong><br />

Luca Cordero di Montezemolo <strong>Fiat</strong> ordinary 19,172 108,000 – 127,172<br />

Sergio Marchionne <strong>Fiat</strong> ordinary 220,000 20,000 – 240,000<br />

Gian Maria Gros-Pietro <strong>Fiat</strong> ordinary – 3,300 – 3,300<br />

Cesare Ferrero <strong>Fiat</strong> ordinary 1 – – 1<br />

Executives with strategic responsibilities <strong>Fiat</strong> ordinary 81,884 45,950 46,707 -11,615 69,512<br />

<strong>Fiat</strong> preference 1,144 – – -1,144 –<br />

<strong>Fiat</strong> savings 2,188 – 728 -842 618<br />

CNH ordinary 2,000 2,212 – – 4,212<br />

Transactions among Group Companies<br />

and with Related Parties<br />

Transactions among Group companies, whether they are made<br />

to support vertical manufacturing integration or to provide<br />

services, are carried out at market conditions that are normal<br />

in the respective markets, taking into account the<br />

characteristics of the goods sold and the services provided.<br />

The main transactions that took place during <strong>2006</strong> between<br />

the Parent Company, <strong>Fiat</strong> S.p.A., and its subsidiaries and<br />

associated companies are provided in Note 30 of the Notes<br />

to the Financial Statements of <strong>Fiat</strong> S.p.A.<br />

Relationships with related parties, whose definition was<br />

extended in accordance with IAS 24, include not only normal<br />

business relationships with listed groups or other major<br />

groups in which the directors of the Company or its parent<br />

companies hold a significant position, but also purchases<br />

of Group products at normal market prices or, in the case<br />

of individuals, the prices that are usually charged<br />

to employees.<br />

Information on transactions with related parties, as required<br />

by Consob communication of July 28, <strong>2006</strong>, are presented<br />

respectively in Note 35 of the Notes to the Consolidated<br />

Financial Statements and Note 30 of the Notes to the Financial<br />

Statements of <strong>Fiat</strong> S.p.A.<br />

Based on the information received from the various Group<br />

companies, there were no atypical or unusual transactions<br />

– as such transactions are defined by Consob – during the year.<br />

Extraordinary transactions among Group companies that<br />

occurred during the year included:<br />

■ the “Series A” preference shares of CNH Global N.V. held<br />

by <strong>Fiat</strong> Netherlands Holding N.V. were automatically converted<br />

into ordinary shares when the underlying conditions were met.<br />

In this connection, reference should be made to the section on<br />

the Scope of consolidation in the Notes to the Consolidated<br />

Financial Statements;<br />

■ the corporate structure of the subholding companies was<br />

rationalised. This has led to placing <strong>Fiat</strong> Partecipazioni S.p.A.<br />

at the head of certain industrial Sectors and, as a result, to<br />

simplifying the chain of foreign subholding companies. <strong>Fiat</strong><br />

Auto Holding B.V. was unwound in <strong>2006</strong> as part of this process<br />

after transferring to <strong>Fiat</strong> Partecipazioni S.p.A. its entire<br />

holdings in the capital of <strong>Fiat</strong> Auto S.p.A. (now <strong>Fiat</strong> Group<br />

Automobiles S.p.A.) and <strong>Fiat</strong> Powertrain Italia S.r.l. (now <strong>Fiat</strong><br />

Powertrain Technologies S.p.A.). <strong>Fiat</strong> Netherlands Holding N.V.<br />

similarly transferred its 100% holding in Iveco S.p.A. on a prorata<br />

basis to its stockholders <strong>Fiat</strong> S.p.A. and <strong>Fiat</strong> Partecipazioni<br />

S.p.A. Finally, <strong>Fiat</strong> S.p.A. contributed its investments in<br />

Magneti Marelli Holding S.p.A. (99.99%) and Teksid S.p.A.<br />

(84.79%) to <strong>Fiat</strong> Partecipazioni S.p.A. in February 2007.<br />

<strong>Report</strong> on Operations Transactions among Group Companies and with Related Parties 55